Gains Out West, Discounts Elsewhere as Weekly Natural Gas Spot Prices Mixed

The natural gas spot market turned in a decidedly mixed week of price action during the trading week ended Nov. 22, including big gains out West and discounts for much of the eastern two thirds of the Lower 48; NGI’s Weekly Spot Gas National Avg. slipped 20.5 cents to $2.490/MMBtu.

Amid constrained conditions that required withdrawals from the restricted Aliso Canyon storage facility, SoCal Citygate rocketed $1.750 higher week/week to average $5.910. Other regional locations also rallied on the week, including SoCal Border Avg., which picked up 37.5 cents to $2.905.

Meanwhile, strong demand in the Pacific Northwest boosted Northwest Sumas prices during the week. The hub averaged $4.445, up $1.210.

Much of the rest of the country posted discounts, an unsurprising outcome given that the Arctic temperatures that swept through the Lower 48 a week earlier failed to stick around. Henry Hub tumbled 16.5 cents week/week to average $2.510.

Discounts were particularly steep for producing-area hubs in West Texas and the Midcontinent, as maintenance on the Natural Gas Pipeline Co. of America system appeared to cause bottlenecks that drove down prices at points like Waha. Prices there averaged $1.130 on the week, down 77.0 cents.

Turning to the futures market, colder trends for early December sent prices rallying Friday, although forecasters were expecting more twists and turns in the weather outlook over the weekend. The December Nymex contract settled at $2.665 Friday, up 9.8 cents. Week/week, however, the front month gave up 2.3 cents after settling at $2.688 the previous Friday.

With a chillier outlook for the first few days of December emerging in recent guidance, particularly from the American model, Bespoke Weather Services on Friday pointed to yet another weekend of price risk because of uncertainty in the forecasts.

“Just like last Friday, we are also facing a very tricky forecast heading into the weekend,” Bespoke said. “Weekend risk is always greater, but especially here, as there has been enough cold showing up” on recent runs of the American model to “easily support higher prices in the near-term…Confirmation of those runs would likely take us to $2.75 Monday.

“But that model has been very erratic, so we have little faith in it verifying. We actually still feel the pattern ultimately breaks warmer, and seeing the evisceration of the North Atlantic Oscillation block in most guidance gives some support to our view.”

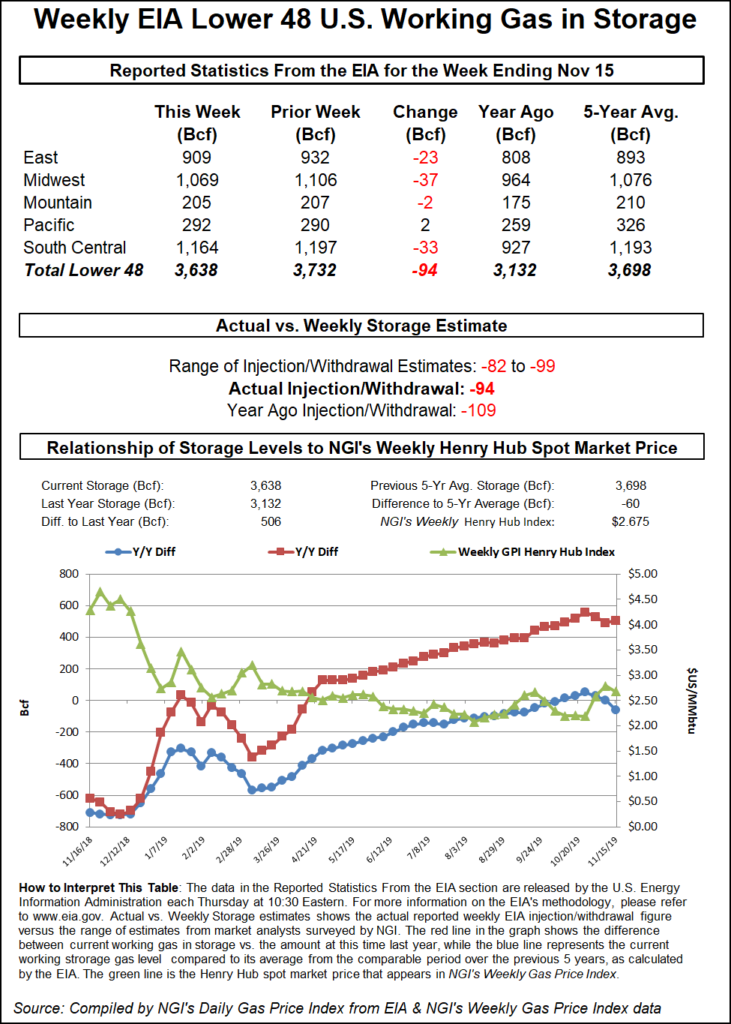

Meanwhile, the Energy Information Administration (EIA) reported a 94 Bcf net withdrawal from U.S. gas stocks during the week ended Nov. 15. The 94 Bcf withdrawal, the first of the season, came in well above the five-year average pull of 32 Bcf but shy of the 109 Bcf draw recorded for the year-ago period.

Prior to the report, survey responses had pointed to a build around 88 Bcf, with expectations ranging from 82 Bcf to 99 Bcf. Intercontinental Exchange futures had settled at 87 Bcf, while NGI’s model predicted a 101 Bcf withdrawal.

During a chat on Enelyst, The Desk’s John Sodergreen said responses to his storage survey had pointed to a consensus 88.8 Bcf pull.

“We received a few forecasts late, and it bumped the number over 89 Bcf,” Sodergreen said. “So, at minus 94 Bcf, it’s supportive but not a barnburner.”

Total Lower 48 working gas in underground storage stood at 3,638 Bcf as of Nov. 15, 506 Bcf (16.2%) higher than year-ago levels and 60 Bcf (minus 1.6%) lower than the five-year average, according to EIA.

By region, 37 Bcf was withdrawn from the Midwest during the week, and 23 Bcf was pulled in the East. In the South Central, 20 Bcf was withdrawn from nonsalt, along with 14 Bcf from salt stocks. The Mountain region recorded a 2 Bcf withdrawal, while the Pacific injected 2 Bcf, EIA said.

“The print came in bullish to consensus at 89 Bcf and on a weather-adjusted basis implies a balanced market,” analysts at Tudor, Pickering, Holt & Co. (TPH) said. “Unfortunately, after the early dose of cold, things have moderated significantly, and week/week flow data suggests demand is receding by around 11 Bcf/d.”

Supply not including Canadian imports was estimated to be down about 1 Bcf/d.

Despite the week’s print “suggesting a balanced market, our supply/demand balances for 4Q2019 and 1Q2020 indicate a 2-3 Bcf/d oversupplied market, resulting in smaller than normal withdrawals and a surplus to the five-year average exiting winter,” the TPH analysts said.

Genscape Inc. analysts viewed withdrawal figure as about 1 Bcf/d looser than the five-year average when compared to degree days and normal seasonality.

“While loose versus weather/seasonality relative to the prior five years, this week’s stat is materially tighter than what we have observed over the last two months,” Genscape analysts Eric Fell and Brandon Lee said in a note to clients. “Over the last nine weeks we have injected 6 Bcf more than the five-year average despite the fact that total degree days have been bullish to the five-year average by 137 over that time frame — averaging more than 4 Bcf/d loose versus weather/seasonality.”

According to Raymond James & Associates Inc. analysts, the 94 Bcf withdrawal implied the market was 0.7 Bcf/d tighter versus the year-ago period. Over the past four weeks, the market has been 2.6 Bcf/d looser year/year, the analysts said.

Prices on deals for weekend and Monday delivery continued climbing at two of the main California hubs Friday, although other points in the region eased lower. PG&E Citygate added 25.5 cents to $3.940, while the average at SoCal Citygate increased to $6.735, also up 25.5 cents. El Paso S. Mainline/N. Baja, meanwhile, slid 51.0 cents to $3.620.

Prices at numerous locations in the Rockies, California and Desert Southwest had enjoyed healthy premiums in the lead-up to Friday’s trading, with the often volatile and supply-constrained SoCal Citygate seeing particularly elevated pricing. The Southern California hub ended Friday nearly $3 higher on average than where it finished a week earlier, when prices averaged $3.990 for the Nov. 15 trade date.

Genscape Inc. analyst Joe Bernardi attributed the week’s SoCal Citygate premiums to maintenance restricting withdrawals from the Honor Rancho storage facility. Southern California Gas (SoCalGas) has had to rely on volumes pulled from the restricted Aliso Canyon storage field instead.

Demand in the SoCalGas territory during the week did not ascend to the levels typically associated with such premium pricing, totaling around 2.4-2.9 Bcf/d, according to Bernardi. SoCalGas demand has topped 3 Bcf/d five times since Sept. 1, but during those higher-demand days SoCal Citygate basis never reached the levels recorded this past week, the analyst said.

Farther north in the Pacific Northwest, Northwest Sumas also traded at a significant premium to surrounding hubs, jumping 93.5 cents Friday to average $5.945.

Strong prices at Northwest Sumas have come even as southbound flows on Westcoast Energy have ramped up in recent weeks, according to Bernardi.

“Not only has this rise corresponded with gains farther south at SoCalgas, but Pacific Northwest demand has been ripping,” the analyst said. “Total gas demand in Washington, Oregon and Idaho has exceeded the daily three-year maximums every day since Oct. 1 with only three exceptions.

“Stated differently, 2019 average daily demand in these states” between Oct. 1 and this past Thursday “has been about 2.3 Bcf/d, compared to 1.8 Bcf/d for the same period in 2016-2018. Northwest Pipeline’s import flows from the Rockies at Kemmerer have been near their maximum this month, as have flows into the main Seattle-Portland demand corridor at Plymouth.”

Amid the strong demand in the region, inventories at Jackson Prairie have seen an “unusually early dip” in November, dropping below 21 Bcf, which is “by far the earliest” point in the season stocks have dropped to that level over the past five years, Bernardi said.

Meanwhile, prices strengthened in the Northeast Friday as Maxar’s Weather Desk was looking for temperatures to cool off in the region over the weekend. The forecaster called for slightly below normal temperatures along the Interstate 95 corridor Saturday, with lows dropping into the mid- to low-30s from Boston to Washington, DC.

Algonquin Citygate added 13.5 cents to average $2.955. Farther south, Transco Zone 5 climbed 10.0 cents to $2.605.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 |