Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Haynesville a Bright Spot as Downtrend in U.S. Rig Count Continues

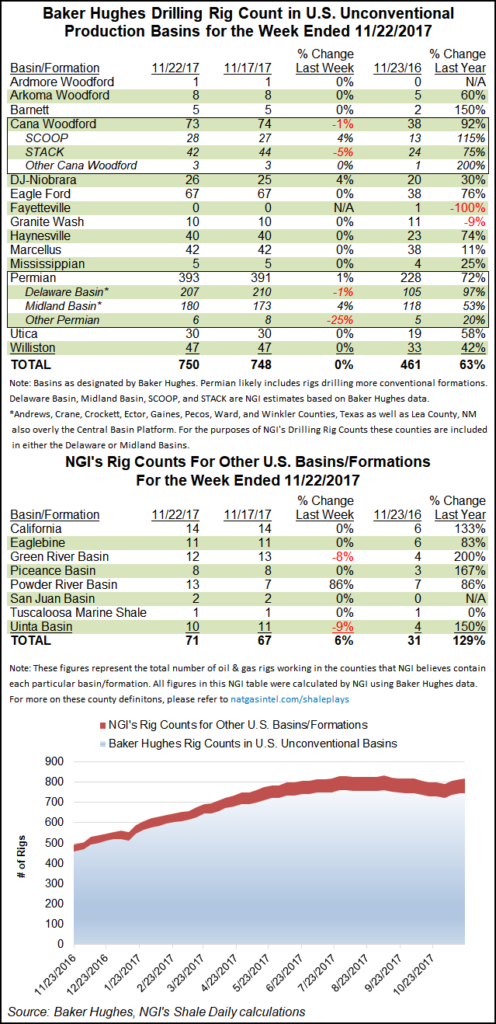

Extending a months-long downtrend, the U.S. rig count dropped another three units to fall to 803 as of Friday, with losses in the Permian Basin and Appalachia offsetting an uptick in the Haynesville Shale, according to Baker Hughes Co. (BKR).

The net declines in domestic drilling for the week all came from the oil patch. The number of natural gas-directed rigs held steady at 129. The Gulf of Mexico also finished the week unchanged at 22 rigs. Total directional and vertical rigs remained unchanged, while three horizontal rigs departed, according to BKR.

Since April, U.S. operators have laid down 222 rigs. The 803 U.S. rigs active as of Friday is down 276 units from the 1,079 rigs active in the year-ago period.

Meanwhile, Canada added three rigs to its total for the week, with the addition of five gas-directed offsetting the loss of two oil-directed. The Canadian rig count ended at 137, down from 204 a year ago.

The combined North American rig count was unchanged week/week at 940, down 343 units year/year.

Among plays, the Permian saw the largest weekly decline, dropping three rigs to 405, versus running 493 a year ago. The Marcellus saw one rig exit, as did the Cana Woodford.

The Haynesville Shale, meanwhile, added two rigs to its total for the week, ending at 53, up from 51 in the year-ago period.

Among states, Alaska dropped three rigs week/week, while Texas dropped two. New Mexico, North Dakota and Pennsylvania dropped one rig a piece, according to BKR.

Mirroring the increase in the Haynesville, Louisiana added two rigs on the week, while Colorado added one.

The rig count has been decreasing, but production of both oil and natural gas out of the most prolific U.S. onshore unconventional plays will increase slightly in December compared with this month, continuing a longstanding upward trend, according to the Energy Information Administration (EIA).

Total natural gas production from the seven plays — the Anadarko, Appalachian and Permian basins, and the Bakken, Eagle Ford, Haynesville and Niobrara formations — is expected to increase by 263 MMcf (0.3%) in December from November, EIA said in its latest Drilling Productivity Report (DPR).

EIA expects increases in five of the seven plays, including the Appalachian Basin, with a forecasted 33.72 Bcf/d, up from 33.67 Bcf/d in November. EIA also expects increases in the Bakken (3.10 Bcf/d from 3.09 Bcf/d), Haynesville (12.05 Bcf/d from 11.93 Bcf/d), Niobrara (5.58 Bcf/d from 5.56 Bcf/d) and the Permian (16.49 Bcf/d from 15.27 Bcf/d).

The Eagle Ford is expected to produce 6.82 Bcf/d in December, down from 6.88 Bcf/d in November, and the Anadarko is expected to decline to 7.43 Bcf/d from 7.54 Bcf/d.

Total oil production from the plays is expected to increase by about 49,000 b/d (0.5%) from 9.08 million b/d in November.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |