NGI All News Access | E&P | Infrastructure

U.S. Drops Two Natural Gas Rigs; Oil Count Falls Further

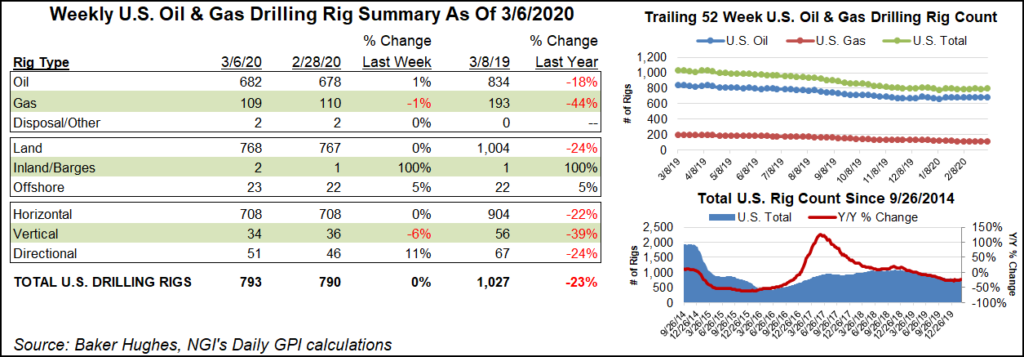

The U.S. natural gas rig count fell two units to 123 during the week ended Friday, while the oil count posted an even large decline, according to the latest figures from Baker Hughes Co. (BKR).

The U.S. rig count stood at 796 as of Friday, down nine units, including seven oil-directed rigs. The domestic count ended the week 279 units behind the year-ago tally of 1,075. Most of the declines occurred on land, with one rig exiting the Gulf of Mexico. Five vertical units packed up shop, joined by two directional units and two horizontal units.

The Canadian rig count fell 14 units to end the week at 85, up from 76 in the year-ago period. A 25-rig drop in oil-directed drilling was partially offset by the addition of 11 gas rigs on the week, according to BKR.

The combined North American rig count finished the week at 881, down from 1,151 at this time last year.

Among plays, the Permian dropped two rigs week/week, while the Arkoma Woodford, Cana Woodford and Marcellus each dropped one. The Ardmore Woodford added one rig after having no active rigs the prior week.

Among states, New Mexico, Oklahoma, Pennsylvania, Texas and Wyoming each dropped one rig from their respective totals, while Alaska added one rig.

Oil-directed drilling in the U.S. onshore has been in an extended slump, but a dramatic increase in tensions in the Middle East has increased upside price risk for crude.

West Texas Intermediate futures were up sharply Friday amid news reports that a U.S. strike in Iraq killed Iran’s Maj. Gen. Qasem Soleimani, a top military leader, threatening further escalation of conflict in the region.

“Suleimani’s killing increases fears of war in the region and of major disruption to regional oil supplies through military or cyber-attacks against oil facilities,” GlobalData editorial director Richard Thompson said. “Unlike the short-term spike in oil prices that we saw after the attacks against Saudi oil facilities in 2019, this is likely to add a security-risk premium to oil prices for the foreseeable future.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |