NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Winter Weather Underwhelms as Weekly Natural Gas Spot Prices Grind Lower

The start of a new year and a new decade brought the same underwhelming winter weather that kept the pressure on natural gas prices to close out 2019; heavy discounts along the East and West coasts during the trading week ended Jan. 3 dropped NGI’s Weekly Spot Gas National Avg. 11.5 cents to $1.970/MMBtu.

With production surging in 2019, bulls were counting on a cold winter to help soak up the supply, but so far January temperatures have disappointed on that front. Regional averages through the middle third of the Lower 48 failed to crest the $2 mark during the week. Benchmark Henry Hub averaged $2.020, off 2.0 cents week/week.

Some of the heftiest losses were recorded in the Northeast, including a 56.0-cent drop at Algonquin Citygate, which finished with an average of $2.420 thanks to unusually warm conditions in New England. West Coast hubs also traded much lower on the week. Malin shed 81.0 cents to $2.245.

Further upstream, spot prices in constrained West Texas bounced back during the week but continued to trade well below neighboring regions. El Paso Permian added 38.5 cents to average 81.0 cents, while Waha picked up 33.0 cents to 80.5 cents.

Meanwhile, on a day when Middle East tensions roiled oil markets and dominated energy headlines, natural gas futures turned in a quiet session Friday, with continued warmth in the forecast leaving prices range-bound heading into the weekend. The February Nymex contract settled at $2.130/MMBtu, up 0.8 cents on the day. Week/week the front month slid 2.8 cents, with the January contract expiring at $2.158 the previous Friday.

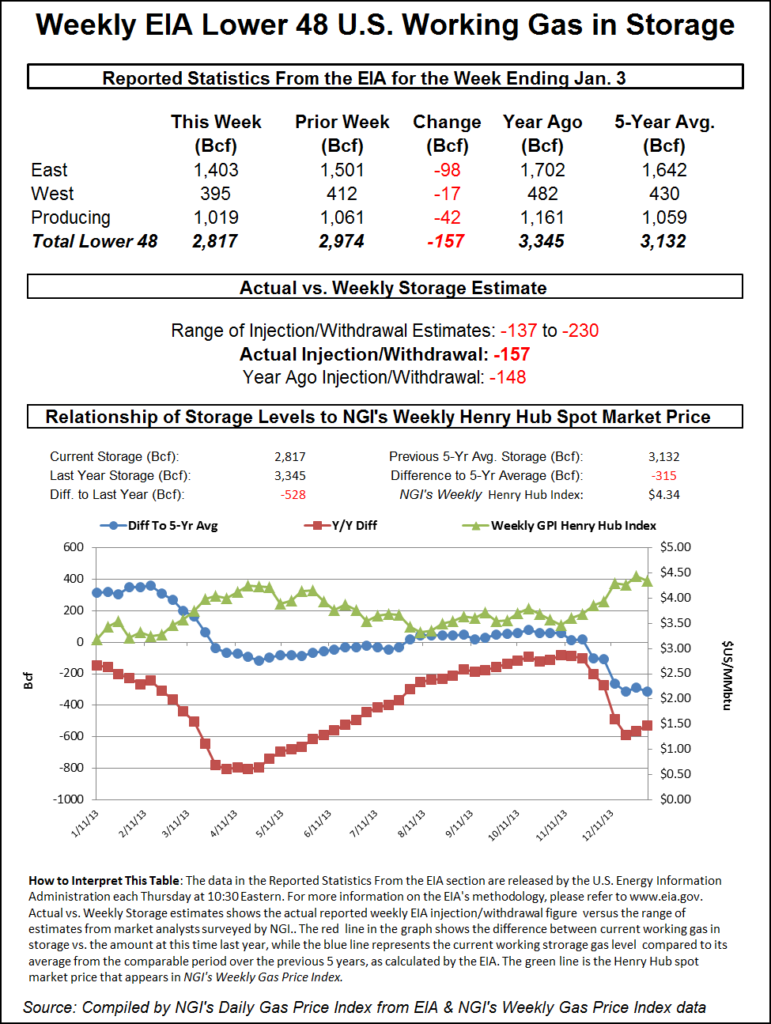

Those hoping the Energy Information Administration’s (EIA) latest storage data would provide a clear direction for prices likely came away disappointed Friday. The EIA reported a 58 Bcf weekly net withdrawal from U.S. gas stocks that came close to expectations, and the print prompted only a muted reaction from the market.

The 58 Bcf pull, recorded for the week ended Dec. 27, compares to a 24 Bcf withdrawal the EIA recorded last year for the similar week and a five-year average withdrawal of 89 Bcf.

Prior to the report, a Bloomberg survey showed a median expectation for a 63 Bcf withdrawal, with predictions ranging from minus 44 Bcf to minus 76 Bcf. A Reuters survey showed a consensus 57 Bcf pull, with estimates from minus 25 Bcf to minus 70 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled at minus 61 Bcf Thursday, while NGI’s model predicted a withdrawal of 49 Bcf.

“We see this as a very neutral number,” Bespoke Weather Services said following the report. “As always, we caution trying to read too much into balances in a holiday period, but we do still feel the balance picture alone is supportive at these price levels. We just need to get out of the very warm weather pattern that we have been stuck in before we can put together any rally.”

Total Lower 48 working gas in underground storage stood at 3,192 Bcf as of Dec. 27, 484 Bcf (17.9%) above year-ago stocks and 38 Bcf (minus 1.2%) below the five-year average, according to EIA.

By region, the East saw the largest net withdrawal for the week at 25 Bcf, followed by the Midwest at 18 Bcf. The Pacific region withdrew 9 Bcf on the week, while the Mountain region withdrew 4 Bcf. In the South Central, a 6 Bcf pull from nonsalt was partially offset by a 4 Bcf injection into salt stocks.

As for the weather outlook Friday, the pattern remained “exceptionally bearish,” but models showed hints of a potential colder shift heading into the back half of January, according to NatGasWeather.

The midday Global Forecast System (GFS) run shed more heating demand from the 15-day outlook, dropping 10 heating degree days versus 24 hours earlier. “But the GFS does continue to show frigid Arctic air over Western Canada and into the Northern Plains Jan. 13-17. It just doesn’t push it aggressively into the most important U.S. regions,” NatGasWeather said.

“…It needs close monitoring, as the data could easily see more of this frigid air push into the northern United States Jan. 16-20 over the weekend break for stronger national demand, but it would require the European model to be on board with it for it to be fully believed.”

An injection of “modest” cold over the weekend, including snow for some areas, helped pull East Coast spot prices up from bargain-basement levels Friday.

The southern and eastern portions of the country were experiencing “unseasonably mild conditions” Friday, including highs in the 40s and 50s in the Northeast and in the upper 50s to 70s from the Mid-Atlantic to Texas, according to NatGasWeather.

“An active pattern over the next week, although still with lighter-than-normal demand” through the early part of the upcoming work week “as weather systems bring rain and snow, but with only modest cooling,” the forecaster said Friday. “Out ahead of and in between systems, conditions will be quite mild…warmest across the southern United States and up the Mid-Atlantic Coast.”

One system was expected to push into the central United States starting Friday before moving into the East and Southeast over the weekend, NatGasWeather said. Starting around the middle of the upcoming week, “a second colder system will push into the Midwest and Northeast…with lows in the teens to 30s, just not widespread.”

The National Weather Service (NWS) on Friday was calling for “light to moderate snow” for parts of the Midwest and Northeast over the weekend.

“A weak clipper system” was expected to track through the Midwest Friday, “bringing light to locally moderate snow from southern Minnesota to central Illinois,” the forecaster said. “As upper-level energy continues eastward, snow is expected to spread over the interior Northeast and higher elevations of the Central Appalachians on Saturday. Snow totals of 3 to 5 inches are currently forecast.”

The prospect of weekend cooling proved enough to send Northeast prices higher Friday, although numerous hubs failed to even approach the $3 mark. Algonquin Citygate picked up 49.5 cents to average $2.700, while Transco Zone 6 NY added 23.5 cents to $2.090.

Farther south, Transco Zone 5 climbed 16.0 cents to $2.100, while Dominion Energy Cove Point picked up 19.5 cents to $2.060.

Midwest hubs traded within a nickel of even. Emerson added 2.0 cents to $1.960.

Elsewhere, West Texas prices showed renewed signs of worsening natural gas constraints in the Permian Basin. El Paso Permian tumbled 30.5 cents Friday to average a paltry 43.5 cents.

Recent developments in the Middle East could change the equation for crude-focused Permian producers as they calculate how much price pain they can tolerate when marketing their associated natural gas.

Amid news reports of a U.S. attack killing high-ranking Iranian military leader Qasem Soleimani, Brent crude oil futures surged Friday to nearly $70/bbl, a level not reached since September. West Texas Intermediate crude oil futures rose $1.87 day/day to $63.05/bbl.

“While there is no immediate impact on oil supply, events such as this naturally have the effect of raising the geopolitical risk premium in oil prices,” Raymond James & Associates Inc. analysts said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |