Markets | NGI All News Access | NGI The Weekly Gas Market Report

U.S. E&Ps Improving Efficiencies, Cash Flow Heading Into 2020

Editor’s Note: This is one of a 14-piece series NGI undertook as the energy industry readied for the new year, with Lower 48 natural gas and oil supply continuing to surge in an uncertain environment as liquefied natural gas exports ramp up, Mexico markets remain shrouded and stakeholders demand more value. Get your complimentary copy of NGI’s 2020 Special Report today.

Oil and natural gas executive teams are facing down a barrage of existential threats going into 2020 as they are pummeled by bleak commodity prices, scorched by some politicians who promise to ban drilling, and municipalities from coast to coast that are working to eliminate the use of fossil fuels.

The pressure was on for exploration and production (E&P) management teams in the third quarter to show they comprehend the assault and are working to improve their operations in every way to ensure relevance.

Value over volumes was prioritized. Environmental, social and governance initiatives took their place on the stage. And many executives during the quarterly conference calls were keen to explain how a drilling ban advocated by some Democratic presidential contenders could (negatively) impact their operations.

For the Lower 48-focused operators, production continued to surge, both for natural gas and oil, albeit at a slower pace. Reduced capital expenditures (capex) are playing a big role in limiting operations, according to Energy Aspects.

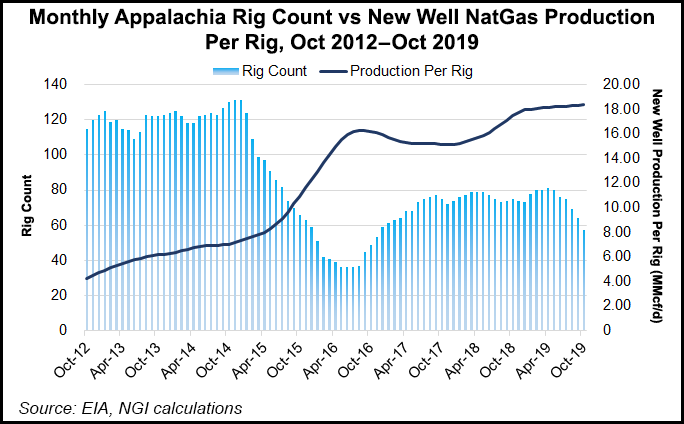

“Reduced capex, including rig reductions, has limited volumes since earlier 2019 results,” analysts said. “While we expect continued rig cuts in 2020, hedging books in the Northeast and the effects of the late 3Q2019 start-up of Gulf Coast Express rippling into next year in the Permian will keep overall gas volumes up year/year (y/y).”

Energy Aspects sampled 50 of the largest publicly traded domestic E&Ps and found overall third quarter gas output climbed 8% from a year ago but was only 1% higher sequentially at 37.4 Bcf/d.

“Part of this growth slowdown is due to total U.S. production growth slumping to 9% y/y (8.3 Bcf/d) in 3Q2019, the lowest percent y/y gain in any quarter since 3Q2017,” Energy Aspects analysts said. “Our sample was also dragged down by a 0.3 bcf/d y/y (27%) decline from Occidental Petroleum Corp., as it incorporated newly acquired assets from Anadarko Petroleum Corp…Our wider results point to increased y/y production, with only 13 of the 50 companies we follow reporting y/y declines.”

Raymond James & Associates Inc.’s analyst team, led by John Freeman, expects onshore gas drilling to be “slashed significantly in 2020.” It’s early yet for official 2020 capital spending plans, but the initial signs point to overall spending coming down by around 6% from 2019, with E&Ps weighted to gas and natural gas liquids “planning much larger cuts to their activity levels next year.”

Appalachian gas-directed Cabot Oil & Gas Corp. is guiding to a 12% y/y capex cut in its preliminary 2020 budget, which could “balloon up to nearly 30% should Henry Hub average below $2.50 next year (where it is currently),” Freeman said. “Across all the gas-weighted operators in our coverage, our most recent estimates have budgets being reduced by almost 30%.”

Appalachia-focused EQT Corp., the largest U.S. gas producer, is aiming for flat y/y output of 3.8 Bcf/d in 2020, while two other big Northeast operators, Antero Resources Corp. and CNX Resources Corp., are guiding for lower spending and single-digit gas growth.

However, “as we noted in early November, these Appalachia producers have hedged over 80% of their estimated 2020 volumes at prices well above the year’s current Henry Hub curve, likely locking in their projected growth,” the Energy Aspects team noted.

Raymond James analysts did not take into account the overall reduction expected in gas activity next year as more oil-weighted producers also opt out of producing their gassier assets.

Take, for example, Apache Corp., which had been trained on its No. 1 global (gassy) target, Alpine High in the Permian Basin. The Houston independent plans to cut its five-rig count to two in the play and cut overall capex by 15% in 2020. The focus next year is on the higher return international portfolio and oilier targets in the Permian.

There also are a few E&Ps restructuring after declaring Chapter 11 or hanging on by a thread, with a watch party on distressed Chesapeake Energy Corp., once the No. 1 U.S. gas producer. The Oklahoma City-based independent warned earlier in November that it may not be able to continue operating, and it has reduced drilling and is pulling up stakes in the Haynesville Shale and the Midcontinent, with total spend cut by around 30%

“Eventually, these significant gas-directed activity cuts will improve the macro outlook for natural gas,” Freeman said. Looking ahead, 2021 is “most likely the inflection year for the commodity.”

There was something to please shareholders in 3Q2019 reports, as E&Ps continued to bear down on free cash flow (FCF). Raymond James is estimating a 4% reduction in 2020 budgets y/y for oil-weighted operators as management teams sacrifice growth for increased shareholder returns and FCF.

“To be clear, operators and investors still want production growth,” but volumes have taken a back seat, Freeman said. The small-to-mid-cap E&Ps trained on oil targets are forecast to cut capex by 6% next year while the large-cap budgets should fall by only 2%. Large caps, like onshore independents Pioneer Natural Resources Co. and EOG Resources Inc., “can actually increase spending and still generate meaningful FCF growth,” Freeman noted.

Borrowing base redeterminations also remain in focus with some E&Ps likely to be financially stressed through 2020.

The upstream team at Tudor, Pickering, Holt & Co. (TPH) said it was having “plenty of investor conversations regarding the emerging haves versus have-nots world (feast for investment-grade credits, famine for high-yield names) as it relates to debt capital availability…”

The upstream “playbook…has been, and will remain, defensive given near term headwinds on crude fundamentals through the first half of 2020. That said, our conviction continues to increase that over the next 12-18 months the market is going to increasingly separate the haves from the have-nots, creating an opportunity for both relative and absolute performance calls.

“Interestingly, the names we wanted to own in 2019 may ultimately be our highest conviction calls in 2020 as we see line of sight for real long-term capital to migrate back into the sector as the liquidity crunch in the upstream sector, core inventory depletion, and industry consolidation may finally moderate some of those near term headwinds on crude fundamentals.”

Not all companies are going to transition to positive FCF, and financing options are sparse. On that note, Chapter 11 filings accelerated in 3Q2019.

“The number of bankruptcies filed in 3Q2019 increased by 186% y/y, with a disclosed debt value of $15 billion,” according to Enverus analysts with upstream operators accounting for 16 of the 20 filings in the quarter.

“Companies have found themselves facing restructuring in a number of ways, but it usually boils down to overly aggressive capex to fund growth, wells substantially underperforming expectations, or some combination of the two,” said Enverus analyst Andrew Dittmar. “However, companies are overall better prepared and more responsive to a changing market than past years, and we don’t expect to reach the level of filings from 2016, which peaked with around 40 upstream companies filing in 2Q2016.”

In its capital markets review, Enverus reported $40 billion was raised in 3Q2019 via debt offerings, and $500 million was raised in equity offerings. Bond issuances were up 198% sequentially and 114% y/y on the back of offerings by midstream and utility companies — and Occidental’s $13 billion bond raise to support its Anadarko takeover. Meanwhile, equity raises were down 85% sequentially and 79% from a year ago.

“On the upstream side, a lack of access to capital for shale companies is becoming a defining story of 2019,” said Dittmar. “Their stock has significantly underperformed the broader market with the S&P E&P Index down nearly 20% in 3Q2019 versus flat performance for the S&P 500. That has eroded investor appetite for new issuances or initial public offerings, and equity capital raised at these prices may be viewed as dilutive for existing shareholders.”

The bond market also is “largely closed off except for large issuers and those carrying an investment grade rating,” he said. “Those best positioned have kept debt in check and have longer-dated maturities on their bonds, giving time for the market to hopefully recover before they need to refinance.”

Credit facilities have taken on more importance as a method for liquidity. Enverus found $47 billion in facilities launched or amended in 3Q2019 across 56 agreements, with $15 billion of upstream facilities that are set to expire between 2019 and 2021.

“Upstream companies may be relying on credit facilities at an increasing rate just as banks take a more conservative outlook in their borrowing base redeterminations,” Dittmar said. “Investors will also be closely watching how drawdowns are spent. They want any use of this credit to be a short-term plug, not another way to delay getting to positive free cash flow while adding leverage to the balance sheet.”

More companies are expected to reach an inflection point on FCF as capex is held in check and operators focus on efficiencies and full-cycle returns, Dittmar said. “Ultimately, that is likely to be what restores investor confidence in the sector and helps energy companies find some traction on stock prices. However, it may take some additional time and a tailwind from commodity prices wouldn’t hurt.”

Rystad Energy’s research team expects domestic onshore explorers to increase oil production overall this year by around 16%, thanks to strong operational execution through the third quarter. The onshore E&Ps tracked by the firm should continue to expand oil output through the fourth quarter by “at least” 1.3% on a quarterly basis.

“The actual results so far this year reaffirm our optimistic expectations for the remainder of the year,” said Rystad’s Veronika Akulinitseva, vice president on the shale team. “We expect continued reductions in capital expenditures and a renewed focus on cash flow next year…We are still likely to see another year of oil production expansion in U.S. shale, although at a slower pace than seen this year.”

Several U.S. producers “showed impressive execution this year and continued to increase oil production guidance throughout the year, while remaining at the lower end of capital guidance,” Akulinitseva said. “Permian players and companies active in multiple plays were especially successful in outperforming their original estimates.”

Goldman Sachs Commodities Research analysts led by Jeffrey Currie see three themes emerging for 2020: deleveraging, decarbonization and rationalization.

“With a reduced focus on capital raising and capex, in 2020 and for the rest of this coming decade, we believe the old economy will be focused on cleaning up their excesses of too much debt, too high emissions, and too much capacity which is compounded from the redundancies created by decarbonization,” the Goldman team said.

A lack of capital discipline during the commodity “super cycle” from 2004-2014 “created too much capacity and too many companies” around the world. China may have been the primary culprit in metals, but the United States was the energy culprit, Currie said.

“In U.S. energy, five companies represent 86% of the investable market cap,” leaving the remaining to more than 50 companies. The five singled out by Goldman were ExxonMobil Corp., Chevron Corp., ConocoPhillips, EOG Resources Inc. and Occidental.

The 50 or so companies not considered “investable”produce two-thirds of U.S. oil, which means consolidation is needed.

Consolidation, said the Goldman team, “would pressure long-dated commodity prices by reducing the costs associated with lower quality marginal assets, further supporting backwardation in coming years.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |