E&P | Daily GPI | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Montney Seen Dominating Canadian Natural Gas Production Going Forward

The Montney Shale in northeastern British Columbia (BC) will dominate Canadian natural gas production growth for the next two decades, according to the Canada Energy Regulator (CER).

Drilling propelled by Pacific Coast liquefied natural gas (LNG) exports will nearly double BC output to 9.93 Bcf/d in 2040 from the current 5.34 Bcf/d, a new CER forecast said.

The Montney proved to be prolific over the last 10 years, according to the agency. As shale and tight gas development with horizontal drilling and hydraulic fracturing spread to Canada from the United States, BC production has about doubled from 2.79 Bcf in 2009.

In the CER’s “reference case” projection of the most likely industry future, the regional distribution of Canadian gas production also changes as forecast total national output rises by 31% to 21 Bcf/d in 2040 from the current 16 Bcf/d.

Alberta, currently the source for two-thirds of Canadian gas with 10.5 Bcf/d, fades to 53% of the national total in 2040 after rising slowly to only 11.1 Bcf/d. Alberta output is expected to shrink to a low of 9.38 Bcf/d in 2024 and 2025 before growth resumes.

The CER projections show the BC share of Canadian gas production climbing to 47% in 2040 from the current 33%. Eastern shale output is expected to remain zero unless New Brunswick and Nova Scotia reverse popular provincial fracking bans.

The CER 20-year projections only count the LNG Canada terminal and Coastal Gaslink supply pipeline currently under construction on the northern Pacific Coast at Kitimat and across BC from the Montney region. The agency does not speculate about when or whether other projects in BC or on the Atlantic side of Canada in Nova Scotia and Quebec would overcome cost, supply and regulatory hurdles.

The CER does not expect big price gains. The projections only foresee US$4.00/MMBtu for Henry Hub gas by 2040. Only a slow increase is likewise anticipated for oil, to US$75.00/bbl in 2040.

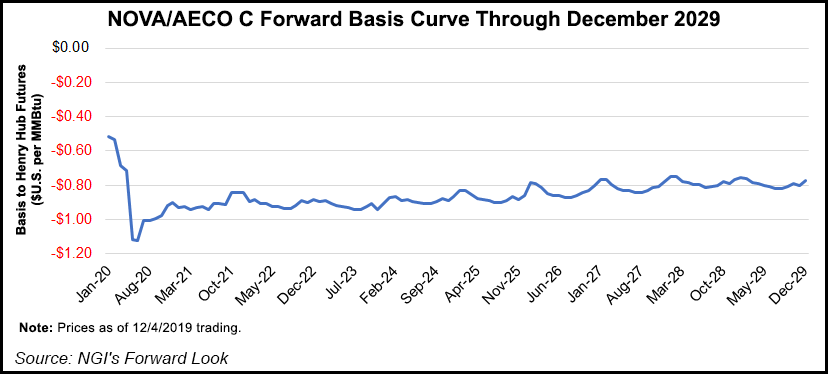

The differential or regional discount for Canadian gas supplies below the Henry Hub benchmark is expected to shrink to a long-term average of US90 cents/MMBtu, as current pipeline expansion programs reduce Alberta and BC surpluses.

While new overseas LNG tanker deliveries add an international dimension to Canadian gas markets, conventional pipeline exports are expected to keep shrinking until the mid-2020s.

Competition from Lower 48 gas is also rated as liable to stay strong on Eastern Canadian as well as American markets, with Ontario and Quebec serving as natural destinations for sales from the Marcellus and Utica shales in Pennsylvania, Ohio and West Virginia.

CER said imports of Lower 48 gas “have been stable over the last decade, hovering between 2-3 Bcf/d. Imports could potentially rise” as pipeline capacity increases from the Appalachian Basin to the Dawn hub.

Canadian gas demand is forecast to rise as environmental policies phase out coal-fired power generation and if not contested, delayed pipeline projects are built to enable resumed growth by Alberta thermal oilsands production.

The CER estimated Canadian oil output has potential for nearly 50% growth to 7 million b/d by 2040 if the Trans Mountain Pipeline expansion, Enbridge Inc.’s Line 3 replacement and TC Energy Corp.’s Keystone XL projects are completed.

The oil pipeline growth trio would add 1.7 million b/d to Canadian export capacity. The cross-border Line 3 and Keystone projects remain contested in the United States. Trans Mountain held a ceremonial start Tuesday of pipe installation on the Alberta end of its all-Canadian route to a Vancouver Harbor tanker dock.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |