NGI All News Access | Infrastructure | Markets

EIA’s 107 Bcf Storage Draw Trims Losses for Natural Gas Futures

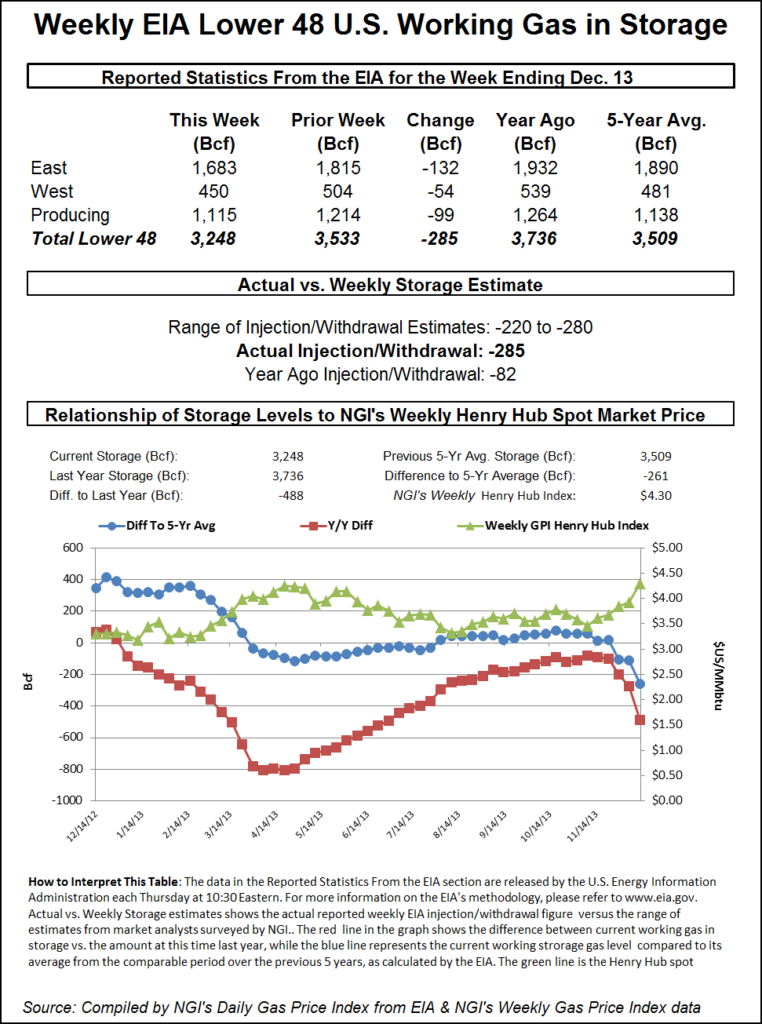

The U.S. Energy Information Administration (EIA) on Thursday morning reported a massive 107 Bcf withdrawal from natural gas storage for the week ending Dec. 13.

The reported draw was far above consensus estimates of a pull in the low 90s Bcf and was even several Bcf above the highest projection in market surveys. However, the 107 Bcf withdrawal was still far below the 132 Bcf withdrawal EIA recorded in the year-ago period and several Bcf below the 112 Bcf five-year average draw.

Nevertheless, the triple-digit pull took the natural gas market by surprise, with prices responding immediately to the latest EIA data. About five minutes before the 10:30 a.m. ET report, the January Nymex gas futures contract was trading at $2.257, down 2.9 cents from Wednesday’s settle, as weather models extended the coming span of mild temperatures further into January.

As the EIA print crossed trading desks, however, the prompt month strengthened to trade less than penny lower at $2.278. February was also nearly flat at $2.261. By 11 a.m., the January contract was just two-tenths of a cent lower at $2.284. February was up fractionally to $2.266.

“A massive draw. Way beyond expectations,” said Het Shah, managing director of The Desk’s energy industry chat platform Enelyst.com.

Ahead of the report, a Reuters poll of 16 analysts estimated withdrawals ranging from 68 Bcf to 102 Bcf, with a median draw of 92 Bcf. NGI expected to see a draw of 86 Bcf.

Andrea Paltrinieri, markets adviser to NatGasWeather, said the tighter draw sets the stage for a potential 160 Bcf withdrawal in the next EIA report. His 104 Bcf estimate for this week’s report was considered a highballer, but given the actual print, “if we keep this tightening, it will be an interesting time ahead.”

Broken down by region, the Midwest reported the largest withdrawal of 40 Bcf, and the East came in second with a 29 Bcf pull, according to EIA. The South Central withdrew 26 Bcf out of storage, including a stout 24 Bcf pull from nonsalt facilities and a 2 Bcf pull from salts.

“The South Central is the biggest miss here,” said independent weather forecaster Corey Lefkov. “Don’t mess with Texas.”

Total working gas in storage as of Dec. 13 stood at 3,411 Bcf, 618 Bcf higher than the year-ago period and 9 Bcf below the five-year average, according to EIA.

Looking ahead, the combination of low cash prices, max power burns and record liquefied natural gas demand could make for some volatile days ahead. However, “if we torch up the first two weeks of January, my view is that weather always wins in wintertime,” Paltrinieri said.

NatGasWeather meteorologist Rhett Milne agreed and said although weather models are starting to tease at colder air arriving in early January, it’s “going to be a painful stretch of weather to get through during the next 10-12 days.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |