Natural Gas Futures Fall as Too Little Cold for Market Stuffed With Supply

Concerned that there won’t be enough weather-driven demand to gobble up all of the supply entering the market, natural gas futures traders sent prices several cents lower Wednesday. In its first day as the front month, the January Nymex contract slid 3.2 cents to $2.501/MMBtu. February dropped 3.1 cents to $2.470.

In the spot market, premiums in the West and in the Northeast, accompanied by generally modest price adjustments through the middle third of the Lower 48, pushed NGI’s Spot Gas National Avg. 10.0 cents higher to $2.475.

Overnight ahead of Wednesday’s trading, the Global Forecast System (GFS) had dropped an “impressive” 16 heating degree days (HDD) from the outlook, and midday data removed an additional 12 HDDs, according to NatGasWeather.

“Clearly, the data has turned awful/red/bearish compared to what it had shown,” the forecaster said. “It doesn’t help production was reported at new record highs in recent days. So, clearly not a favorable setup for a strong rally.

“…The latest midday GFS does tease cold returning Dec. 11-12, but that’s too far out to expect it, especially after the weather models failed miserably” by showing a “much-too-cold early December forecast.”

Meanwhile, the market appeared to get an early dose of tryptophan Wednesday, courtesy of a rather unsurprising storage report from the Energy Information Administration (EIA).

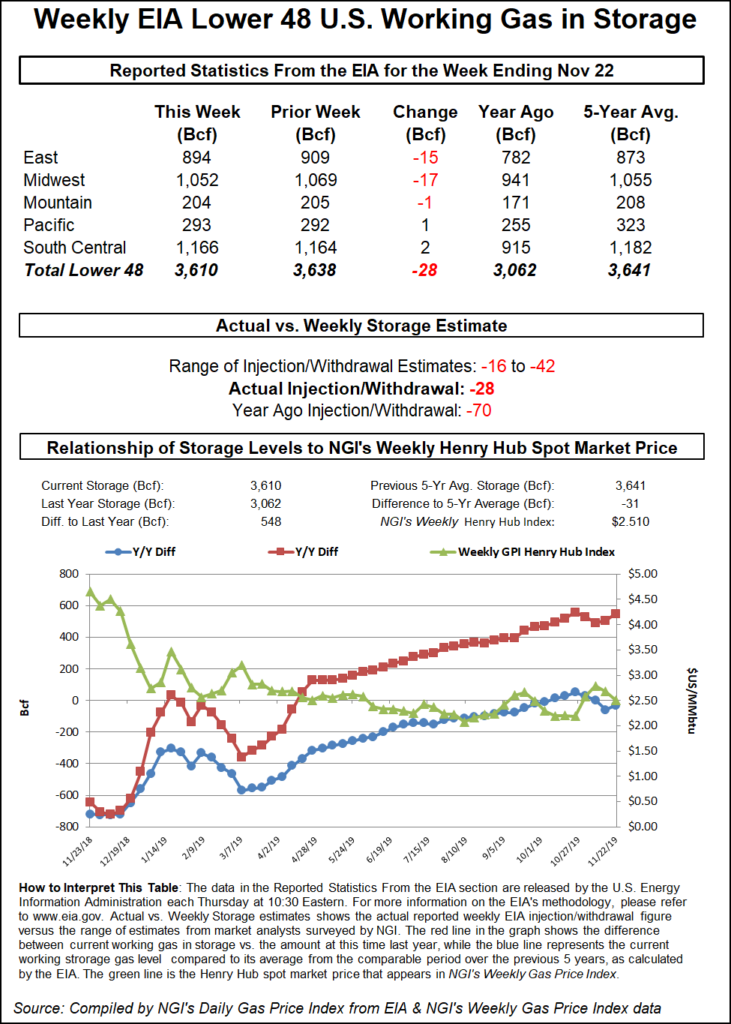

The EIA reported a 28 Bcf weekly withdrawal from U.S. gas stocks that fell in line with estimates. Whether it was a product of the on-target print, or just a case of traders leaving their offices early to be with family, futures prices barely budged on the news.

The 28 Bcf pull, recorded for the week ending Nov. 22, compares to a five-year average of minus 57 Bcf and a 70 Bcf pull for the year-ago period.

In the hour leading up to Wednesday’s report, released a day early ahead of the Thanksgiving holiday, the January contract had traded around $2.500-2.520. As the report crossed trading screens at noon ET, the front month briefly popped to as high as $2.532 before falling back in line with the pre-report trade at around $2.510-2.515.

Prior to the report, major surveys had pointed to a withdrawal around 27-28 Bcf, with expectations ranging from minus 16 Bcf to minus 42 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at minus 27 Bcf. NGI’s model predicted a withdrawal of 29 Bcf.

“Not much life in the natural gas markets,” said Enelyst.com managing director Het Shah during a discussion on the industry chat platform following EIA’s report. “Everyone looks to be in holiday mode.”

Shah noted that Midwest stocks ended the period “well above” year-ago levels, potentially “quite bearish for Midwest prices” given the supply directed into the region from various producing areas.

The East “should continue to see light withdrawals” given “strong production levels” in the Appalachian Basin, Shah said.

Total Lower 48 working gas in underground storage stood at 3,610 Bcf as of Nov. 22, 548 Bcf (17.9%) higher than year-ago levels and 31 Bcf (minus 0.9%) below the five-year average, according to EIA.

By region, the Midwest recorded a 17 Bcf withdrawal for the week, while 15 Bcf was withdrawn in the East. Farther west, the Mountain region recorded a net 1 Bcf withdrawal, while the Pacific injected 1 Bcf. In the South Central, a 4 Bcf injection into salt stocks was partially offset by a 1 Bcf withdrawal from nonsalt, according to EIA.

Things appeared to be quieting down Wednesday as market participants looked ahead to a long Thanksgiving holiday weekend, according to Genscape Inc. senior natural gas analyst Rick Margolin.

“Forecasts continue to show slightly colder-than-normal temperatures for most of the country over the next 14 days, but the forecasts are also trending ever-so-slightly milder. As a result, our forecast shows a few days early next week of 100 Bcf/d-plus demand, but a far cry from levels hit during the cold snap from a few weeks back,” Margolin said. “Meanwhile, production levels are running steady at 94 Bcf/d-plus.”

Helping to soak up some of this production, U.S. exports, including via liquefied natural gas (LNG) and via pipeline to Mexico, are up 3.4 Bcf/d year/year, according to Genscape’s estimates. As of Wednesday, the firm’s estimates showed aggregate U.S. exports had averaged 12.28 Bcf/d over the past 30 days.

Margolin attributed the year/year increase to LNG trains coming online since last year, as well as the start-up of the Sur de Texas-Tuxpan pipeline delivering gas from South Texas into Mexico.

“The bulk of the aggregate gains are from the LNG space,” Margolin said. Estimates Wednesday showed feed gas deliveries to LNG terminals back up above the 7 Bcf/d mark after operational issues at the Sabine Pass and Corpus Christi terminals, “along with continued volatility in deliveries to Freeport for its commissioning process” had dropped feed gas volumes to a two-week low of 6.4 Bcf/d on Monday (Nov. 25).

As for exports to Mexico, volumes had averaged 5.28 Bcf/d month-to-date as of Wednesday, with total exports over the prior 30 days coming in about 0.5 Bcf/d above the prior year period, the analyst said.

Sur de Texas-Tuxpan has been moving around 0.7 Bcf/d, but Genscape has been advising clients that “flow rates this high were possible only by diverting exports off other lines,” Margolin said. “This is what is happening, with exports from South Texas’ NET Mexico to Mexico’s Los Ramones line having declined by about 0.3 Bcf/d from the same period last year. As a result, total South Texas exports are up about 0.44 Bcf/d year/year.”

With temperatures in the region expected to cool off over the weekend, Northeast prices gained sharply Wednesday, especially at often-volatile New England hubs. Because of the holiday weekend and the end of the month, spot price deals conducted Wednesday were for Sunday and Monday delivery (Dec. 1-2).

As Maxar’s Weather Desk was calling for temperatures in Boston to drop to below-normal levels by the weekend, including lows in the 20s by Sunday, Algonquin Citygate prices soared $1.320 to $4.625. Elsewhere in the region, Tenn Zone 6 200L surged $1.475 to $4.810.

Heading into the Thanksgiving holiday, the seven-day weather outlook included a system with rain and snow tracking across the Great Lakes and Ohio Valley and a “second, more potent storm” crashing into the West Coast, according to NatGasWeather.

The storm hitting the Western United States was expected to track into the Central and Eastern Lower 48 over the weekend and into the early part of the upcoming work week, the forecaster said. The system was expected to bring “rain and snow, along with cold conditions, with widespread lows” ranging from near zero to the 30s, driving higher demand levels.

“But the amount of cold is not nearly as impressive as the data once showed,” NatGasWeather said Wednesday. “High pressure will return across the Western, Central and Southern U.S.” by the middle of the upcoming week, “with highs warming into the 50s to 70s for much lighter demand.”

With more chilly temperatures expected along the West Coast, hubs from California to the Pacific Northwest saw continued premiums in Wednesday’s trading. Maxar was calling for lows in Seattle to dip into the 20s over the holiday weekend. Farther south, the forecaster predicted below-normal conditions in Burbank, CA, as well, including lows in the 40s.

Northwest Sumas averaged $4.925 Wednesday, down 33.0 cents on the day but still well above the Henry Hub benchmark. Similarly, SoCal Citygate averaged $5.795, a 19.5-cent drop on the day. Elsewhere in the Western United States, Malin picked up 14.0 cents to $3.490, while Kern River jumped 25.5 cents to $3.455.

Price action was generally a lot more muted through the middle third of the Lower 48. Regional averages finished within a nickel of even throughout the Midwest, Midcontinent and Gulf Coast. Henry Hub eased 1.5 cents to $2.330.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |