On-Target EIA Data Leaves Nymex NatGas Futures Higher; Cold Blast Lifts NE Cash

With recent long-term weather models not providing much guidance for price direction, natural gas traders looked to the latest government storage data for inspiration. With a storage withdrawal that was bigger than what some analysts had projected, the January Nymex contract settled 2.8 cents higher on Thursday at $2.427/MMBtu. February rose 2.4 cents to $2.398.

Spot gas prices ended the day mostly in the black, but gains were generally capped at less than a dime, and some modest loses were also seen across the country. The Northeast put up several double-digit increases and helped lift the NGI Spot Gas National Avg. 5.0 cents to $2.345.

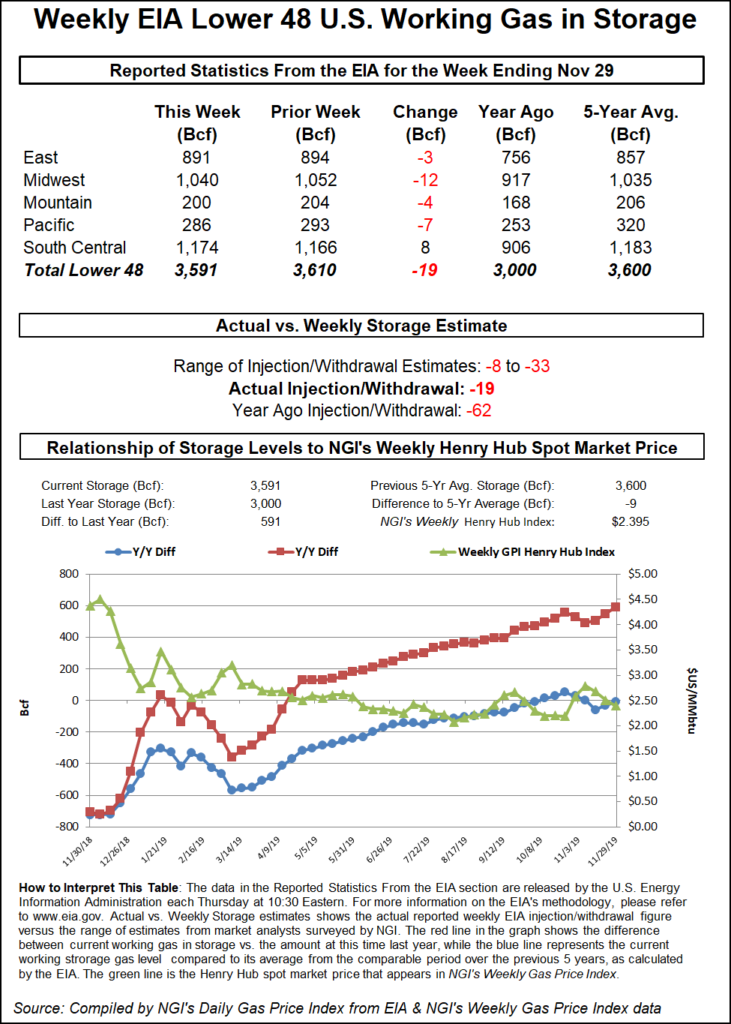

Given the volatility in recent weather model runs, the gas market was fixated on Thursday’s government storage inventory report. Ahead of the report, estimates for the withdrawal ranged widely from a draw of just 8 Bcf to a draw of as much as 33 Bcf.

The U.S. Energy Information Administration (EIA) reported a 19 Bcf pull for the week ending Nov. 29, easily coming in within the range of projections but still far below historical levels. The EIA recorded a 62 Bcf withdrawal in the same week last year, and the five-year average stands at 42 Bcf.

The reported 19 Bcf draw was “almost dead-on” with Bespoke Weather Services’ estimate and well within the range of market estimates. “For that reason, we label this as a ”neutral’ report, although we do feel that many in the market anticipated a smaller draw, which we think explains the move higher in prices since the report came out.”

Indeed, the January Nymex contract had climbed as high as $2.463 before going on to settle several cents below that level.

Next week’s number will be more interesting now, according to Bespoke, as it definitely sees some balance tightening showing up in the data, “enough so that any decent turn back colder can promote a rally back over $2.50 in prompt-month pricing rather easily, in our view.”

Broken down by region, the Midwest reported the largest withdrawal of 12 Bcf, while the Pacific pulled 7 Bcf out of storage, according to EIA. Just 4 Bcf was drawn out of inventories in the Mountain region, and the East pulled out 3 Bcf.

The South Central region posted a net injection of 8 Bcf, including 13 Bcf that was added into salt facilities and 5 Bcf that was withdrawn from nonsalts, the EIA said.

The Desk’s Het Shah, managing director of its energy chat platform Enelyst.com, noted the “nice build in salt” and said the region pretty much injected the amount it had withdrawn a couple of weeks back. The region is now “back to net salt injection over the month of November.”

Total working gas in storage as of Nov. 29 stood at 3,591 Bcf, which is 591 Bcf above year-ago levels and 9 Bcf below the five-year average, according to EIA.

As for the latest weather data, models remained starkly at odds, although the much milder European model added some demand to its outlook in the afternoon run. After the Global Forecast System (GFS) model trended colder midday in a rather bullish pattern Dec. 11-18, it was of considerable interest to see what the afternoon European model would show since it’s been running nearly 35-40 heating degree days (HDD) milder comparatively, according to NatGasWeather.

The afternoon European model added 5-6 HDDs versus Wednesday night’s run, but only 1 HDD versus its run the previous 24 hours. As such, the difference between the European and the GFS models remains vast, the forecaster said.

“It should make for an interesting Friday ahead of what is going to be another very dangerous weekend to hold due to the potential for big weather trends,” NatGasWeather said.

But, even normal weather may be cause for price declines, according to EBW Analytics Group. The winter price outlook for gas has also weakened on soaring natural gas production.

Production flow monitors suggest dry gas production may have broached 97 Bcf/d in the final days of November, EBW said. Pipeline flow monitors remain notoriously inaccurate, but can be directionally correct. Recent measurements, however, suggest a mind-boggling 4.0 Bcf/d of incremental production from the September average to the end of November.

“Rising supplies heading into the winter have tilted a bearish outlook further in favor of shorts, and contributed to decisive losses in Nymex futures last week,” EBW said.

Weather will remain the most critical near-term variable, with Nymex futures reacting to the latest weather model runs, according to the firm. “The forecast evolution will be critical”, with any delayed signs of emerging cold allowing the winter risk premium to erode further.

“Still, unpredictable shifts — such as the 68 Bcf decline during Thanksgiving week when other leading meteorologists were anticipating a cold outbreak to emerge — will continue to drive the market near term,” EBW said.

It was a relatively quiet trading day on Thursday for cash markets across the United States as moderate temperatures have settled in over much of the country. The exception was in the Northeast, where a winter weather system was set to arrive and bring reinforcing cold that may make it feel more like the middle of winter.

An Alberta clipper storm was forecast to spread a swath of snow, followed by a quick freeze from the Great Lakes to the Appalachians and New England coast, according to AccuWeather. This type of storm system originates from western Canada, and they tend to be starved of moisture; however, they can bring enough snow to shovel.

One such clipper storm was forecast to do just that across much of northern Michigan and southern Ontario beginning Thursday night, then across much of New York state, northern Pennsylvania and central New England on Friday.

“A general 1-3 inches of snow is forecast in much of this zone with a patch of 3-6 inches likely in part of central and eastern New York state,” said AccuWeather senior meteorologist Dave Bowers.

On the southern edge of the storm, from western and central Pennsylvania to northern New Jersey, southeastern New York state and southern New England, rain and snow showers are in store, but a quick coating to an inch of snow can occur in some locations, especially over the higher elevations, the forecaster said.

In the wake of the system, much of the Great Lakes and Northeast states “will remain locked in with a colder-than-average weather pattern through Saturday,” AccuWeather said.

The chilly outlook sent spot gas prices at New England’s constrained Algonquin Citygate surging 83.0 cents to $4.605. Farther south, Transco Zone 6 NY rose only 5.5 cents to $2.410.

Appalachia prices also strengthened on the frigid near-term outlook, although gains were limited to around a nickel at most pricing hubs. The exception was along Texas Eastern Transmission, which continues to be restricted at various points as part of a long-term maintenance event.

Several markets in the Southeast, Louisiana and Midcontinent saw spot gas prices slip a few cents amid the mild weather in store for those regions. Henry Hub fell 5.5 cents to $2.315. OGT posted a more substantial 10.5-cent decrease to $1.645.

In the Midwest, Chicago Citygate prices held steady at $2.190, with every pricing hub in the region only budging by a few cents at best.

West Texas prices similarly posted only small day/day changes, with Waha coming in at $1.485.

California cash was a mixed bag as SoCal Citygate plunged 31.5 cents to $4.805, while PG&E Citygate picked up 2.0 cents to reach $3.295.

The modest gain in the northern part of the state comes as forecasts call for a major winter storm to slam central and northern California beginning Friday. Although the center of the storm system will move ashore in Oregon later Saturday into Saturday night, the worst of the impacts will occur farther to the south, according to AccuWeather.

Heavy rain and gusty winds are forecast to target coastal areas from San Francisco northward into southern Oregon spanning Friday into Saturday, as well as the Central Valley’s I-5 corridor from Sacramento to Redding, the forecaster said. A general 1-2 inches of rain is expected in the lowest elevations of the I-5 corridor and San Francisco Bay area, while 2-4 inches is more likely in coastal areas of Northern California.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |