NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

Wild Ride Leaves Natural Gas Forwards Much Lower Despite Long-Term Weather Uncertainty

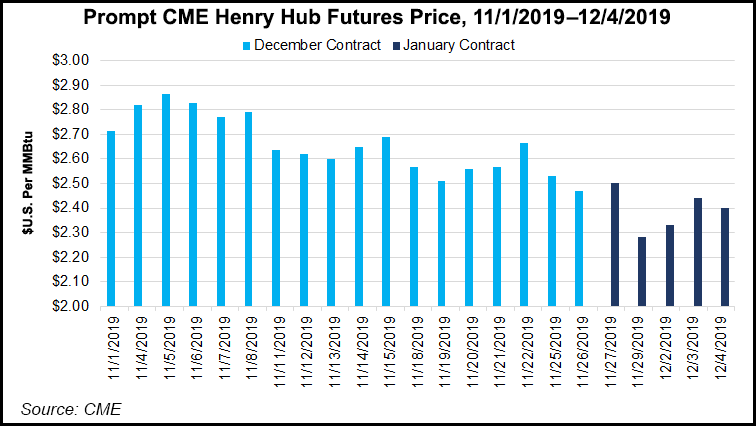

After somewhat of a stall in the days leading up to Thanksgiving, natural gas forwards resumed their grind lower between Nov. 26 and Dec. 4.

With massive sell-offs on the East and West coasts, January prices fell an average 20 cents and the balance of winter (January-March) dropped an average 16 cents, according to NGI’s Forward Look.

The extreme move lower occurred despite some intraweek volatility that resulted from wild swings in the weather data over the period.

Black Friday resulted in steep discounts for natural gas futures, with the January Nymex contract ending the day 22 cents lower once the dust settled. Prices began to recover on Monday and then posted a more substantial 10-cent-plus gain on Tuesday when the American weather model added a significant chunk of demand to its outlook.

However, an about-face in Wednesday’s weather model runs resulted in a pullback for futures, with the January contract settling at $2.399, down about 13 cents for the Nov. 26-Dec. 4 period. The balance of winter also fell 13 cents to around $2.35, while the summer 2020 strip slipped 7 cents to $2.28.

With production near all-time highs and storage inventories well ahead of historical levels, weather is absolutely key to winter natural gas prices recovering from their current sub-$3 levels. On Thursday morning, models showed a little higher demand versus the previous 24 hours, but the main story continued to be the massive gap in forecast demand between the American and European models.

That gap is now back up near 40 gas-weighted degree days over the next 15 days, with almost all of that coming in the eight- to 15-day period, according to Bespoke Weather Services. The European model showed a relatively tame pattern with demand not far from normal, while the American ensemble data placed more upper-level ridging around Alaska, turning the pattern much colder.

“Given sizable volatility and errors” in the Global Ensemble Forecast System (GEFS) in recent weeks, “we do not trust this model, but it does pose enough risk to maintain caution just in case it scores a win here,” Bespoke chief meteorologist Brian Lovern said. “We don’t believe the orientation of tropical forcing supports it, however.”

With such a difference between the two datasets, it is likely that one of them makes a large move soon. Bespoke placed odds higher on the GEFS coming down to meet the European model.

Forecasters at NatGasWeather agreed. “Clearly, one of them is wrong.” If the GEFS is correct, “weather sentiment should be considered bullish.” But since it was wrong last time, “it has the burden of proving it since the important European model disagrees and is nearly 40 heating degree days milder.”

Even if colder weather were to prevail in December, record production and healthy storage inventories could be too much for the market to overcome.

On the supply front, Lower 48 production has raced up by more than 6 Bcf/d since April on a monthly average basis, the bulk of that in the last four months, according to RBN Energy LLC. Production volumes jumped by 2.5 Bcf/d in August to average 93 Bcf/d. That was followed by a modest uptick in September, but in October, the volumes catapulted to 94.5 Bcf/d and then proceeded to climb by roughly 1 Bcf/d in November to average 95.5 Bcf/d.

“Production first topped the 95 Bcf/d mark on a daily basis in late October, and in the few short weeks since then, daily estimates also have crested 96 Bcf/d and hit a new high of 96.4 Bcf/d just this past Saturday, Nov. 30,” RBN analyst Sheetal Nasta said in a recent blog.

Demand also set record highs as Lower 48 demand from power generation, industrial and residential/commercial heating eked out new monthly highs in all but two months so far this year, according to RBN. But the year/year gains have been relatively modest compared with the bigger jump seen in 2018 and not enough to keep up with production growth.

December 2018 was much warmer than average, particularly in the second half of the month. So, there is still a chance that the balance could tighten this month compared to last year — but only if relatively cooler weather materializes through December.

“And, given the fickleness of weather, liquefied natural gas (LNG) exports will be all the more critical for balancing the market, especially if it is to bear the weight of 100 Bcf/d production levels, which may come sooner than you think,” Nasta said.

For its part, analysts with Tudor, Pickering, Holt and Co. (TPH) see the market exiting 2019 about 3 Bcf/d oversupplied, limiting winter withdrawals and resulting in storage inventories exiting the winter at around 2.0 Tcf, which is 25% above the five-year average.

“We expect this surplus to persist through 2Q2020, driving pricing below $2/Mcf, ultimately forcing around 1.4 Bcf/d of supply reductions by year end, which, combined with roughly 3.3 Bcfd of demand growth, puts the market about 2 Bcf/d undersupplied to exit 2020,” TPH analysts said.

Supply reductions will be the key to balancing the market and if supply surprises to the upside like it has in 2019, TPH expects it will lead to extended periods of extremely weak pricing. Like RBN, TPH analysts see LNG demand as a key input to watch as capacity adds from the Cameron and Freeport export terminals represent nearly two-thirds of the firm’s demand forecast, “meaning on-time start-up will be important.”

It’s also possible the LNG market remains oversupplied and requires a reduction in supply to balance the market, according to TPH. “If this proves to be the base, lower utilization from U.S. projects could cause gas to back up and further compound the U.S. supply-demand balance.”

Thursday’s storage report didn’t move the needle much as the data was viewed as neutral overall. The U.S. Energy Information Administration (EIA) reported a 19 Bcf withdrawal from storage inventories for the week ending Nov. 29, which was lower than last week’s 28 Bcf pull and far below the 62 Bcf withdrawal recorded in the same week last year and the 42 Bcf five-year average.

However, market observers on The Desk’s energy platform Enelyst.com noted that the market held up fairly well considering the reporting week included the Thanksgiving holiday.

Nymex futures action initially reflected this sentiment. The January gas contract was trading 2.1 cents higher at $2.42 at 10:20 a.m. ET, and then slipped fractionally to $2.417 as the EIA print crossed screens. After climbing as high as $2.463, the prompt month went on to settle Thursday at $2.427, up 2.8 cents on the day.

The reported 19 Bcf draw was “almost dead-on” with Bespoke’s estimate and well within the range of market estimates. “For that reason, we label this as a ”neutral’ report, although we do feel that many in the market anticipated a smaller draw, which we think explains the move higher in prices since the report came out.”

Indeed, estimates ahead of the EIA ranged widely from an 8 Bcf withdrawal to as much as a 33 Bcf draw.

Next week’s number will be more interesting, according to Bespoke, as analysts see some balance tightening showing up in the data, “enough so that any decent turn back colder can promote a rally back over $2.50 in prompt-month pricing rather easily, in our view.”

Broken down by region, the Midwest reported the largest withdrawal of 12 Bcf, while the Pacific pulled 7 Bcf out of storage, according to EIA. Only 4 Bcf was drawn from inventories in the Mountain region, and the East pulled out 3 Bcf. The South Central region posted a net injection of 8 Bcf, including 13 Bcf that was added into salt facilities and 5 Bcf that was withdrawn from nonsalts, the EIA said.

Total working gas in storage as of Nov. 29 stood at 3,591 Bcf, which is 591 Bcf above year-ago levels and 9 Bcf below the five-year average, according to EIA.

After a chilly and snowy week for the Thanksgiving holiday in parts of the Northeast, Mother Nature has had a change of heart in delivering a White Christmas to the region, with forward prices responding with steep declines to the milder forecasts.

Forecasters are closely watching a storm system that is expected to take shape and track toward the Great Lakes early next week. This will be the player that may help to flip the weather conditions in the East, according to AccuWeather. As wintry weather and yet another snowstorm are predicted for portions of the Midwest, surging warm and moist air will race out ahead of the system.

“Temperatures are expected to rebound to the 30s over the northern tier to near 50 degrees F in parts of Virginia as a southerly breeze develops on Sunday,” AccuWeather said. “On Monday, temperatures are forecast to surge into the 40s across the northern tier and the 50s and 60s across part of the mid-Atlantic region.”

Given the mild near-term outlook and uncertainty over long-term weather, Northeast forward prices came crashing down between Nov. 26 and Dec. 4. Transco Zone 6 NY January prices plunged 86 cents during that time to $6.203, while the balance of winter dropped 60 cents to $5.071, according to Forward Look. Summer 2020 fell just 7 cents to $1.98, and the winter 2020-2021 strip dropped 8 cents to $4.90.

Further north, prices in the often more volatile New England region posted less dramatic decreases across the curve. Algonquin Citygate January was down 34 cents to $7.581, and the balance of winter was down 24 cents to $6.578. Summer 2020 prices slid 6 cents to $2.34, and the winter 2020-2021 lost 11 cents to reach $6.52.

In Appalachia, Texas Eastern M-3 posted dramatic declines across the curve that easily bested other pricing hubs throughout the region. January plunged 56 cents from Nov. 26-Dec. 4 to reach $5.218, and the balance of winter dropped 41 cents to $4.320. The summer 2020 strip slipped 6 cents to $1.94, and the winter 2020-2021 fell 11 cents to $3.87.

In the Rockies, Northwest Sumas posted the largest decrease at the front of the curve amid a dramatically improved supply picture in the region.

Pipeline operator Enbridge Inc. last week completed engineering assessments on the Westcoast Transmission pipeline that were required to restore them to normal operating pressure after the October 2018 rupture near Prince George, British Columbia. The Canada Energy Regulator confirmed on Nov. 28 that the assessments were satisfactorily completed. Since then, southbound flows through Westcoast’s Station 4B increased over the weekend by nearly 200 MMcf/d, to around 1,860 MMcf/d from about 1,670 MMcf/d, according to Genscape Inc.

Jackson Prairie Storage inventories have recovered after an early drawdown as well. After hitting 20.25 Bcf on Nov. 8, only 86% of the five-year normal for that date, they have since rebounded to be within 2% of that five-year average at around 22.2 Bcf, Genscape said.

The vast improvement in the supply situation sent prices in the region barreling lower in the Nov. 26-Dec. 4 period, according to Forward Look. Northwest Sumas January tumbled $1.01 to $3.635, while the balance of winter dropped 60 cents to $2.983. Much smaller losses were seen further out the curve, with the summer 2020 strip shedding just 7 cents to hit $1.70 and the winter 2020-2021 strip slipping 3 cents to $3.09.

California’s storm-weary residents should finally catch a break next week from the train of winter storms that has swept across the region. Of course, that’s not before another large storm system is set to slam Central and Northern California beginning Friday.

The center of the storm system is expected to move ashore in Oregon into Saturday night, but the worst of the impacts will occur to the south, according to AccuWeather. Heavy rain and gusty winds are forecast to target coastal areas from San Francisco northward into southern Oregon, as well as the Central Valley’s Interstate-5 (I-5) corridor from Sacramento to Redding.

A general one-to-two inches of rain is forecast in the lowest elevations of the I-5 corridor and San Francisco Bay area, while two-to-four inches is more likely in coastal areas of Northern California, the forecaster said. It is in the coastal ranges and foothills of the Sierra, however, that rainfall totals of three-to-six inches are expected.

Drier conditions should gradually return from Sunday into Monday as the storm system pushes into the Rockies and Plains, according to AccuWeather.

The improving weather outlook helped send SoCal Citygate prices for January down 32 cents from Nov. 26-Dec. 4 to reach $5.062 and the balance of winter down 19 cents to $4.238, Forward Look data show. Interestingly, the summer 2020 strip climbed 6 cents to $2.91, while the winter 2020-2021 eased by 3 cents to $3.46.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |