Shale Daily | Bakken Shale | E&P | NGI All News Access

Bakken Production Sputters on North Dakota; Slowdown Seen Through Spring

Bakken Shale oil and natural gas production is unlikely to strengthen through the first quarter, according to the latest monthly statistics from North Dakota.

Department of Mineral Resources Director Lynn Helms said Friday December and January oil and gas production totals also are likely to be “pretty flat.”

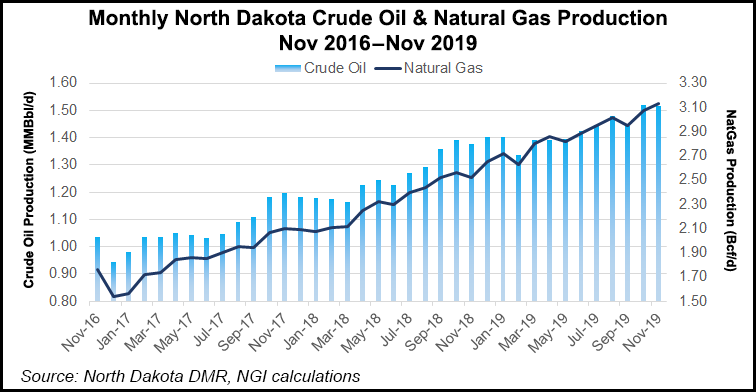

For November, crude production was 45.4 million bbl (1.515 million b/d), compared to 47.05 million bbl (1.517 million b/d) in October when all-time records were set. Natural gas reached 94.01 Bcf (3.13 Bcf/d) in November compared to a record 95.3 Bcf (3.07 Bcf/d) the previous month.

The results for November indicated it’s “steady as she goes,” Helms said, following “very wet fall and snowy early winter.” Bakken sweet crude prices hit $47.75/bbl on Jan. 10, down slightly from an average $48.35/bbl in December.

More broadly, the Bakken Three Forks formation may be impacted by continuing low oil and gas prices and a “slight oversupply” globally, Helms said. Operators in North Dakota are working to operate within cash flow, and that also has impacted investments.

“Cash flow takes $65/bbl oil, and we aren’t seeing $65 anymore,” he said, and oil prices need to be closer to $60/bbl. One bright sign might emerge from oil processing plants starting to operate at full capacity, including Oneok Inc.’s Elk Creek Pipeline, which came online late last year.

Added processing and the new pipeline also should help operators meet the current state gas capture goal of 88%, said Helms. Gas capture improved slightly statewide in November to 83%, but the volume was down slightly from October at 77.7 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |