NGI The Weekly Gas Market Report | Infrastructure | LNG | LNG Insight | NGI All News Access

McDermott Expects Natural Gas, Oil Projects to ‘Seamlessly’ Continue through Chapter 11 Process

U.S. natural gas export projects underway on the Gulf Coast and other plans in the works are to “continue seamlessly” after McDermott International Inc. launched a prepackaged Chapter 11 restructuring on Tuesday.

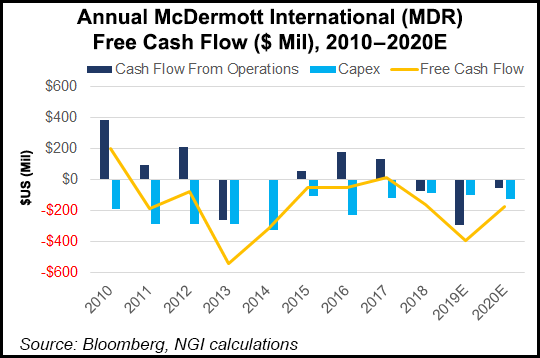

The transition would eliminate more than $4.6 billion in debt from the balance sheet, allowing the Houston-based engineering, procurement and contracting (EPC) leader to emerge from bankruptcy “with robust liquidity and significant financing to execute on customer projects in our backlog,” CEO David Dickson said.

“Throughout this process, which we expect to complete expeditiously, McDermott will continue all business operations as normal and deliver on our commitments to our customers.”

McDermott, which merged with global EPC operator CB&I in 2017, has activities underway offshore and onshore, which include helping to build liquefied natural gas (LNG) projects on the Gulf Coast. Included in its portfolio are Freeport LNG on Quintana Island, TX, and Cameron LNG in Hackberry, LA.

McDermott plans to equitize nearly all funded debt and emerge from voluntary bankruptcy with a committed letter of financing and $500 million of funded debt. The plan has the support of $2.81 billion of debtor-in-possession (DIP) financing. All suppliers would continue to receive payments and be paid in full.

“The restructuring transaction, which has the full support from all of our funded creditors, including our unsecured bondholders, is further recognition of McDermott’s fundamentally solid operating business and proven strategy,” Dickson said. “Our record backlog, the majority of which has been booked in the last two years, and high rate of new project awards, demonstrates our customers’ continued confidence in our business, the demand for our skills and our long-term opportunities ahead.”

The financial restructuring would “create a sustainable capital structure that matches the strength of our operating business.”

The DIP financing, combined with cash generated by McDermott, is expected to enable the company to stabilize cash flow, as well as continue to fulfill commitments to key stakeholders, including customers, suppliers, joint venture partners, business partners and employees.

All of McDermott’s businesses are expected to continue to operate as normal for the duration of the restructuring. The company expects to continue to pay employee wages, as well as health and welfare benefits, and to pay all suppliers in full. All customer projects are expected to continue uninterrupted on a global basis.

The Chapter 11 filing was made in U.S. Bankruptcy Court for the Southern District of Texas. The company expects court approval of the plan within two months.

As part of the restructuring transaction, subsidiaries have entered into a share and asset purchase agreement with a joint partnership between The Chatterjee Group and Rhône Group under which the partnership would serve as the “stalking-horse bidder” in a court-supervised $2.725 billion sale process for Lummus Technology.

McDermott would have the option to retain/purchase a 10% equity ownership interest in the entity purchasing Lummus. Proceeds from the sale are expected to repay the DIP financing in full, as well as fund emergence costs and provide cash to the balance sheet for long-term liquidity.

As a result of the Chapter 11 filing, McDermott expects to be delisted from the New York Stock Exchange. Common stock would continue to trade in the over-the-counter marketplace throughout the process.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |