NGI The Weekly Gas Market Report | Markets | NGI All News Access

Column: Valley Crossing Maintenance Highlights Significant Flaw in Mexican Pipeline System

Editor’s Note: NGI’s Mexico Gas Price Index, a leader tracking Mexico natural gas market reform, is offering the following column as part of a regular series on understanding this process, written by Eduardo Prud’homme.

Prud’homme was central to the development of Cenagas, the nation’s natural gas pipeline operator, an entity formed in 2015 as part of the energy reform process. He began his career at national oil company Petróleos Mexicanos (Pemex), worked for 14 years at the Energy Regulatory Commission (CRE), rising to be chief economist, and from July 2015 through February served as the ISO chief officer for Cenagas, where he oversaw the technical, commercial and economic management of the nascent Natural Gas Integrated System (Sistrangas).

The opinions and positions expressed by Prud’homme do not necessarily reflect the views of NGI’s Mexico Gas Price Index.

The capacity of a gas pipeline is not a static parameter dependent solely on the diameter and power of its compression facilities. A pipeline’s interaction with other systems, the location of injection and extraction points, and the behavior of consumption and gas deliveries are all relevant to understand the operating conditions on a specific day. What happens upstream of the pipeline affects downstream conditions. The reverse phenomenon is also true. Determining what the effective capacity of a pipeline is is a technical job that requires specialized modeling tools and an amount of information that can be overwhelming. If you do not have a good estimate of real capacity, a system operator such as Cenagas can calculate space poorly and cause firm contracted services to not to be honored. Paradoxically, adding a new injection source by interconnecting with a new pipeline does not necessarily improve conditions. This may surprise users of the system and even the operators themselves.

A gas network like Mexico’s Sistrangas presents additional complications. Its original design does not correspond to the present balance conditions. Its main historical gas sources, the processing centers of Cactus and Burgos, are today surpassed by points of importation from Texas. Since the end of January 2016, the injection from NET Mexico that feeds the Ramones phase I system is the main source of gas in Mexico. This is not desirable from an operational point of view, but given the dramatic drop in Pemex production, the structural gas deficit has forced the market to accept this as a normal circumstance. The maximum daily amount added at that injection point is approximately 2.1 Bcf/d and its use frequently reached 100% in 2018 and 2019. Needless to say, in this context, cuts to nominations have been recurring.

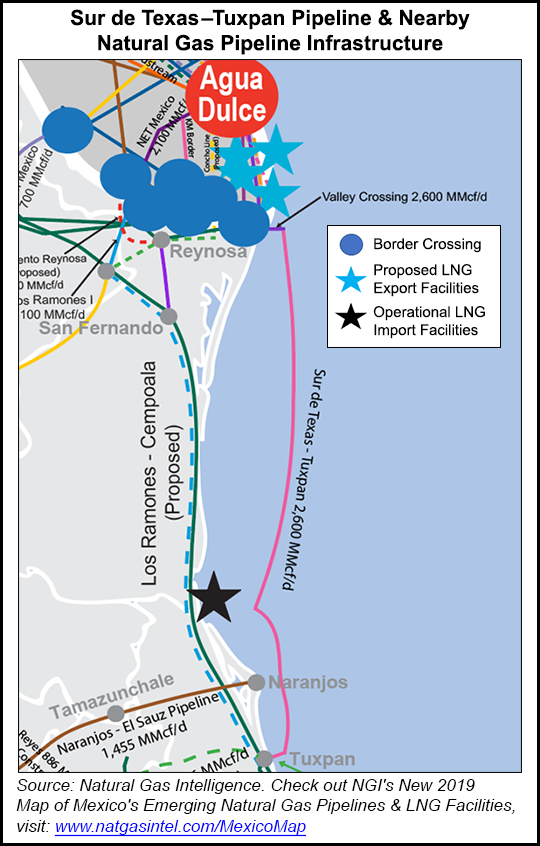

Then came the entry into operation of the Sur de Texas-Tuxpan marine pipeline, operated by TC Energía, which brought high expectations about its positive impact on gas balance conditions in the country. With 2.6 Bcf/d in capacity, it was reasonable to think that supply disruptions would no longer occur. With four interconnections on land, of which two have direct discharge in the Sistrangas, the interconnections at the border would see operational slack giving way to commercial opportunities for reallocation of capacity. The Sistrangas would enjoy healthy stability all the time and consequently, the injection of liquefied natural gas (LNG) for balancing would not be necessary anymore.

Without announcing the availability of any new capacity and therefore voiding the need for an open season, Cenagas enabled last December the injection point called Montegrande where the marine pipeline connects to the Sistrangas. The nominal operational capacity of this connection is 500 MMcf/d. The use of routes originating at this point in interruptible service has given way to quantities ranging from 20-150 MMcf/d. These incremental amounts entail an additional drop in the injection to Ramones phase I.

Given CFE owns all the capacity on the marine pipeline, gas volumes are associated with generation plants in the center of the country or bilateral assignments that escape the scope of regulation. The incremental flow in the Sistrangas therefore has nothing to do with Cenagas, but instead depends on the commercializing subsidiary of CFE. This situation makes evident the fact that despite being a stronger player than Pemex in the natural gas market, CFE avoids regulation due to the nature of its activities.

Since September 2019 and as part of Cenagas’ job as a manager to inject gas into the pipelines for system balancing, the line packing level data on the National Gas Pipeline System, the main component of the Sistrangas, has been published by Cenagas and by the Ministry of Energy. Although the parameters that denote a healthy operation of the system are multiple, this packing statistic largely offers a picture of the possibility of having supply interruption problems.

Values must be in a band of 7-7.5 Bcf so that Cenagas can operate with relative tranquility; the lack of storage throughout the system means Cenagas doesn’t have much at its disposal if these conditions are not met.

Given fluctuations in the supply and demand balance, the online gas inventory is used as a variation buffer. Prior to September 2019, if Monday’s early morning line packing recordings were 7.5 Bcf, then the week could be handled without issues. Similarly, if Friday’s value was 7 Bcf, lower economic activity on weekends would allow gas accumulation in pipelines and recovery to the desired level of 7.5 Bcf by Monday. Line packing levels below 6.8 Bcf implied a high risk of Cenagas having to apply cuts in consumption, meaning the switching of fuels from gas to fuel oil in the electricity sector and rolling gas injections.

The entry of the marine pipeline into operation in the fall of 2019 meant less oscillations and in general, line packing at the beginning of the day has been between 6.9 and 7 Bcf. Consequently, LNG balancing with injection by Cenagas has not been necessary since the end of 2019.

But this splendid framework from an operational perspective would prove not to be permanent. Recently, a disruptive scenario occurred due to maintenance work on the intrastate Valley Crossing Pipeline in Texas, owned by Enbridge Inc., which carries gas from the header in Nueces to the international crossing that feeds the marine pipeline.

On Jan. 20, 2020, Cenagas notified the market via its electronic bulletin board that the packing conditions in the Sistrangas, at a level of 6.8 Bcf, were below the desirable level. Therefore, “in order to ensure the operational integrity of Sistrangas and in order to affect the users of said system to a lesser extent,” the shippers had to maintain their injections and extractions in strict accordance with the amounts confirmed by Cenagas from Jan. 20-23, 2020.

In the same vein, Cenagas warned that, “in compliance with its obligation and attribution to guarantee continuity in the provision of the transport service” the manager reserves the right to: i) make the purchase of LNG to maintain the balance and operation of the Sistrangas; ii) transfer to users that cause imbalances in the system any cost that could be incurred to maintain the balance in it, and iii) take any necessary action to fulfill its mandate. At the conclusion of the Enbridge pipeline maintenance period, the packaging reported by Cenagas on the morning of Jan. 23 fell to a level of 6.7 Bcf.

The line pack dropped by 100 MMcf/d despite the fact that confirmed volumes for injection in Ramones phase I exceeded 2.1 Bcf/d during the period that Valley Crossing was under maintenance. That is, the return of the main injection point to its maximum even before Jan. 20 has not been sufficient to maintain stable supply conditions. Given this, it is possible to deduce that the Sistrangas received LNG regasified from Manzanillo. This means that the security enjoyed by the Mexican gas system does not exempt it from requiring balancing LNG, even in a seasonal period of low demand.

The corollary of the above is the need to recognize the complexity of the network that has been built in recent years. The fact that the new routes have been designed with the sponsorship of CFE and not Cenagas, today shows that some systemic considerations have probably been omitted and that the predominant objective function is in the interest of CFE and not the general user. The lack of interoperability translates into a lack of commercial flexibility.

To date, a shipper does not have access to a robust secondary market that facilitates the permutation of routes preventively. The simultaneity of high injection in Ramones phase I and the injection of LNG in Manzanillo suggest a paradoxical condition: low consumption causes an overpressurization in the north of the country that constrains the trunk lines from north to south, causing pressure drops in the center and in the Bajío that lead to injections from Manzanillo.

Cenagas purchases of balancing gas with agents other than CFE will only be a minor palliative. There is no way to achieve robust management if the system manager is subject to the commercial decisions of the CFE. Cenagas should not leave projects in the pipeline that give it greater flexibility, such as underground storage and even an alternative source, such as a floating storage regasification unit that compensates for the very plausible decline in Pemex production in the southeast.

This year will be a better year in terms of national balance than any year in the past decade thanks to the increase in import capacity. However, the conditions of reliability and efficiency are not fully guaranteed without operating rules that give Cenagas greater visibility of the variables and conditions of the infrastructure outside the scope of Sistrangas. These same rules should deepen the need for effective open access and new open seasons.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |