NGI Mexico GPI | Markets | NGI All News Access

Fading Demand Takes Toll on Natural Gas Futures, Cash

With projected demand in long-range weather forecasts continuing to decline midweek, natural gas futures softened for the second day in a row. The January Nymex gas futures contract settled Wednesday at $2.286, down 3.3 cents on the day. February slid a more pronounced 3.9 cents to $2.264.

Spot gas prices also fell as the bitter winter conditions that had blanketed much of the United States earlier in the week were expected to begin easing on Thursday. However, multi-dollar gains continued across the Northeast, bumping up the NGI Spot Gas National Avg. by 16.0 cents to $3.405.

Progressively warmer long-range outlooks early Wednesday essentially put this month on track with the very warm December last year, according to Bespoke Weather Services. Specifically, weather models reflected warmer changes from the Plains to the East next week, something Bespoke saw as a risk given how strong the upper level ridge is projected to be in the eastern half of the nation during that time.

“Up to that point, agreement in the forecast models is good,” Bespoke chief meteorologist Brian Lovern said.

“That agreement deteriorates afterwards” as the Global Ensemble Forecast System, as usual the colder model, showed a much more favorable setup to get cold air back into the United States, while the European model suggested the eastern half of the nation would start the new year warmer. While Bespoke sees risks of “some cold” in January, it continues to lean toward the European model to start the month.

The Global Forecast System (GFS) midday run gained back 5 of the 10 heating degree days (HDD) that it had lost overnight, according to NatGasWeather, which is “no surprise after the GFS lost more than 50 HDDs over the past numerous days.

“The GFS data is still exceptionally bearish” beginning Saturday (Dec. 21) to Dec. 29, “with much above-normal temperatures over most of the United States,” the forecaster said.

Barring any major flips back to colder, Wednesday may have been the highest demand day for the rest of 2019. Furthermore, the impact of the turn to milder temperatures beginning Friday (Dec. 20) through Dec. 30 would be to flip year/year storage deficits back to surpluses, which may continue expanding until more ominous cold arrives, according to NatGasWeather.

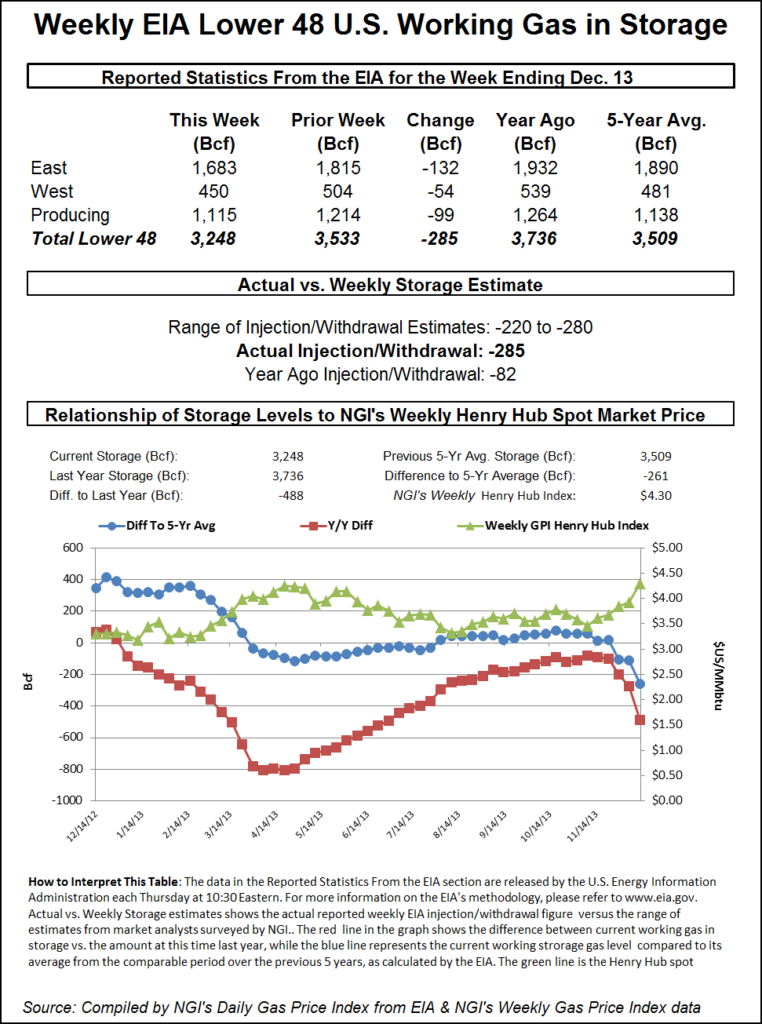

The U.S. Energy Information Administration (EIA) is scheduled to release its weekly storage inventory report on Thursday. Estimates, though wide ranging, are clustering around a pull in the low 90s Bcf.

A Reuters poll of 16 analysts estimated withdrawals ranging from 68 Bcf to 102 Bcf, with a median draw of 92 Bcf. NGI expected to see a draw of 86 Bcf.

This would compare with the 132 Bcf withdrawal EIA recorded in the year-ago period and the 112 Bcf five-year average draw. Inventories as of Dec. 6 stood at 3,518 Bcf, 593 Bcf above last year and 14 Bcf below the five-year average, according to EIA.

With “blowtorch” warm weather and the looming Christmas holiday, salt storage operators likely will be required to step up and absorb excess supplies in order to prevent a price collapse, according to EBW Analytics Group. Given current weather forecasts, the seasonal storage trajectory points to more than 1,550 Bcf in end-of-March inventories, a figure it said is probably too high by several 100 Bcf.

However, with futures prices still relatively well supported and closing a few cents off session lows on Wednesday, “the question is, ”how many more punches can bulls absorb before succumbing to bearish seasonal fundamentals?’” EBW asked.

Looking ahead into 2020, the firm said that if hopes for a cold January are shattered and support for natural gas crumbles, downward pressure may be intense. While not the most likely scenario, “prices skirting sub-$2.00 levels in the middle of winter cannot be fully ruled out.”

On the other hand, failure to succumb to likely intense bearish pressure next week may be an indicator that bulls are strong enough to propel Nymex futures higher into mid-January, according to EBW. Each of the past two winters has seen a 60-cent decline in natural gas prices from mid-November to mid- to late December, only to see a 50-cent increase from December lows to mid- to late-January peaks.

“A similar outcome remains possible this year, but will take significantly colder forecasts ahead,” the firm said.

Cash prices mostly slumped Wednesday as high pressure began sweeping across the country, leaving warmer temperatures in its wake. The milder air was expected to hit the East Coast by Friday, but not before dropping temperatures into the single digits and sending prices screaming higher for the second day in a row.

Pipelines have taken various measures to prepare for this cold spell, according to Genscape Inc. Aside from operational flow orders (OFO) announced by pipelines including El Paso Natural Gas (EPNG), Iroquois Gas Transmission, Southern California Gas Co. and Transcontinental Gas Pipe Line Co., Tennessee Gas Pipeline expanded its existing OFO to include Zones 2-6 and Columbia Gas Transmission declared a critical day. Dominion Energy Transmission also enacted area restrictions ahead of the coming cold, Genscape natural gas analyst Josh Garcia said.

With an Alberta clipper storm dipping into the Great Lakes and Northeast and producing lake-enhanced snow showers and occasional snow squalls across the region, cash markets posted another day of dramatic gains.

Next-day gas at Iroquois Zone 2 in New England shot up $3.63 to average $15.480, with some transactions seen as high as $16.500. Wednesday’s surge was the highest Iroquois Zone 2 has climbed since this past January, when prices raced up to $2.036 on Jan. 18.

Transco Zone 6 non-NY climbed 44.0 cents to $4.775, while Texas Eastern M-3, Delivery jumped 56.5 cents to $5.585 as pipeline work on Texas Eastern Transmission continued.

With temperatures set to begin moderating late Thursday/early Friday, other pricing hubs in Appalachia softened day/day by as much as 13.5 cents.

In the Southeast, Transco Zone 4 spot gas fell 7.0 cents to $2.215, while Henry Hub fell 5.5 cents to $2.240.

In the Midcontinent, Southern Star dropped 16.5 cents to $1.905, and farther north, Chicago Citygate fell a dime to $2.115.

Spot gas prices on the West Coast came crashing down as well, with losses of up to nearly 40 cents seen in the Rockies and California.

Meanwhile, planned maintenance Thursday on EPNG may limit South Mainline flows by as much as around 130 MMcf/d, according to Genscape.

The work would limit throughput capacity for the “CASA C” meter to 437 MMcf/d. The meter, about 35 miles south of Phoenix, typically flows at or close to its operating capacity of 580 MMcf/d, Genscape analyst Matthew McDowell said.

EPNG has shown in previous events that molecules can be rerouted from its intermediate to low pressure lines to mitigate overall flow impact. “However, despite this reroute ability, there’s price risk for both downstream and upstream spot markets.”

El Paso S. Mainline/N. Baja cash tumbled 46.5 cents on Wednesday to $4.165.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |