E&P | NGI All News Access | NGI The Weekly Gas Market Report

Pennsylvania Shale Production Ticked Upward in 3Q as Operators Curbed Activity

Pennsylvania’s unconventional natural gas production again increased in the third quarter, albeit at a more modest pace compared to recent years, as Appalachian operators curb activity in response to a variety of market factors.

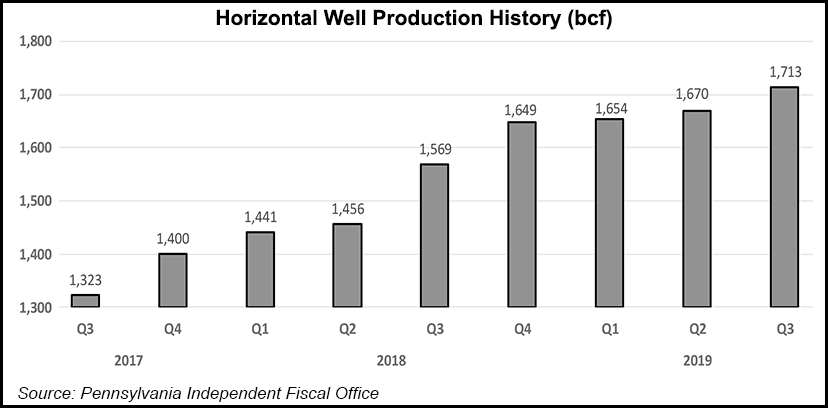

Natural gas production hit 1.715 Tcf in 3Q2019, up by 9.1% from the year-ago period and about 3% from 2Q2019, according to the state’s Independent Fiscal Office (IFO), which compiles a quarterly report based on data collected by the Pennsylvania Department of Environmental Protection.

Last year at this time, the IFO reported that production increased by 18.5% between 3Q2017 and 3Q2018. The office also said this week that between 3Q2017 and 3Q2019, unconventional production increased by 29.5%. There has been a quarter/quarter increase from unconventional horizontal production for 13 consecutive quarters. The IFO also tracks results from vertical wells drilled to unconventional formations, but they account for a marginal share of quarterly volumes.

Operators have been pulling back throughout the year on gas prices that have continued to remain low, while publicly traded producers have come under pressure from investors seeking better returns. As a result, the double-digit production growth that characterized the basin over the last decade has been expected to slow and increase at a more modest single-digit pace.

There were 9,116 producing horizontal wells in the third quarter, an 8.1% increase over the year-ago period.

The IFO also noted that the well inventory, those shut-in or drilled but uncompleted, declined by 68 wells to stand at 1,376 at the end of the third quarter. There were 132 horizontal wells spud in the period, or about 23% less than at the same time last year.

“This figure represents the lowest number of new wells spud since” 2Q2016, IFO said, likely reflecting both the slowdown and the efficiencies operators have gained from larger wells with more stages and longer laterals.

Meanwhile, IFO said all of the production growth during the third quarter came from wells spud in 2018. Wells spud in 2016 showed the largest decline in production, with volumes falling off by nearly 24%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |