Markets | NGI All News Access | NGI Data

Natural Gas Futures Drop Into December Expiry as Demand Outlook Weakens

Natural gas futures slouched into the front-month expiration Tuesday, unable to shake off the burden of a weakening outlook for weather-driven demand and indications of new record highs for production. The December Nymex contract rolled off the board at $2.470/MMBtu, off 6.1 cents. January settled just a few pennies above the $2.500 mark at $2.533, down 5.1 cents day/day.

In the spot market, a snowy system that threatened to foil Thanksgiving travel plans didn’t spark much buying interest on deals covering an unusually long four-day delivery window; NGI’s Spot Gas National Avg. fell 9.5 cents to $2.375.

The midday data from the Global Forecast System (GFS) Tuesday continued to trend in the milder direction for early December, according to NatGasWeather.

“The latest GFS maintained several weather systems and associated cold shots sweeping across the country through early next week, just not nearly as cold with them as the data showed Sunday,” the forecaster said. Meanwhile, the model “maintained a rather seasonal/unimpressive pattern Dec. 5-10, with near- to warmer-than-normal conditions over most of the United States besides portions of the slightly cool East.”

Subsequent data from the European model failed to return any heating demand to the outlook after dropping a “hefty” amount of degree days overnight, NatGasWeather said. The data came in “a little further warmer Dec. 3-10 in the latest run in a rather bearish pattern where only the far northern United States and Interior West would be cold enough to matter.”

Coming off recent milder forecast trends, meteorologists at Genscape Inc. called for Lower 48 population-weighted heating degree days (HDD) to peak next Tuesday (Dec. 3) at 21.6 HDDs, part of a stretch of colder-than-normal temperatures expected next week.

“However, current expectations are not as cold as previous weather model runs suggested,” Genscape senior natural gas analyst Rick Margolin said. “Current weather forecasts should lift demand to about 103 Bcf/d by early next week, with the cold being geographically dispersed. However, those projected levels will be well short of the winter-to-date highs logged earlier this November.”

This comes as production has been “back on the upswing,” according to Margolin.

Freeze-offs and maintenance affected output earlier this month, but recent daily estimates from Genscape have shown Lower 48 production topping 94 Bcf/d over the last four days. Monday set a new record high at 94.39 Bcf/d, the analyst said.

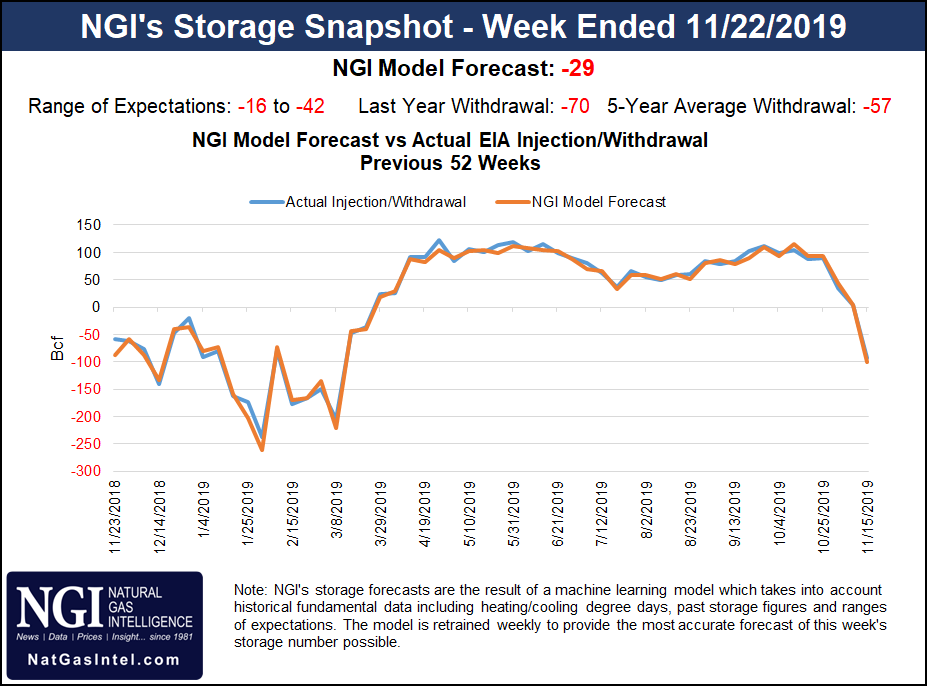

Meanwhile, estimates for this week’s Energy Information Administration (EIA) storage report, scheduled for noon ET Wednesday because of the Thanksgiving holiday, were pointing to a notably smaller withdrawal compared to last week’s 94 Bcf pull.

A Bloomberg survey showed a median estimate for a 27 Bcf withdrawal for the week ending Nov. 22, with an expected withdrawal range of 19 Bcf to 35 Bcf. A Reuters survey showed a consensus for a 28 Bcf withdrawal, with a range of minus 16 Bcf to minus 42 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures settled Monday at minus 33 Bcf, while Kyle Cooper of ION Energy called for a 23 Bcf pull. NGI’s model predicted a withdrawal of 29 Bcf.

Energy Aspects issued a preliminary estimate for a 32 Bcf pull.

“Both residential/commercial demand and power burn are set to decline on more moderate weather, chopping 9.1 Bcf/d week/week off of total demand,” Energy Aspects said. “Production will continue to creep higher, by a projected 0.3 Bcf/d week/week.”

A withdrawal in line with expectations would be bearish versus the five-year average of minus 57 Bcf. Last year, EIA recorded a 70 Bcf pull for the period.

Spot traders had plenty to consider Tuesday as they locked in deals for four-day delivery over the long holiday weekend and through the end of the month (Nov. 27-30).

According to the National Weather Service (NWS), stormy winter weather could disrupt Thanksgiving travel plans across “large portions” of the Central and Western United States.

“The lead storm developing across the Southern to Central Plains Tuesday will deepen as it pushes northeast into the Upper Mississippi Valley/Upper Great Lakes Wednesday and across northern New England by early Thursday,” the NWS said. “A broad region of heavy snow potential with this storm will stretch from the Central Plains into the Upper Mississippi Valley Tuesday, across the Upper Great Lakes on Wednesday and into northern Maine by Thursday.”

Snow accumulations could reach eight-to-12 inches or more in these areas, according to the forecaster.

Even with a wintry system making its way across the Lower 48 this week, buying interest was limited for most regions Tuesday. In the Midwest, Dawn fell 18.0 cents to $2.400, while Joliet tumbled 11.0 cents to $2.225.

A pocket of gains in New England stood out amid the discounts in other regions. Algonquin Citygate jumped 58.0 cents to $3.305, while Tenn Zone 6 200L added 57.5 cents to $3.335.

Genscape was calling for New England regional demand to ramp up over the Thanksgiving holiday, rising to 3.43 Bcf/d on Thursday and 3.77 Bcf/d for Friday. That’s compared to a recent seven-day average of 3.17 Bcf/d, according to the firm.

Further upstream, Appalachian prices eased lower, including at Dominion South, which gave up 4.5 cents to average $2.030.

Unplanned maintenance on the Equitrans system in Ohio has been impacting flows through the PLASMA-OVC compressor since Sunday, and restrictions through the point ramped up to as much as 259 MMcf/d for Tuesday’s gas day, according to Genscape analyst Anthony Ferrara.

“Located at the Ohio Valley Connector (OVC), which stretches from northern West Virginia into Ohio, flows through the PLASMA-OVC compressor are being limited to 573 MMcf/d until further notice,” Ferrara said.

This maintenance impacts interconnects with the Rockies Express and Rover pipelines at the western end of the OVC, the analyst said. Deliveries through the location have averaged 792 MMcf/d over the past 30 days, with a max of 832 MMcf/d.

Meanwhile, Western hubs continued to trade at an elevated basis Tuesday as forecasts called for another storm to crash into the West Coast. Malin averaged $3.350, 2.5 cents higher day/day. PG&E Citygate slid 27.5 cents on the day but averaged more than $1 above Henry Hub at $3.480.

“At the same time the storm develops across the central United States on Tuesday, another storm will be pushing southeast toward the Oregon/Northern California coast,” the NWS said. “This storm is already beginning to strengthen rapidly and will continue to do so before making landfall Tuesday night.”

The forecaster called for “damaging winds, heavy mountain snows” and coastal flooding for parts of Oregon and California.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |