Natural Gas Futures Market Snoozes After Ho-Hum EIA Report

The natural gas market appeared to get an early dose of tryptophan Wednesday, courtesy of a rather unsurprising storage report from the Energy Information Administration (EIA).

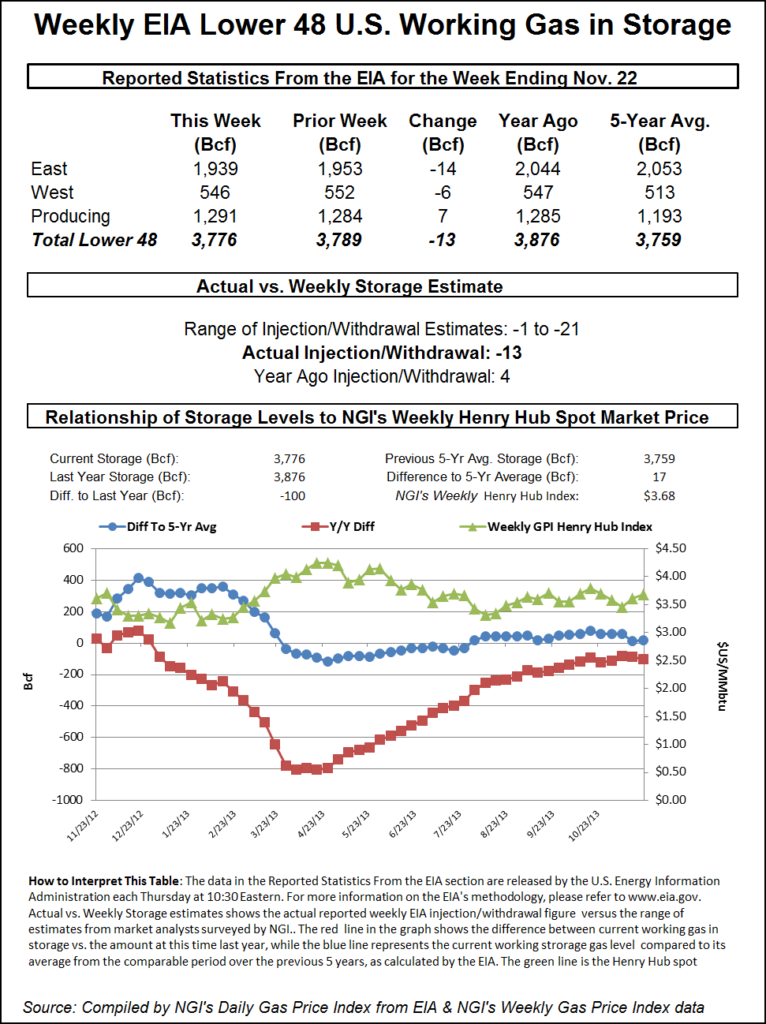

The EIA reported a 28 Bcf weekly withdrawal from U.S. gas stocks that fell in line with estimates. Whether it was a product of the on-target print, or just a case of traders leaving their offices early to be with family, futures prices barely budged on the news.

The 28 Bcf pull, recorded for the week ending Nov. 22, compares to a five-year average of minus 57 Bcf and a 70 Bcf pull for the year-ago period.

In the hour leading up to Wednesday’s report, released a day early ahead of the Thanksgiving holiday, the January contract had traded around $2.500-2.520. As the report crossed trading screens at noon ET, the front month briefly popped to as high as $2.532 before falling back in line with the pre-report trade at around $2.510-2.515. As of around 12:20 p.m. ET, January was trading at $2.508, off 2.5 cents from Tuesday’s settle.

Prior to the report, major surveys had pointed to a withdrawal around 27-28 Bcf, with expectations ranging from minus 16 Bcf to minus 42 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at minus 27 Bcf. NGI’s model predicted a withdrawal of 29 Bcf.

“Not much life in the natural gas markets,” said Enelyst.com managing director Het Shah during a discussion on the industry chat platform following EIA’s report. “Everyone looks to be in holiday mode.”

Shah noted that Midwest stocks ended the period “well above” year-ago levels, potentially “quite bearish for Midwest prices” given the supply directed into the region from various producing areas.

The East “should continue to see light withdrawals” given “strong production levels” in the Appalachian Basin, Shah said.

Total Lower 48 working gas in underground storage stood at 3,610 Bcf as of Nov. 22, 548 Bcf (17.9%) higher than year-ago levels and 31 Bcf (minus 0.9%) below the five-year average, according to EIA.

By region, the Midwest recorded a 17 Bcf withdrawal for the week, while 15 Bcf was withdrawn in the East. Farther west, the Mountain region recorded a net 1 Bcf withdrawal, while the Pacific injected 1 Bcf. In the South Central, a 4 Bcf injection into salt stocks was partially offset by a 1 Bcf withdrawal from nonsalt, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |