Futures Slip as Natural Gas Traders Wait to See How Weather Data Shakes Out

The rollercoaster ride for natural gas prices continued on Wednesday as weather models whipsawed overnight, erasing much of the demand they had gained in recent runs. Given the lack of confidence in weather data, the January Nymex futures contract slipped 4.2 cents to settle at $2.399/MMBtu. February fell 3.1 cents to $2.374.

Spot gas prices also retreated as much of the United States was expected to be rather mild in the next day or so. The NGI Spot Gas National Avg. dropped 5.0 cents to $2.295.

After some early-season blasts of cold in November, outlooks for the final month of 2019 have so far failed to inspire much hope for bulls. On Tuesday, the January Nymex contract surged as much as 16 cents, climbing above $2.50 after the midday Global Forecast System (GFS) added a massive 30 heating degree days (HDD) to its outlook. When the afternoon European model failed to back it up, prices backed off by a nickel.

“Then came the overnight GFS that lost nearly all the 30 HDDs it gained Tuesday by showing not nearly as much cold air across the northern United States,” NatGasWeather said. “Prices quickly dropped several cents on the milder overnight GFS and then continued a few more cents lower when the European model also wasn’t as cold and lost 5-6 HDDs.”

The latest midday GFS was colder for next Tuesday and Wednesday but not as chilly Dec. 14-19, so the model essentially held onto the dramatic pullback in demand. As for the European model, the latest run added and subtracted demand for various days in the outlook, but overall added 8 HDDs to the forecast.

Bespoke Weather Services said it “is very difficult to trust any model that jumps around by 20-30 gas-weighted degree days in just 12-hour periods.” The European data has been much more stable, and remains warmer, while also hinting at what would be a warmer 16- to 20-day pattern as well, thanks to a trough over Alaska and no North Atlantic Oscillation blocking whatsoever.

The firm cautiously continues to lean toward that European model theory, continuing to feel that it has support from the overall background tropical forcing over the next couple of weeks. However, “we would not be surprised to see models continue to jump around,” Bespoke chief meteorologist Brian Lovern said. “We do still favor risks for cold to return late month, but if our forecast path is correct, we have a fair amount of milder weather first.”

Longer term, however, there are signs of a major stratospheric warming event, according to EBW Analytics Group. This could lead to a return of colder weather in late December, preventing natural gas from falling below last week’s lows.

This is not something Bespoke expects to show in the modeling for another week to week-and-a-half, however. Until that time, the firm holds an admittedly lower confidence view that favors lower price risks “until the dust settles.”

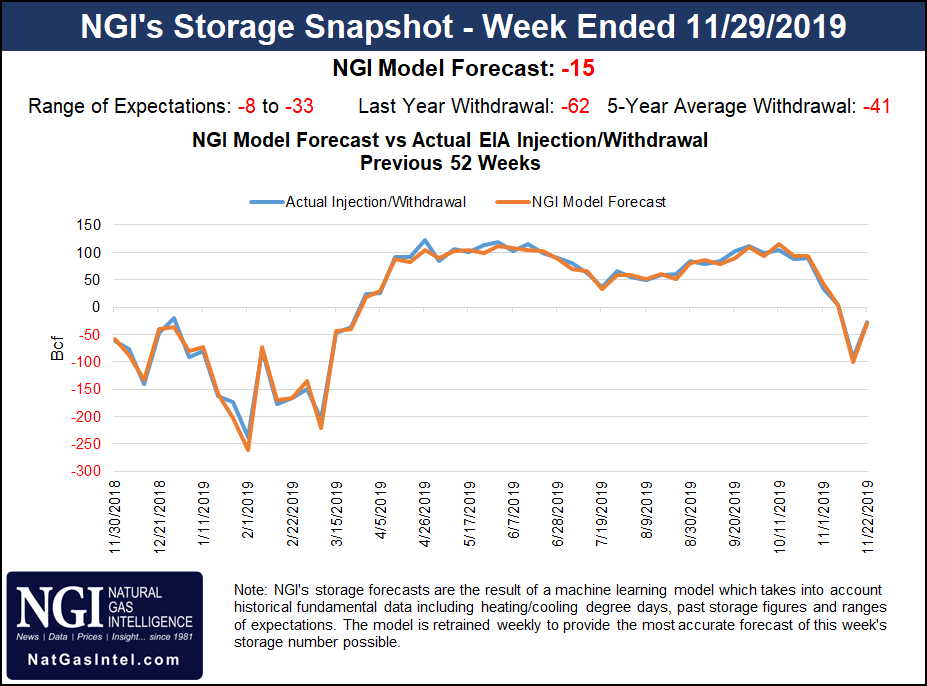

In the meantime, all eyes will be on Thursday’s natural gas storage inventory report. Analysts are projecting the Energy Information Administration (EIA) to report a much smaller-than-normal withdrawal, although the range of estimates is exceptionally wide.

A Reuters survey of 19 market participants showed withdrawal estimates ranging from 8 Bcf to 33 Bcf, with a median pull of 24 Bcf. A Bloomberg survey of 12 analysts showed withdrawals ranging from 8-29 Bcf, with a median pull of 25 Bcf.

This is not too far off last week’s EIA print of a 28 Bcf draw, although holiday weeks can be tricky considering the huge chunk of demand that typically falls off the grid during this time. NGI projected a pull of 15 Bcf.

Last year, the EIA recorded a 62 Bcf withdrawal in the same week, while the five-year average stands at 41 Bcf.

Spot gas prices declined across most of the United States as the central and southern part of the country was forecast to warm the next few days, with highs reaching 40s to 70s, warmest over Texas and the South, according to NatGasWeather. Prices were lower even in the Northeast, where a reinforcing cool shot was forecast to track into the region through Thursday for locally strong demand. Overnight temperatures were forecast to dip into the 20s and 30s.

Warm high pressure was then expected to strengthen across the southern and eastern United States late this weekend into early next week with warmer-than-normal conditions, including highs in the 50s to 70s, the forecaster said. However, very cold air will likely push into the Northern Plains at the same time, then spread across the Midwest and East toward the middle of next week.

Given the mild setup in the near term, however, daily prices fell. In the Northeast, Transco Zone 6 non-NY spot gas dropped 13.5 cents to $2.320, while prices at Algonquin Citygate in New England came off close to 30 cents to average $3.770.

Appalachia prices were mixed, although the majority of pricing locations moved less than a nickel. One exception was Texas Eastern M-3, Delivery, which plunged 17.5 cents to $2.335.

Prices across the Southeast and Louisiana were down anywhere from a few pennies to as much as 14 cents, while Panhandle Eastern in the Midcontinent tumbled some 20.0 cents to average $1.650.

Over in the Rockies, prices were mostly lower, although Northwest Sumas posted one of the region’s only gains. Sumas next-day gas rose 8.0 cents to $2.815.

Nevertheless, Sumas’ premium to benchmark Henry Hub, at about 45 cents, is far below levels seen just last week when southbound flows from Canada remained constrained.

Enbridge Inc. completed the required engineering assessments last week on the Westcoast Transmission pipeline following the October 2018 explosion and force majeure. Enbridge was required to inspect segments on an individual basis in order to restore them to normal operating pressure after the rupture near Prince George, British Columbia.

The Canada Energy Regulator confirmed on Nov. 28 that these assessments were satisfactorily completed. Since then, southbound flows through Westcoast’s Station 4B increased over the weekend by nearly 200 MMcf/d, to around 1,860 MMcf/d from about 1,670 MMcf/d, according to Genscape Inc.

Jackson Prairie Storage inventories have recovered after an early drawdown as well. After hitting 20.25 Bcf on Nov. 8, only 86% of the five-year normal for that date, they have since rebounded to be within 2% of that five-year average at around 22.2 Bcf.

In California, the brutal start to winter and strong demand have prompted sustained withdrawals from Aliso Canyon over the last week, according to Genscape. Over the course of six days from Nov. 26 through this past Sunday, Southern California Gas withdrew a total of 1,865 MMcf from Aliso Canyon, an amount equal to about 5% of its California Public Utility Commission (CPUC)-directed total working inventory (35 Bcf).

These withdrawals averaged around 270 MMcf/d, with the largest withdrawal of 644 MMcf/d occurring last Friday, Genscape analyst Joseph Bernardi said.

Cold weather in southern California last week and over the holiday weekend translated to notably high demand: SoCalGas’ rolling seven-day average demand crossed above 3 Bcf/d this past weekend for the first time since February, according to Genscape.

“Comparing those days in February with a rolling seven-day average demand above 3 Bcf/d to the recent week-long period, both have featured withdrawals from Aliso Canyon, but this recent cold snap has had a relatively subdued spot price response,” Bernardi said.

This may be partially the result of the new Aliso Canyon Withdrawal Protocol that the CPUC put into effect this summer, which is intended to make withdrawals from that storage field relatively easier. Several caveats need to be mentioned when comparing this recent demand period to February, however.

The import capacity at the border on L235-2 and L4000 has increased, which, when lower, had played a significant role in increasing price volatility in Southern California starting in the fall of 2017. Also different is the timing — early versus late winter, with different accompanying overall SoCalGas storage levels — and the length of time featuring high demand, Bernardi said.

Next-day gas at SoCal Citygate fell 19.0 cents to $5.120, while pricing hubs farther north moved only a couple of cents day/day.

Farther upstream in the Permian Basin, a one-day pigging run on Thursday through El Paso Natural Gas’ Line 2000 in Southeast Arizona has the potential to disrupt 236 MMcf/d of Permian takeaway. The maintenance event will see operational capacity limited to 334 MMcf/d, a decline of 236 MMcf/d from the 30-day average of 570 MMcf/d, according to Genscape.

The planned work helped send El Paso S. Mainline/N. Baja down 13.5 cents to $2.755, while points farther upstream on the El Paso system tacked on more than a nickel day/day.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |