Markets | NGI All News Access | NGI The Weekly Gas Market Report

Mexico’s CFE Urged to Capitalize On Idle Capacity, Cheap Texas Gas

Mexican state power utility Comisión Federal de Electricidad (CFE) is uniquely positioned to capitalize on a surplus of cheap natural gas in Texas but must do more to use its pipeline capacity, according to multiple experts on the burgeoning U.S.-Mexico energy trade.

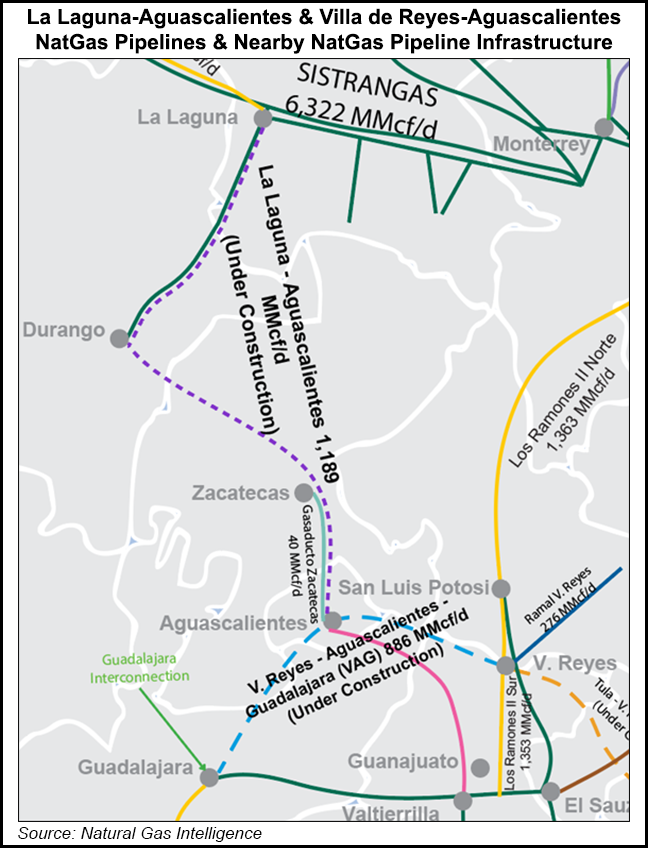

CFE is the anchor customer for some 3,200 miles of gas pipelines that have entered service within Mexico since 2012, and 682 miles of pipelines north of the border in the United States, according to energy ministry Sener.

Another 1,043 miles of CFE-anchored pipelines, which have faced delays for various reasons, remain under construction.

A recent audit by Mexico’s Auditoría Superior de la Federación found that CFE was only utilizing a small fraction of its pipeline transport capacity.

Although CFE’s own gas demand is poised to grow as the company expands its combined-cycle gas turbine fleet, “the availability of these new pipelines definitely should result in the CFE monetizing some unused capacity to allow for others to bring natural gas for industrial, commercial and residential uses,” Mayer Brown LLP’s José Valera, partner, told NGI’s Mexico GPI.

Talanza Energy Consulting’s Daniela Flores, head of midstream and downstream, told the US-Mexico Natural Gas Forum in San Antonio, TX, last month that CFE had yet to sign any contracts with third parties for its idle pipeline capacity, and that it was importing gas exclusively for its power generation plants.

Valera, who heads Mayer Brown’s oil and gas practice, said that the open access pipeline rules enacted under Mexico’s 2013-2014 energy reform should, in theory, prevent CFE from hoarding unused pipeline capacity.

Of the pipeline projects under construction in Mexico, Fermaca’s Waha-to-Guadalajara system holds the most potential as an outlet for gas produced in the Permian basin, according to RBN Energy LLC analyst Jason Ferguson.

“That’s a segment that could really open up and get Permian gas that just now stops essentially in northwest Mexico…all the way to central Mexico,” Ferguson said at the San Antonio event.

The final segment of the colloquially named “Wahalajara” system comprises the 232-mile, 886 MMcf/d, Villa de Reyes-Aguascalientes-Guadalajara section, which RBN expects to enter service in early 2020.

Direct exports from the Waha hub in the Permian to Mexico had averaged about 0.5 Bcf/d over the preceding two months, Ferguson said.

He cited that flows from Waha to the Mexican border had been well below the combined 3.1 Bcf/d of capacity on the Roadrunner, Trans-Pecos and Comanche Trail pipelines.

This gas was mainly serving power generation plants in northwestern Mexico, Ferguson said.

Looking ahead, he said, the Energía Costa Azul (ECA) liquefied natural gas (LNG) export project on Mexico’s Pacific coast could also provide a westbound outlet for Waha gas, explaining that any significant westbound gas demand increase from the Permian “would be from LNG.”

The recent entrance into service of Kinder Morgan Inc.’s Gulf Coast Express (GCX) pipeline had provided temporary relief to Permian gas prices, reducing basis differentials between Waha and Henry Hub.

“We’ll see how long that lasts,” Ferguson said. “We think probably a few more months…there will be some issues likely next year.”

The prospects for Permian gas prices are not helped by the recent postponement to by Kinder Morgan Inc. of the in-service date for its 2.1 Bcf/d Permian Highway Pipeline (PHP) to early 2021.

PHP will transport gas from Waha to the U.S. Gulf Coast and Mexico markets.

There is currently “not a stellar outlook” for Permian natural gas prices through 2020, Ferguson said, although that fact is “certainly an opportunity for those buying gas, including Mexico.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |