NGI Data | Markets | NGI All News Access

Natural Gas Bulls Not Enthused by EIA Storage Data as Prices Pull Back

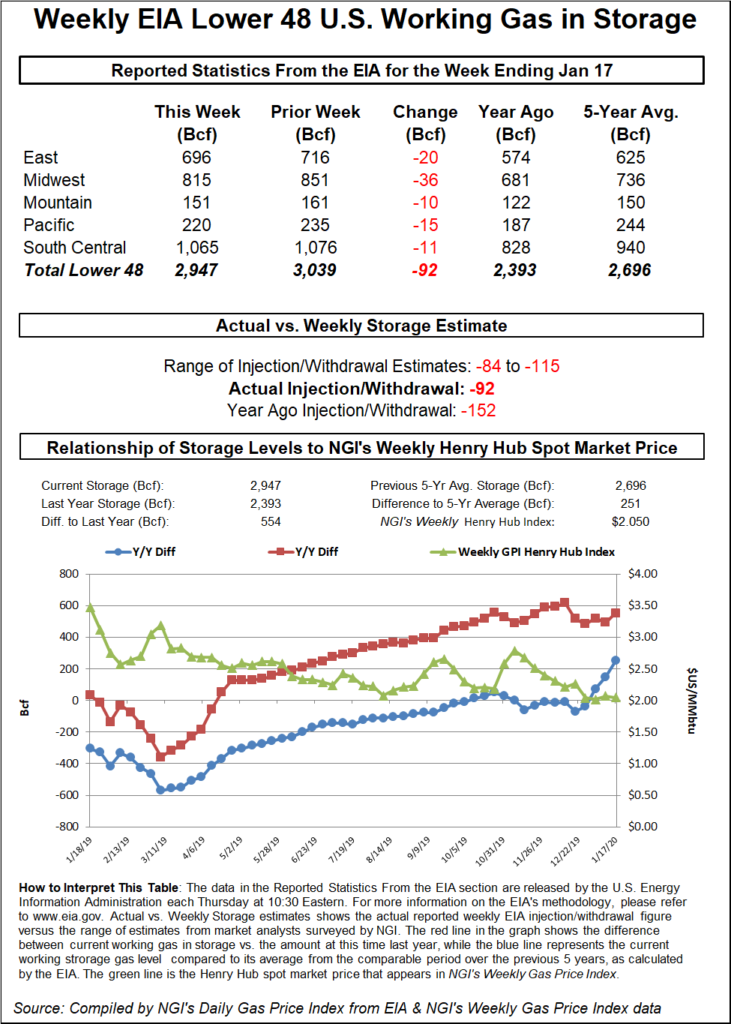

The Energy Information Administration (EIA) Thursday reported a net 92 Bcf weekly withdrawal from U.S. natural gas stocks, slightly to the tighter side of consensus; futures prices, already rallying, pulled back on the news.

The 92 Bcf withdrawal, recorded for the week ended Jan. 17, compares with a 152 Bcf pull for the year-ago period and a five-year average withdrawal of 194 Bcf. Consensus estimates had pointed to a pull of around 88-91 Bcf.

In the lead-up to EIA’s report, the February Nymex contract had been trading about a nickel higher, around $1.954-1.970, with glimpses of colder temperatures near the end of the 15-day outlook perhaps leading traders to look for a bottom in the market.

Once the report crossed trading screens at 10:30 a.m. ET, the front month dropped several cents, going as low as $1.932 over the next 10 minutes. By around 11 a.m. ET, February was trading at $1.944, up 3.9 cents from Wednesday’s settle.

Prior to the report, a Bloomberg survey showed a median prediction for an 88 Bcf withdrawal, while a Reuters survey landed on a 91 Bcf pull. Predictions ranged from minus 84 Bcf to minus 115 Bcf. NGI’s model predicted a 98 Bcf withdrawal.

In terms of balances, this week’s EIA figure is not as supportive as the 109 Bcf withdrawal the agency reported a week earlier, according to Bespoke Weather Services, which viewed the 92 Bcf pull as neutral.

“Balances off this number are not nearly as tight as those seen last week, although that can at least partially be explained by higher week/week wind” along with a “dip” in liquefied natural gas exports last week, Bespoke said. “We would categorize this number as neutral overall, with balances still supportive if we can just get any decent weather demand as we head through the month of February.”

Total Lower 48 working gas in underground storage stood at 2,947 Bcf as of Jan. 17,554 Bcf higher than year-ago stocks and 251 Bcf above the five-year average, according to EIA.

By region, the Midwest recorded a 36 Bcf withdrawal on the week, with the East pulling 20 Bcf. The Pacific withdrew 15 Bcf, while the Mountain withdrew 10 Bcf, according to EIA. In the South Central, a 19 Bcf withdrawal from nonsalt was partially offset by an 8 Bcf injection into salt stocks.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |