NGI Data | Markets | NGI All News Access

Natural Gas Traders Keep Powder Dry as EIA Storage Number Lands Near Consensus

The Energy Information Administration (EIA) on Friday reported a 58 Bcf weekly net withdrawal from U.S. natural gas stocks that came close to expectations, and the print prompted only a muted reaction from the futures market.

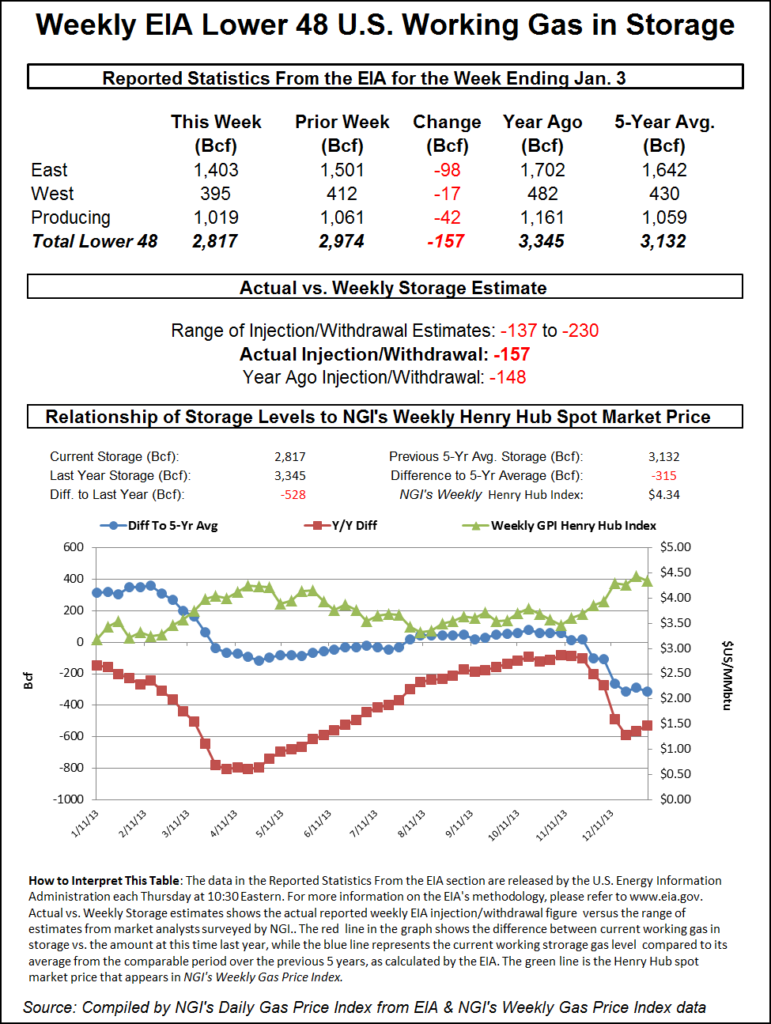

The 58 Bcf pull, recorded for the week ended Dec. 27, compares to a 24 Bcf withdrawal the EIA recorded last year for the similar week and a five-year average withdrawal of 89 Bcf. Major surveys had pointed to a withdrawal in the low 60s Bcf.

In the half hour leading up to Friday’s EIA report, pushed back a day due to the New Year’s holiday, the February Nymex contract traded in a range from $2.119-2.129/MMBtu. Immediately following the 10:30 a.m. ET report, the front month went as low as $2.116 and as high as $2.142.

By 11 a.m. ET, the February contract was trading around $2.141, up 1.9 cents from Thursday’s settle.

Prior to the report, a Bloomberg survey showed a median expectation for a 63 Bcf withdrawal, with predictions ranging from minus 44 Bcf to minus 76 Bcf. A Reuters survey showed a consensus 57 Bcf pull, with estimates from minus 25 Bcf to minus 70 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled at minus 61 Bcf Thursday, while NGI’s model predicted a withdrawal of 49 Bcf.

“We see this as a very neutral number,” Bespoke Weather Services said following the report. “As always, we caution trying to read too much into balances in a holiday period, but we do still feel the balance picture alone is supportive at these price levels. We just need to get out of the very warm weather pattern that we have been stuck in before we can put together any rally.”

Total Lower 48 working gas in underground storage stood at 3,192 Bcf as of Dec. 27, 484 Bcf (17.9%) above year-ago stocks and 38 Bcf (minus 1.2%) below the five-year average, according to EIA.

By region, the East saw the largest net withdrawal for the week at 25 Bcf, followed by the Midwest at 18 Bcf. The Pacific region withdrew 9 Bcf on the week, while the Mountain region withdrew 4 Bcf. In the South Central, a 6 Bcf pull from nonsalt was partially offset by a 4 Bcf injection into salt stocks.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |