NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

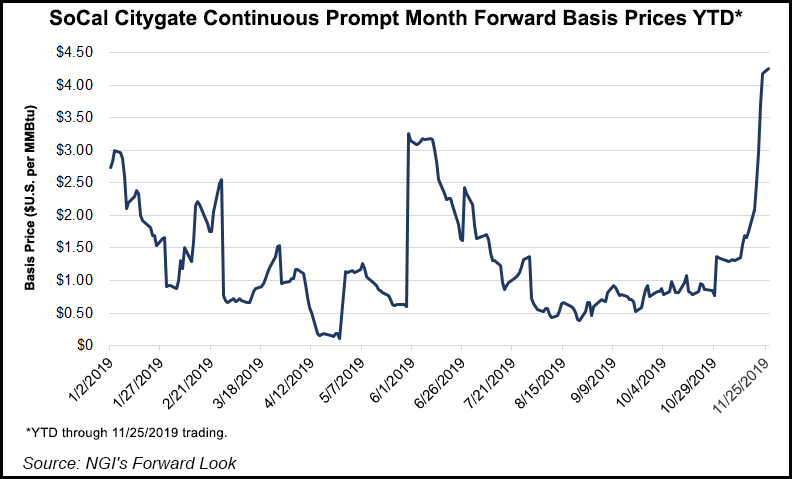

Winter Storms Grip West, Send Forward Natural Gas Prices Surging

Volatility was in full force for natural gas forward prices in the days leading up to the long Thanksgiving Day weekend as weather models gave bulls some hope for a cold December, only to flip milder and then trend even warmer in the latest runs.

However, with winter storms barreling through the western United States, prices throughout that region surged, helping lift December prices across the country up by a penny on average between Nov. 21 and Nov. 25, according to NGI’s Forward Look. January fell an average 2 cents, and the balance of winter (December-March) slipped 1 cent.

Trading activity could not be more different when comparing the Western United and the rest of the country, with snow, rain and winds up and down the West Coast leading to strong demand and higher prices in regional cash and forward markets, while outlooks for a mild December elsewhere sent prices lower for the third week in a row.

An early week storm that brought heavy snow to the Denver area and wind gusts of 70-80 mph to Los Angeles on Monday set the stage for a winter-like chill across much of the West, according to AccuWeather. A “more potent” storm was forecast to arrive late Tuesday in southern Oregon and Northern California, diving southward into Arizona and Utah through Thursday.

“This storm threatens to bring rain and mountain snow to much of California, including places like San Francisco and Sacramento, places that were largely spared by the past week’s rain,” AccuWeather senior meteorologist Brian Thompson said.

The Sierra Nevada mountain range in California was expected to see a few feet of snow, with some areas up to 42 inches, according to AccuWeather. Snow was also forecast to reach as far south as the Peninsular Ranges in Southern California.

Southern California Gas (SoCalGas) initiated withdrawals last week from the restricted Aliso Canyon facility under a revised protocol approved by state regulators earlier this year to meet the strong demand. As for this week, SoCalGas was projecting total demand on its system to rise to around 2.7 million Dth/d for Tuesday and Wednesday.

Given the hike in demand, cash prices at SoCal Citygate surged well above $6 and lent support to both forward markets and bidweek prices for December despite outlooks for milder weather in the weeks to come.

SoCal Citygate December forward prices shot up 61 cents from Nov. 21-25 to reach $6.781, while January climbed 31 cents to $5.530, according to Forward Look. The balance of winter also gained 31 cents to reach $5.114, and the summer 2020 strip (August-October) tacked on just 8 cents to $2.88.

Northern California forwards also strengthened considerably, although the most extreme increases were limited to the front of the curve and outright prices remained below $4.

In the Rockies, reduced imports into the region continued to drive up forward prices at Northwest Sumas, Forward Look data show. December soared 56 cents from Nov. 21-25 to reach $6.874, January climbed 18 cents to $4.904 and the balance of winter rose 19 cents to $4.542. The summer 2020 strip, however, was down a penny to $2.84.

The strong demand in the West was the Permian Basin’s saving grace over the past few days given the lackluster downstream demand in the central and eastern United States and flood of associated gas resulting from oil-directed drilling.

Waha December prices climbed 9 cents from Nov. 21-25 to reach $1.338. January, however, slipped a penny to $1.527. The balance of winter tacked on 3 cents to $1.252, and summer 2020 edged up 2 cents but remained below $1 at just 79.0 cents.

The recent rally in cash and forwards also spilled over into bidweek. NGI’s preliminary bidweek data for December shows massive gains of more than $3 in Southern California and the Rockies, boosting prices to nearly $7 at SoCal Citygate and Northwest Sumas.

In the Permian, December bidweek was up more than 60 cents at major pricing hubs, moving prices back above $1.

The dramatic gains seen across the West were in stark contrast to the rest of the country, which generally followed the lead of Nymex futures in the days leading up to Thanksgiving.

The December Nymex gas futures contract slipped some 3.6 cents from Nov. 21 to settle Monday at $2.531, although the prompt month had traded as high as $2.709. January fell 4 cents during that time to $2.584, and the balance of winter dropped 3 cents to $2.526. Summer 2020 prices, however, were up a penny to $2.36.

The wild swings during the short week were reflective of the dramatic shifts in weather outlooks in recent days. Tuesday’s change occurred mostly in the Dec. 4-8 window, as the Pacific side of the pattern cut off the connection to stronger cold, and the Atlantic block vanished as well, according to Bespoke Weather Services.

There were still some notable differences, the firm said. The American data remains much colder than the European data, by around 20 gas-weighted degree days, but the other difference is at the end of the run. The Global Ensemble Forecast System, despite being the colder model, showed a pattern that could lead to more warmth into mid-December, while the European model had a weak colder trough into the East.

“We do still lean toward a warmer mid-December pattern, based on our best assessment of the upcoming tropical forcing evolution,” Bespoke chief meteorologist Brian Lovern said. “With the weaker weather, it’s no wonder prices are declining the way that they are.”

To be sure, the December Nymex futures contract plunged as low as $2.421 before going on to expire 6.1 cents lower on Tuesday at $2.470. January, which moves into the prompt-month position on Wednesday, settled at $2.533, down 5.1 cents.

With December’s slide into expiration, 2019 goes down in the books at the second-lowest calendar average in the shale era at about $2.65, according to Mobius Risk Group. Looking back, 2019 has been “a year of peaks and valleys” with low inventory supporting prices early in the year, and robust production growth pressing the $2.00 mark in the summer months.

If price action on Monday and Tuesday were any indication, the market’s thoughts looking ahead to 2020 were centered on concern that an inventory overhang could require more extreme measures to expedite a rebalancing of supply and demand, Mobius said. “Although it is a well known fact that there is a multi-month lag between lower prices and lower production, reactions to warm weather have had a more pronounced effect on near-term prices.”

Indeed, even with record feed gas deliveries to liquefied natural gas export terminals and record production also influencing prices, weather remained the primary driver of the natural gas market. Despite the front-month natural gas contract having averaged just $2.38/MMBtu since June, market outcomes could have been significantly worse for if not lifted by above-normal weather-driven demand, according to EBW Analytics Group.

“Over the past six months, weather-driven demand has been more than 300 Bcf above normal, increasing prices by 50 cents/MMBtu, all else equal,” EBW explained. “If weather had been near normal or bearish, gas prices may have averaged below $2.00/MMBtu and current storage levels could be significantly higher.”

The U.S. Energy Information Administration (EIA) is set to release its weekly storage inventory report at noon ET Wednesday, a day earlier than usual because of the Thanksgiving holiday. Estimates pointed to a draw in the mid-20s to 30s Bcf, which compares with last year’s 70 Bcf pull and the five-year average of 57 Bcf.

A Bloomberg survey of 10 analysts had a withdrawal range between 19 Bcf and 35 Bcf, with a median pull of 25 Bcf. Reuters polled 12 analysts, who estimated withdrawals ranging from 16 Bcf to 42 Bcf, with a median draw of 28 bcf.

NGI’s model had projected a 29 Bcf withdrawal.

Last week, the EIA reported its first withdrawal of the season, a whopper at 94 Bcf. While at first glance, that would appear bullish, Bespoke categorized it as rather neutral, as it took tail-event cold to ratchet up the power burns, along with some minor freeze-offs. All of this pointed to the higher draw being more of a “one-off” than anything, which was supported by the much weaker power burns last week for this week’s report.

Wednesday’s print will likely be well below the five-year average build despite demand being not far from normal overall, the firm said. “All of this confirms that we need to sustain some very cold weather to truly balance the market, pending any structural tightening, which does not appear likely in the near term at least.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |