E&P | NGI All News Access | Permian Basin

Permian’s Bone Spring Formation Key to Building Delaware Production, Says EIA

With better drilling techniques improving extraction volumes, the Permian Basin’s Bone Spring formation should continue to drive growth in the Delaware sub-basin, the Energy Information Administration (EIA) said Wednesday.

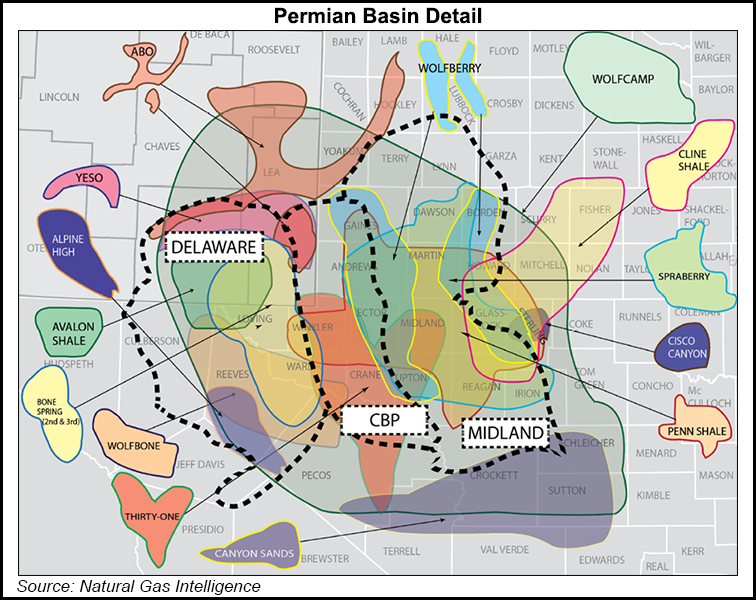

Updated maps and geologic information for the Bone Spring play in the Delaware, which runs from southeastern New Mexico to West Texas, include formation geology, deposition history and regional tectonic features.

“With the introduction of hydraulic fracturing and horizontal drilling, hydrocarbon production has increased considerably in the Bone Spring,” according to the EIA report, which was completed by principal contributors Olga Popova, Emily Geary, April Patel and Julie Cohen.

“The number of producing wells in Bone Spring grew from 436 wells in January 2005 to 4,338 wells in mid-2019.” The wells also have become more productive, researchers said.

Average oil production per well for the first six months of operation has increased to 770 b/d in 2019 from 67 b/d in 2005. In that same period, average natural gas production per well for the first six months of operation grew to 1.6 MMcf/d from 0.1 MMcf/d.

“In August, average monthly production from Bone Spring reached 0.6 million b/d of oil and 1.7 Bcf/d,” the researchers said. “EIA expects Bone Spring production to continue to drive production growth in the Permian Basin,” with additional oil and natural gas pipeline takeaway capacity coming online through 2020 to accommodate the production increase.

The Bone Spring formation, EIA noted, lies directly under the Delaware Mountain Group and over the Wolfcamp formation, and it consists of interbedded siliciclastic, carbonate and shale rocks up to 4,000 feet thick in four intervals. From top to bottom, they are the First, Second and Third Bone Spring. The Avalon Shale is within the First Bone Spring carbonate.

“Each interval has very low permeability, which means that oil and natural gas cannot flow easily,” researchers noted. “Recent advances in completion techniques have increased oil recovery factors to as high as 34%, meaning 34% of the estimated resource base in an area is produced.”

Many exploration and production companies have touted their findings within the Bone Spring. EOG Resources Inc. CEO Bill Thomas during the 3Q2019 conference call said the Houston producer had identified more targets in the Wolfcamp and Third Bone Spring that could add 1.6 billion boe net of resource potential. The targets, he said are economic at a flat $40/bbl oil price and a flat $2.50/Mcf gas price.

Devon Energy Corp. also claimed success in the Second Bone Spring during the third quarter. The Oklahoma City-based independent said Delaware net output jumped 76% year/year to 107,000 boe/d, with operating results highlighted by five Cat Scratch Fever wells that targeted a Second Bone Spring interval in southwest Lea County, NM. Each well averaged initial 24-hour production rates of more than 10,000 boe/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |