Weather Rules as Natural Gas Futures Slide Despite Bullish EIA Storage Miss

New data from European weather model Thursday weakened cold expectations for the final third of January, ushering sellers into a natural gas futures market that had seemed poised for a modest rally. The February Nymex contract fell 4.3 cents to settle at $2.077/MMBtu. March dropped 3.7 cents to $2.046, while April settled at $2.064, down 3.3 cents.

In the spot market, a return to winter-like pricing in the Northeast helped send NGI’s Spot Gas National Avg. 25.0 cents higher to $2.370.

The afternoon European model dropped more than 15 heating degree days from its forecast for the period running from next Tuesday through Jan. 28, NatGasWeather said in a note to clients.

“The latest European model was quicker with cold exiting during the middle of next week for lost demand, then was milder with the break Jan. 23-27 as colder air pushes out of the United States and back into Canada,” the forecaster said. “Colder air is still favored by the European model to return into the northern United States Jan. 28-30, but the amount of cold air and how far into the United States it pushes has backed off considerably this run.”

The latest storage data Thursday from the Energy Information Administration (EIA) pointed to a tighter supply/demand balance, “but weather patterns haven’t been cooperating, as the past three weeks of warmth” has resulted in withdrawals “being a hefty 300 Bcf lighter than normal,” NatGasWeather said.

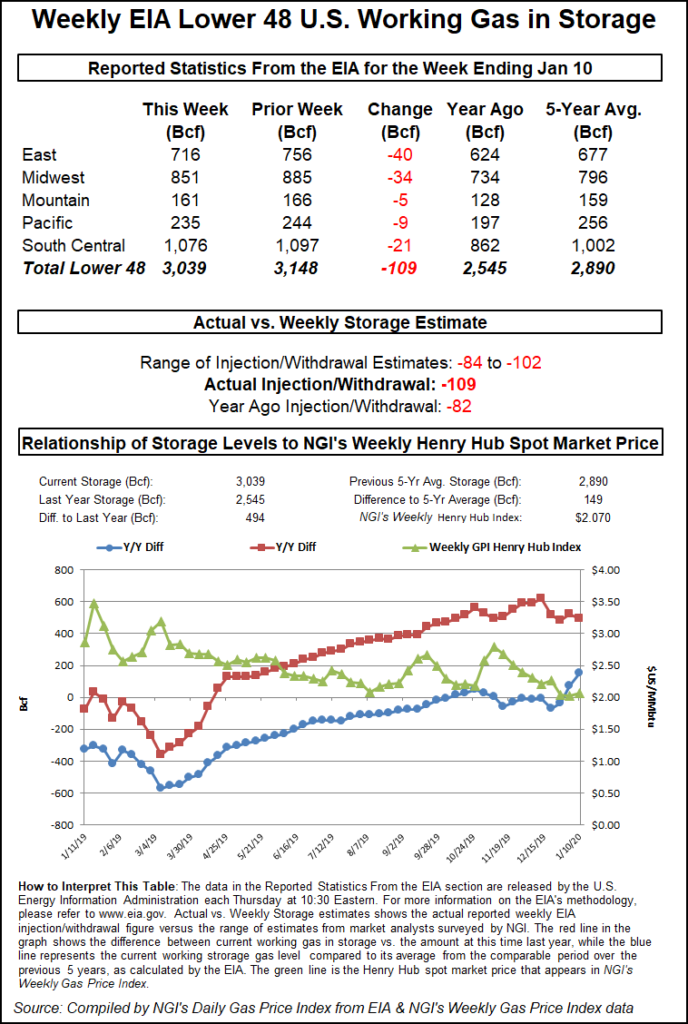

The EIA reported a surprisingly robust 109 Bcf weekly withdrawal from U.S. natural gas stocks, briefly injecting some upward momentum into a futures market starved for bullish catalysts.

The 109 Bcf print, for the week ended Jan. 10, comes in lighter than the five-year average 184 Bcf but easily outpaces the 82 Bcf pull recorded in the year-ago period. Perhaps more importantly, the reported withdrawal beat consensus expectations by roughly 15 Bcf.

In the lead-up to the report, the February contract had been trading around $2.128-2.140/MMBtu. As the EIA figure crossed trading screens at 10:30 a.m. ET, the front month popped to as high as $2.170, but that would mark the high point for the day. Bulls went on to concede ground through the remainder of the session, a downtrend that gained in intensity in the afternoon hours.

Prior to the report, projections had been pointing to a withdrawal just shy of the triple-digit mark. Major surveys had landed on a pull around 93-95 Bcf, with responses ranging from minus 84 Bcf to minus 102 Bcf.

NGI’s model had deviated from that range, predicting a 106 Bcf withdrawal for the week, not far from the actual figure.

Total Lower 48 working gas in underground storage stood at 3,039 Bcf as of Jan. 10, 494 Bcf (19.4%) higher than last year and 149 Bcf (5.2%) higher than the five-year average, according to EIA.

By region, EIA recorded a 40 Bcf withdrawal in the East and a 34 Bcf pull in the Midwest. The Pacific withdrew 9 Bcf on the week, while the Mountain withdrew 5 Bcf. In the South Central, an 18 Bcf pull from nonsalt and a 3 Bcf withdrawal from salt stocks resulted in a net 21 Bcf drawdown for the period, according to EIA.

New England spot prices rallied sharply for a second straight day Thursday, displaying the kind of volatility that has more typically characterized winter trading in the region, unlike the run of bargain-basement deals recorded prior to this week’s surge.

Iroquois Zone 2 soared $4.700 to $7.375 Thursday, while Algonquin Citygate jumped $2.915 to average $7.375.

Since the start of the year, Algonquin Citygate spot prices have languished at uncharacteristically low levels, even dropping below the $2 mark last week. By comparison, the lowest average price recorded there during the first two weeks of January 2019 was $2.71. During the same stretch in January 2018, Algonquin Citygate averaged as high as $78.98 and spent most of the period averaging $10 or more, only briefly dropping to a low of $3.38 on Jan. 11, 2018.

The National Weather Service (NWS) on Thursday was calling for a system developing over the Central Plains to track across the Midwest and into the Great Lakes through Saturday.

“This system will go on to produce snow, rain and freezing rain for much of the eastern half of the country,” the forecaster said, adding that 4-8 inches of snow could be possible for “parts of the Upper Midwest, Great Lakes and the Northeast, with isolated areas of a foot of snow possible downwind of the lakes.”

Amid a “modest return to normal winter weather and temperatures” in the Northeast to close out the week, major pipeline systems in the region as of Thursday were implementing operational restrictions, according to Genscape Inc. senior natural gas analyst Rick Margolin.

“Total EIA East region demand has climbed to slightly more than 36 Bcf/d” for Thursday, “an increase of about 7 Bcf/d versus the prior seven-day average,” Margolin said. “This rise comes just days after major cities through the region broke high-temperature records.”

Pipeline systems including Millennium, Tennessee Gas, Transcontinental and East Tennessee had all declared operational flow orders as of Thursday in response to the colder temperatures, the analyst noted.

Columbia Gas Transmission “warned of the risk of declaration of a transport critical day due to the Millennium alert,” Margolin said. “Dominion has also implemented weather-triggered restrictions on its Northern system. Weather forecasts show current temps lingering to close out the work week,” and Genscape’s daily supply and demand modeling showed East demand potentially reaching 40 Bcf/d for Friday “before retreating with milder weather and the weekend.”

Gains were the most extreme in New England, but other Eastern U.S. hubs also rallied Thursday. Dominion Energy Cove Point jumped 38.0 cents to $2.535, while Texas Eastern M-3, Delivery picked up 49.0 cents to $2.545.

Elsewhere, price moves were generally small for Gulf Coast and Southeast hubs. Transco Zone 4 added 7.0 cents to $2.075. In Texas, Texas Eastern S. TX added 2.5 cents to $2.010.

As of Thursday, exports to Mexico are being impacted by a week-long planned maintenance event on the Valley Crossing Pipeline (VCP) in South Texas.

As of early Thursday “VCP was indicating it was not flowing any volumes,” but reporting from the Sur de Texas-Tuxpan pipeline showed the pipe receiving about 1 Bcf/d, Genscape’s Margolin said. During an analogous maintenance event earlier this month, “a somewhat similar (albeit smaller-volume) dynamic occurred, which we surmised was a product of Sur de Texas-Tuxpan receiving volumes through a draw-down of linepack.”

The maintenance was also coinciding with “notable reroutes” in the form of a roughly 0.3 Bcf/d day/day increase in deliveries from NET Mexico into Mexico’s Los Ramones system, according to the analyst.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |