Markets | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

November Cold Snap Said Boon for Coal, but Natural Gas Holds Competitive Edge Longer Term

Cheap, abundant supply has allowed natural gas to emerge as a fuel of choice in electricity markets once dominated by coal, leading to plant retirements and shifting capacity trends. However, last month’s record-setting cold snap showed how much price continues to shape the competition between the two fuels.

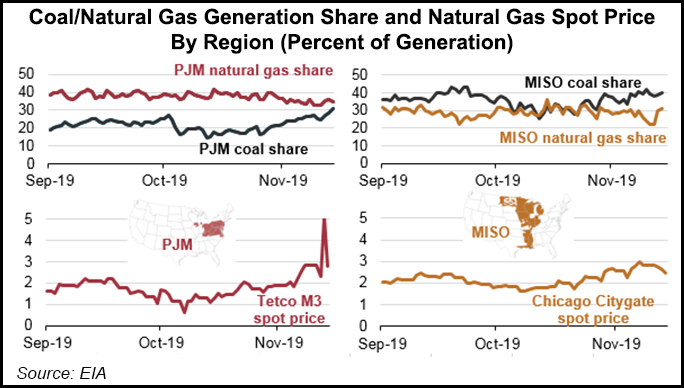

In a recent note, the Energy Information Administration (EIA) examined the impact weather-driven spot price gains had on the relative share of natural gas- versus coal-fired generation in the PJM Interconnection and Midcontinent Independent System Operator (MISO) territories. In PJM and MISO, “strong competition exists” between gas and coal, making fuel prices influential on generation trends in these markets, EIA said.

For 2019 overall, natural gas has enjoyed an increasing share of generation in these territories, averaging 35% in PJM and 27% in MISO. Amid weak shoulder season pricing in October, EIA said natural gas-fired generation rose to a year-to-date high in MISO at 36%. This represented the first time in 2019 that gas had topped coal in the territory, which covers much of the Midwest and extends into the Gulf Coast.

Higher gas prices saw the share of gas generation in MISO fall to 22% on Nov. 10, an eight-month low, the agency said. Coal, on the other hand, fueled an average 38% share of MISO generation through the first 13 days of November; that’s compared to a 25% share on Oct. 12 and an October average of around 32%.

Average Chicago Citygate spot prices fell to as low as $1.635/MMBtu during the Oct. 4 and Oct. 7 trade dates, Daily GPI historical data show. Amid the early winter cold blast that brought unusually frigid temperatures to much of the Lower 48, prices in Chicago climbed to as high as $2.975 in Nov. 6 trading.

It was a similar story in PJM, where natural gas-fired generation topped coal generation throughout the shoulder season. As Arctic chills swept through in early November, driving up the price of gas in the PJM region, coal closed the gap, according to EIA.

Natural gas fueled 34% of PJM generation on Nov. 9, the lowest level since May. Only days later, coal enjoyed its highest share of PJM generation since March, climbing to 31% on Nov. 14, EIA said. Unsurprisingly, the falling gas generation share coincided with a spike in Texas Eastern M-3, Delivery spot prices, which peaked at $5.35 on Nov. 12 after trading below $2 for much of October.

While fuel costs influence competition between gas and coal in the short-term, operating costs are — and will likely continue to be — a key factor in the longer-term shift away from coal generation. According to EIA, an analysis of coal-fired capacity retirements between 2008 and 2017 showed a correlation between plant retirements and higher operating and maintenance costs.

“Sustained relatively low natural gas prices has allowed natural gas-fired generators to become more competitive with coal-fired units, leading to a general decline in using coal-fired capacity,” EIA said. “A decline in use leads to a decline in revenues at a plant, which generally translates to lower operating margins, less ability to cover costs, and in many cases, retiring that capacity.”

After peaking at close to 318 GW in 2011, coal-fired capacity in the United States fell to 257 GW in 2017. Using data reported to the Federal Energy Regulatory Commission, EIA sorted coal plants into three groups based on their operating and maintenance costs. Those in the highest cost group reported operating and maintenance costs ranging from $28-40/MWh, while those in the lowest-cost group reported costs from $20-26/MWh.

“In general, the group with the lowest variable operating and maintenance costs tended to run more often, which resulted in higher capacity factors,” EIA said. “…As natural gas prices fell and coal use decreased, capacity factors at coal-fired power plants fell from 75% in 2008 to 54% in 2017. The number of operating coal plants in the highest operating cost group fell by more than the fleet average, from 75% in 2008 to 47% in 2017.”

Facing down continued competition from natural gas, including low fuel prices, more advanced combined-cycle generators and the “increasing efficiency of the natural gas generator fleet,” EIA projects more coal capacity retirements moving forward. Between 2019 and 2030, the agency expects 90 GW of coal-fired capacity retirements, including 66% of the units in the group with the highest operating costs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |