Regulatory | E&P | NGI All News Access

Federal Oil, Gas Leasing Terms in Colorado Said to Cost Government Billions

The U.S. government has missed out on billions of dollars of revenue from overly generous and outdated terms for oil and gas leases on federal land in Colorado, according to a report by the Taxpayers for Common Sense advocacy group.

The report cited royalty rates “that lag the rates imposed on production from federal waters and Colorado state lands,” as well as annual rental rates and minimum bid prices for leases “that have not changed in more than 30 years.”

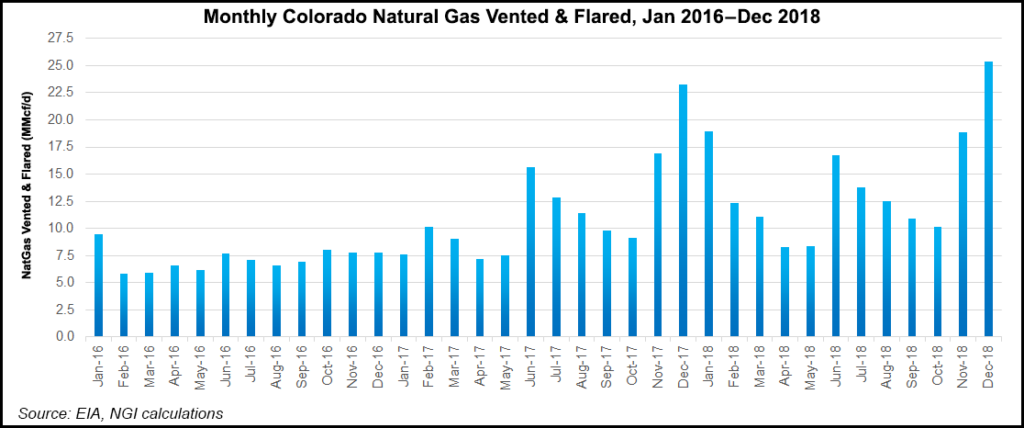

The group also cited venting and flaring of natural gas “that’s ignored on federal lands,” while the Bureau of Land Management (BLM) “refuses to charge producers for it,” and noncompetitive leases that allow companies to lease land with no minimum bid requirement.

The royalty rate of 12.5% on the sales value of oil and gas extracted from federal lands in Colorado is “considerably lower” than the corresponding rates for new leases on private or state trust lands in Colorado, the advocacy group said.

By comparison, the Colorado State Land Board increased the royalty rate for leases on state trust land stands to 16.67% from 12.5% in May 2011, and to 20% from 16.67% in February 2016.

New Mexico charges corresponding rates of up to 20%, while Texas charges up to 25%, the report noted. In federal waters, meanwhile, the royalty rates set by the Bureau of Ocean Energy Management are 12.5% for leases in shallow water, i.e. water depths of less than 200 meters (656.2 feet), and 18.75% for deepwater, or depths of 200 meters or more.

The Department of the Interior said in October revenue disbursements collected on federal and American Indian-owned land and offshore areas rose 31% year/year in fiscal year 2019 to $11.69 billion.

If the 18.75% offshore royalty rate had been imposed on federal oil and gas produced in Colorado from 2009-2018, the state’s Office of Natural Resources Revenue (ONRR) “could have collected up to $1.3 billion more,” the Taxpayers for Common Sense report said, meaning that “Colorado taxpayers would have received $600 million more in disbursements.”

Rules implemented by Colorado in 2014 to reduce methane emissions from venting, flaring, and fugitive emissions of natural gas resulted in a reduction in the state by one-third between 2013 and 2018, the report said.

However, “Of the 3.9 Bcf of gas reported lost by operators on federal lands in Colorado between 2008 and 2017, ONRR reported collecting royalties on just 102 MMcf, or 2.6%.”

Meanwhile, neither the annual rental rate nor the minimum acceptable bid rate for oil and gas leases awarded on federal land has been adjusted since 1987, the report noted.

If a parcel on offer in Colorado were to receive no bids, then a company may submit a noncompetitive offer with no minimum bid requirement, the report said, citing that BLM issued 129 noncompetitive leases covering 80,750 acres of federal land in Colorado.

The report’s authors argued that BLM should exercise its “existing statutory authority to independently change each of the policies discussed here, including royalty rates, rental rates, and treatment of natural gas waste.”

“Our federal laws and regulations are in place to ensure public benefit,” a BLM Utah spokesperson told NGI’s Shale Daily. “The BLM implements federal laws and regulations that determine royalty rates for activities on public lands.

“In fiscal year 2018, oil and gas development on public lands managed by the BLM in Colorado contributed an estimated $6.9 billion to the economy, with approximately 30,600 jobs tied to oil and gas development on BLM-managed public lands.”

The state of Colorado receives 48% of the proceeds from each oil and gas lease sale, with the remainder going to the U.S. Treasury, the BLM spokesperson said.

The taxpayer report comes amid proposals from some Democratic presidential candidates to ban oil and gas drilling on federal lands altogether. Founded in 1995, Taxpayers for Common Sense is a nonpartisan budget watchdog group.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |