Natural Gas Futures Mount Modest Rally on Big, Bullish Miss From EIA Storage Number

The Energy Information Administration (EIA) on Thursday reported a surprisingly hefty 109 Bcf weekly withdrawal from U.S. natural gas stocks, injecting some upward momentum into a futures market starved for bullish catalysts.

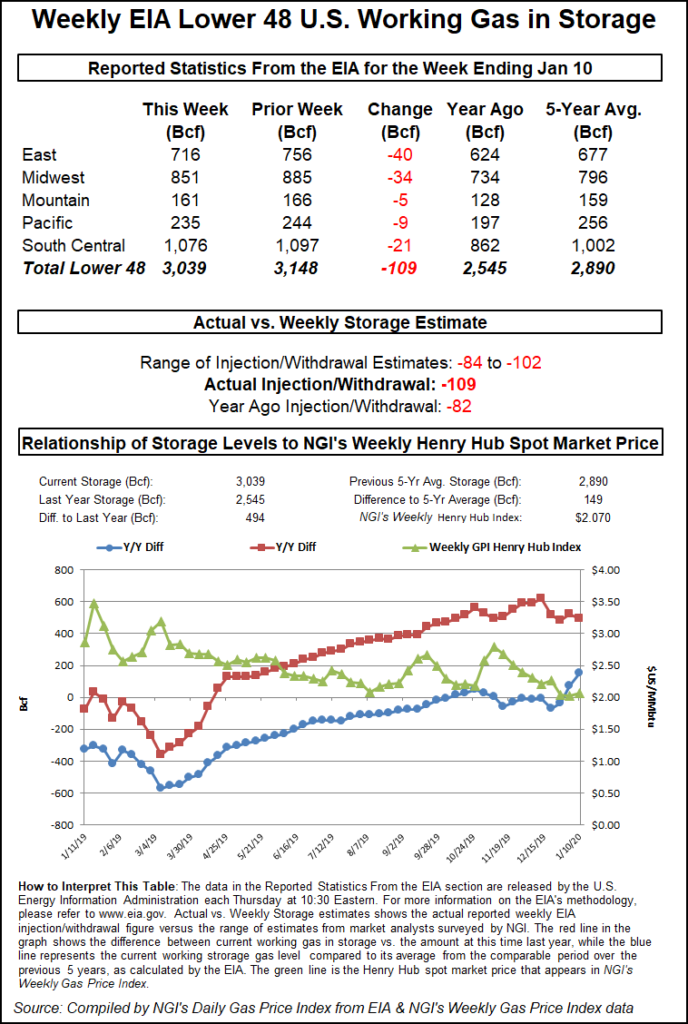

The 109 Bcf print, for the week ended Jan. 10, comes in lighter than the five-year average 184 Bcf but easily outpaces the 82 Bcf pull recorded in the year-ago period. Perhaps more important, the reported withdrawal beat consensus expectations by roughly 15 Bcf.

In the lead-up to the report, the February Nymex contract had been trading around $2.128-2.140/MMBtu. As the EIA figure crossed trading screens at 10:30 a.m. ET, the front month popped to as high as $2.170.

Shortly after 11 a.m. ET, February was trading at $2.149, up 2.9 cents from Wednesday’s settle and slightly above the pre-report trade.

Prior to the report, projections had been pointing to a withdrawal just shy of the triple-digit mark. Major surveys had landed on a pull around 93-95 Bcf, with responses ranging from minus 84 Bcf to minus 101 Bcf.

NGI’s model had deviated from that range, predicting a 106 Bcf withdrawal for the week, not far from the actual figure.

Market observers discussing the latest EIA data on Enelyst.com proposed higher power burns or lower production as among the possible explanations behind the high-side miss in this week’s withdrawal.

Still, Enelyst managing director Het Shah expressed surprise that the market wasn’t able to rally further on the news.

“Doesn’t make sense,” Shah said. “14 Bcf higher than market consensus. How does the market miss by 2 Bcf/d, and markets only respond with a 3-cent move higher?”

Total Lower 48 working gas in underground storage stood at 3,039 Bcf as of Jan. 10, 494 Bcf (19.4%) higher than last year and 149 Bcf (5.2%) higher than the five-year average, according to EIA.

By region, EIA recorded a 40 Bcf withdrawal in the East and a 34 Bcf pull in the Midwest. The Pacific withdrew 9 Bcf on the week, while the Mountain withdrew 5 Bcf. In the South Central, an 18 Bcf pull from nonsalt and a 3 Bcf withdrawal from salt stocks resulted in a net 21 Bcf drawdown for the period, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |