Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Permian Consolidation Continues As Parsley Completes $2.3B Jagged Peak Merger

Parsley Energy Inc. on Friday announced the completion of its $2.27 billion acquisition of fellow Permian Basin pure-play Jagged Peak Energy Inc., which is backed by Houston-based private equity firm Quantum Energy Partners.

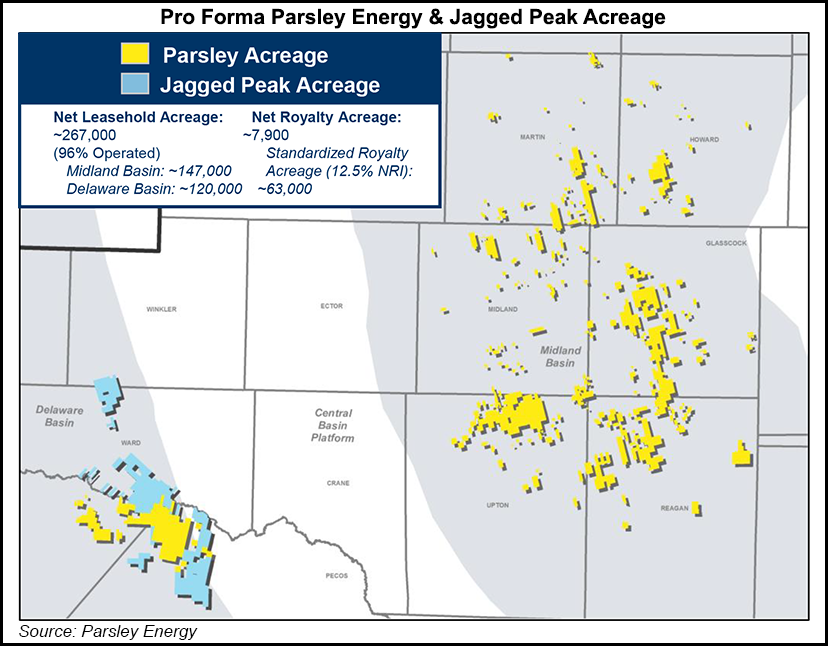

The all-stock transaction, which was announced in October, combines Jagged Peak and Parsley acreage across the Permian’s Delaware and Midland sub-basins.

“We first publicly announced our proposed combination with Jagged Peak less than ninety days ago,” said Parsley CEO Matt Gallagher. “This collective expediency to closing allows our team to hit the ground running on these complementary, high margin assets and start capturing tangible synergies that will enhance value for our combined shareholder base.”

He added that the merger should result in “a more capital efficient enterprise with more free cash flow.”

In a presentation this month, Parsley said it expects capital efficiency gains from the Jagged Peak transaction to enhance its 2020 free cash flow profile by $20-40 million.

Upon the announcement of the transaction in October, Quantum Energy CEO and Jagged Peak director S. Wil VanLoh, Jr., said, “The inevitable consolidation in the Permian has started, and Jagged Peak made a decisive move to team up with the right partner…”

The Permian continued to be the leading basin for Lower 48 mergers and acquisitions activity during 2019, according to a recent analysis by energy data specialist Enverus.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |