Natural Gas Futures Gain as Market Eyes Possible End to ‘Blowtorch Regime’

With guidance increasingly favoring an end to the recent run of exceptionally warm temperatures, the natural gas futures market managed to absorb a bearish miss from the latest inventory data Thursday. The February Nymex contract settled 2.5 cents higher at $2.166/MMBtu. March picked up 1.4 cents to $2.148, while April settled at $2.150, up 1.5 cents.

Meanwhile, widespread warmth in the near term saw spot prices grind lower for the most part, especially along the East Coast; NGI’s Spot Gas National Avg. tumbled 9.0 cents to $1.945.

After inconsistency in recent model runs, the latest guidance Thursday appeared to be honing in on a shift to at least somewhat colder temperatures later this month, according to Bespoke Weather Services.

“We seem to be gaining some consistency regarding at least getting a step change from the endless blowtorch regime to something that has some variability and can get back at least closer to normal,” Bespoke said. “In mid-winter it is rare that you get such a step change without a decent market reaction…but we understand some skepticism in light of how everything has turned out warmer the last several weeks.”

Despite unseasonably mild temperatures in December and through the first part of January, technical support has “impressively displaced the bulk of downward pressure” on futures prices, according to analysts at EBW Analytics Group. They pointed to a decline in the February contract of just 9.3 cents between Dec. 9 ($2.234) and Wednesday’s settle at $2.141.

A pullback in production and gains in liquefied natural gas (LNG) exports have helped to bolster support, and hedge funds were likely “hesitant to expand short positions over the holidays,” according to EBW.

“Falling production and rising LNG exports — led by strong feed gas flows at Cameron Train 2 increasing demand ahead of schedule — have helped lay a stronger weather-normalized foundation for natural gas,” the EBW analysts said. “Although both may ultimately turn out to be near-term blips rather than an inflection point in a long-term trend, this may not become clear for several weeks — potentially allowing gas prices to run higher in the interim.

“Similarly, the relative strength amid plummeting weather-driven demand may presage a near-term rally if late January cold arrives as anticipated. Should gas prices begin to rise, short-covering behavior could take prices sharply higher even if unwarranted by seasonal fundamentals.”

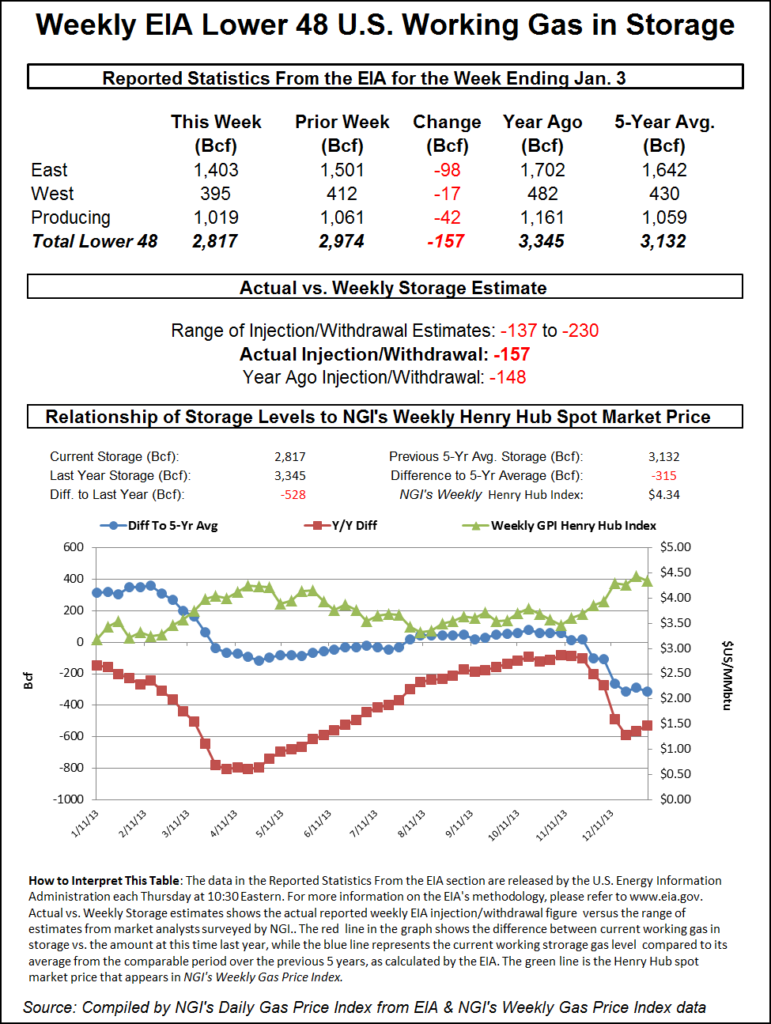

On the topic of fundamentals, the Energy Information Administration (EIA) on Thursday reported a lighter-than-expected 44 Bcf weekly withdrawal from U.S. natural gas stocks, briefly prompting an already bearish futures market to probe even lower.

The 44 Bcf pull, recorded for the week ended Jan. 3, is much smaller than historical norms for this time of year. Last year, EIA recorded a 91 Bcf withdrawal for the week ended Jan. 4, 2019, and the five-year average according to NGI calculations is a 169 Bcf pull.

Still, the market managed to absorb the initial blow from the bearish miss. As the report crossed trading screens at 10:30 a.m. ET, the February Nymex contract dropped as low as $2.105/MMBtu before quickly recovering to levels at or above the pre-report trade.

Prior to the report, the market had been looking for a print in the low 50s Bcf, with predictions ranging from minus 41 Bcf to minus 73 Bcf. A Reuters survey had pointed to a 53 Bcf withdrawal, while a Bloomberg survey had landed on a pull of 52 Bcf. NGI’s model had predicted a 51 Bcf withdrawal.

Bespoke said it wasn’t reading too much into this week’s report given the impact of the New Year’s holiday and some “tail-event warmth” last week.

“We rarely read much into any holiday number, especially one with tail-event weather, and last week was super warm,” Bespoke said. “It may be that we simply underestimated holiday-related impact between Christmas and New Year’s Day. It may also be somewhat of a correction for the slightly bullish miss on last week’s report.”

Total Lower 48 working gas in underground storage stood at 3,148 Bcf as of Jan. 3, 521 Bcf (19.8%) higher than last year and 74 Bcf (2.4%) above the five-year average, according to EIA.

By region, the Midwest posted the largest net withdrawal at 20 Bcf, followed by a 15 Bcf pull in the East. The Mountain and Pacific regions each withdrew 7 Bcf for the week. The South Central posted a net injection, with a 10 Bcf refill of salt stocks offsetting a 6 Bcf pull from nonsalt.

With warmth expected to dominate the eastern half of the country going into the weekend, spot prices headed lower at hubs throughout the Midwest, Gulf Coast and East on Thursday.

New England, often home to volatility and price spikes this time of year, posted the largest discounts on the day. Far from spiking, Algonquin Citygate plunged below the $2 mark, falling 98.5 cents to average $1.920.

Upstream in Appalachia it was a similar story. Dominion South eased 9.0 cents to $1.615. Over in the Midwest, most hubs shed a few pennies. Joliet slumped 2.0 cents to $1.950.

A strong front over the central United States was expected to create a “stark temperature gradient” in the days ahead, according to the National Weather Service (NWS).

“In the warm sector ahead of the front, daily temperatures will average 15-25 degrees warmer than typical early January readings,” the forecaster said. “Numerous records are expected to be broken from the Plains to the Ohio and Tennessee Valleys. The warmth will reach the Eastern Seaboard by this weekend.

“In contrast, the western half of the country will be much colder than usual as a cold front and secondary cold front reinforces the frigid airmass. By Friday, high temperatures in the single digits are forecast for the north-central tier of the nation.”

Price moves were generally mixed for the Rockies and California Thursday. Northwest Sumas continued to rally, picking up 16.5 cents to $3.605. In California, Malin shed 23.0 cents to $2.530, while farther south SoCal Citygate climbed 27.5 cents to $5.075.

Mojave Pipeline Co. LLC declared a force majeure Wednesday from an equipment failure associated with the Topock Compressor Station. The pipeline plans to reduce until further notice operational capacity through Segment 3000 by 117,000 Dth/d starting with Thursday’s Timely Cycle.

Genscape Inc. analyst Matt McDowell said the event could impact Southern California imports flowing through the Arizona/California border.

“Heating degree days in Southern California are trending colder-than-average for the next week, according to Genscape meteorologists, which could contribute to SoCal basis volatility,” McDowell said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |