NGI Mexico GPI | E&P | NGI All News Access

Mexico’s Private Oil Industry Maintains Diplomatic Approach Amid Criticism From AMLO

Mexico’s private oil and gas industry has maintained a diplomatic tone as it defends itself from now familiar criticism by President Andrés Manuel López Obrador.

Local oil and gas trade association Asociación Mexicana de Empresas de Hidrocarburos (Amexhi) said Wednesday that its private sector members “have fulfilled 100%” of their contractual commitments and invested $11 billion to date, reiterating the findings of a report published by the group in late 2018.

The statement was presumably in response to accusations made by López Obrador earlier that day to the opposite effect. He has suspended the awarding of further upstream contracts, alleging that operators are not fulfilling their commitments or reaching production fast enough.

A total of 111 exploration and production (E&P) contracts awarded under Mexico’s 2013-2014 constitutional energy reform are currently in effect.

Prior to the reform, only national oil company Petróleos Mexicanos (Pemex) was allowed to hold oil and gas acreage.

In addition to the $11 billion invested, upstream regulator Comisión Nacional de Hidrocarburos (CNH) has approved investment commitments from private operators totaling $36 billion, Amexhi said.

The group said that private sector-operated crude oil production stood at 47,000 b/d as of Dec. 1, and repeated a previous pledge to reach 280,000 b/d by 2024.

Private operators have so far drilled 67 wells, and committed to drilling another 647, Amexhi said, adding that the private oil sector has so far transferred $900 million to Mexico’s sovereign oil fund, and $671 million directly to Pemex.

The contracts also have allowed CNH to double the amount of subsoil information that it had prior to the reform, for new discoveries to made, and for existing discoveries to be reassessed, Amexhi said.

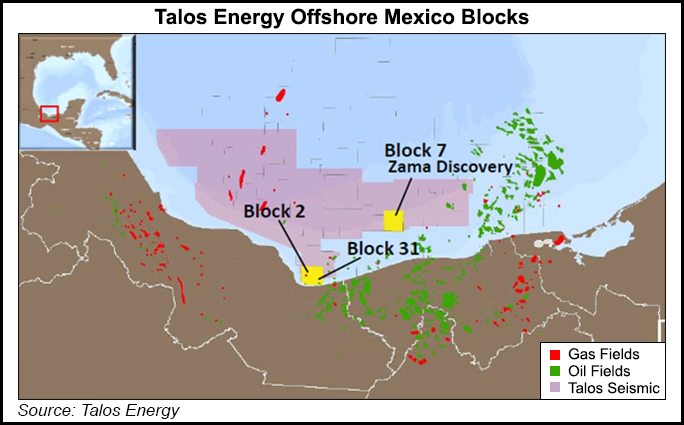

The largest of the new discoveries, the offshore Zama deposit, has also led to tension with the new government, since the shallow water reservoir straddles one block operated by Talos Energy Inc. and another operated by Pemex.

Talos on Tuesday announced that Netherland, Sewell & Associates, Inc. (NSAI) had concluded its contingent resource estimate of the Zama shallow water discovery offshore Mexico.

NSAI’s best estimate of Zama’s 2C gross recoverable resource is about 670 million boe, in line with Talos’s previously guided range of 400-800 million boe.

Houston-based Talos holds a 35% operating interest in the consortium that operates offshore Block 7, which was awarded through the Round 1.1 bidding process conducted by CNH in 2015.

The remaining stakes are held by Sierra Oil & Gas, a Wintershall DEA Company (40%), and Premier Oil Plc (25%).

“NSAI estimates 60% of the total resources of Zama are located on Block 7 in the 2C case,” Talos said. “As previously disclosed, the Zama reservoir extends into the adjacent block to the east, owned by Petróleos Mexicanos (Pemex) and, therefore, is subject to unitization between the consortium and Pemex.”

In 2018, under Mexico’s previous government, Talos and Pemex had signed a pre-unitization agreement to lay the framework for how the firms would jointly develop the area in the event of a confirmed, shared reservoir.

Pemex, however, has been dragging its feet on its share of the work toward a unitization agreement, according to Talos.

“Talos and its partners in the consortium have made great progress in meeting the milestones required to keep our world class Zama discovery on pace for a 2020 FID (final investment decision) if we can conclude unitization discussions soon,” Duncan said.

He added, “Doing so will allow us to establish first oil in 2023…We believe it is in everyone’s best interests to maintain the urgency in bringing this project forward, and ensuring it is done so in an efficient way that draws from international best practices is critical to achieve those objectives.”

Reuters reported in September 2019 that under the new government, Pemex was seeking to wrest control of Zama from the Talos-led consortium, citing two former energy officials and two Pemex executives. López Obrador denied the report.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |