NGI Mexico GPI | Markets | NGI All News Access

Market Waiting on Weather as Natural Gas Futures Rebound Modestly

After recent heavy selling, signs of colder temperatures returning near the end of the 15-day outlook provided enough impetus for a modest natural gas futures rally Thursday; however, an on-target inventory report saw prices pull back a few cents. The February Nymex contract went on to settle 2.1 cents higher at $1.926/MMBtu after trading as high as $1.980. March settled at $1.904, up 0.4 cents.

In the spot market, a comfortable forecast temperature-wise accompanied mostly minor day/day adjustments throughout the Lower 48; NGI’s Spot Gas National Avg. eased 2.0 cents to $1.780.

Despite Thursday’s Energy Information Administration (EIA) storage print falling within a few Bcf of consensus, “sellers quickly stepped into the entire curve,” Bespoke Weather Services observed. “This action seems a little peculiar given the tighter balances, which are tied into much lower production levels compared to the late-November highs.” Still, “as of right now, the market clearly has little fear of anything near term or longer term.”

The weather outlook, which as of Thursday showed colder temperatures returning to the eastern part of the country around Feb. 5-6, will “dictate the next move” for the market, the forecaster said.

“We do have concerns that models may again be forecasting too much cold in the longer range…but if they aren’t, or if the high latitude pattern changes, we can still easily see a rally back to or even over $2.00 in the next few sessions heading toward February expiration,” Bespoke said. “On the flip side, if we do again see a total failure of cold to progress forward and lose another chunk of forecast demand over the weekend, we will most certainly make new lows early next week.”

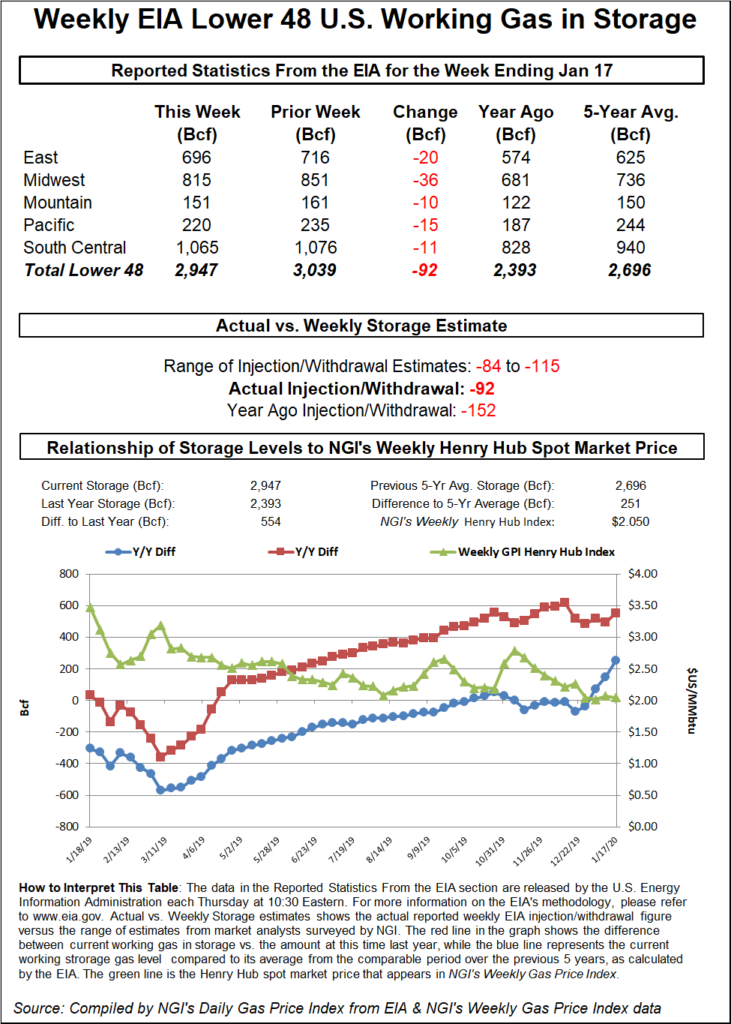

The EIA reported a net 92 Bcf weekly withdrawal from U.S. natural gas stocks, slightly to the tighter side of consensus.

The 92 Bcf withdrawal, recorded for the week ended Jan. 17, compares with a 152 Bcf pull for the year-ago period and a five-year average withdrawal of 194 Bcf. Consensus estimates had pointed to a pull of around 88-91 Bcf.

In the lead-up to EIA’s report, the February Nymex contract had been trading about a nickel higher, around $1.954-1.970, with glimpses of colder temperatures by next month perhaps leading traders to look for a bottom in the market.

Once the report crossed trading screens at 10:30 a.m. ET, the front month dropped several cents, going as low as $1.932 over the next 10 minutes.

Prior to the report, a Bloomberg survey showed a median prediction for an 88 Bcf withdrawal, while a Reuters survey landed on a 91 Bcf pull. Predictions ranged from minus 84 Bcf to minus 115 Bcf. NGI’s model predicted a 98 Bcf withdrawal.

Total Lower 48 working gas in underground storage stood at 2,947 Bcf as of Jan. 17, 554 Bcf higher than year-ago stocks and 251 Bcf above the five-year average, according to EIA.

By region, the Midwest recorded a 36 Bcf withdrawal on the week, with the East pulling 20 Bcf. The Pacific withdrew 15 Bcf, while the Mountain withdrew 10 Bcf, according to EIA. In the South Central, a 19 Bcf withdrawal from nonsalt was partially offset by an 8 Bcf injection into salt stocks.

On the exports front, the conclusion of maintenance on the Valley Crossing Pipeline (VCP) in South Texas was corresponding with an uptick in flows south of the border into Mexico Thursday, according to Genscape Inc.

“Our modeled estimate of exports to Mexico has climbed to 5.9 Bcf/d after dipping as low as 4.8 Bcf/d earlier this week” because of the VCP maintenance, Genscape senior natural gas analyst Rick Margolin said. VCP serves as “the sole source of supply to Mexico’s Sur de Texas-Tuxpan system.”

The VCP maintenance started last week and had restricted flows through VCP to zero until Thursday, Margolin said.

“A good portion of the curtailed volumes found their way into Mexico via a re-route to Mexico’s Los Ramones system,” the analyst said. “VCP flows are back up to 0.86 Bcf/d” as of Thursday, “driving the total U.S. to Mexico number to 5.9 Bcf/d, though we believe subsequent days will see those numbers recede to pre-outage levels around 0.6 Bcf/d and 5.4 Bcf/d, respectively.”

Having already dropped to discounted levels — especially for the dead of winter — spot prices were steady Thursday for most locations. Prices generally picked up a few pennies to a nickel through the middle third of the Lower 48. Benchmark Henry Hub added 6.0 cents to $1.950.

The National Weather Service (NWS) Thursday was forecasting wintry weather for the Upper Midwest into the Great Lakes, Appalachians and Northeast, but temperatures for the most part weren’t expected to be particularly cold for this time of year.

Temperatures for the contiguous United States should remain “near to above normal over the next couple of days going into the weekend,” according to the forecaster. “One exception will tend to be over the Mid-Atlantic and Southeast, where temperatures overall will be perhaps a few degrees below normal.”

A system dropping “light to moderate snow from the Upper Midwest through the Great Lakes region” Thursday night was expected to “advance east on Friday and Saturday as low pressure crosses the Ohio Valley and moves into the lower Great Lakes,” the NWS said. “Moisture advancing out ahead of this will interact with sufficient cold air for some areas of accumulating snow to develop.”

The wintry weather hardly inspired any buying interest Thursday. In the Midwest, Emerson added 1.5 cents to $1.835. Northeast prices posted some of the largest discounts on the day. Iroquois, Waddington shed 7.5 cents to $1.935. Upstream in Appalachia, Texas Eastern M-3, Delivery slid 10.0 cents to $1.705.

Elsewhere, West Texas hubs mostly saw modest gains. El Paso Permian picked up 8.5 cents to 87.5 cents.

Northern Natural Gas (NNG) earlier this week notified shippers of a force majeure at its Spraberry compressor station in Midland County, TX. As of Thursday, capacity for the pipeline’s Spraberry 12-inch delivery allocation group remained restricted.

The operator said it could have one unit at the station back in service by Saturday under a “best case scenario,” with the second unit back online by Monday.

According to Genscape, the event initially restricted about 53 MMcf/d of deliveries from NNG into Atmos and Enterprise Texas compared to the prior 30-day average.

However, the pipeline subsequently changed the operational limit from 58 MMcf/d to 0 MMcf/d starting with Thursday’s evening cycle, Genscape analyst Joe Bernardi said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |