Traders Shrug Off Large Withdrawal as NatGas Futures Steady

A larger-than-expected drop in inventories to open the withdrawal season failed to spark a sustained rally in the natural gas futures market Thursday, although prices finished the day slightly higher. After probing both sides of even, the December Nymex contract ultimately settled at $2.567/MMBtu, up 0.8 cents. January added 1.1 cents to $2.622.

In the spot market, rain and snow accompanied rising prices for markets in the West, while mild temperatures inspired New England discounts; the NGI Spot Gas National Avg. added 12.5 cents to $2.580.

Prices traded within a relatively narrow range Thursday, suggesting a market engaged in a “search for equilibrium,” according to Powerhouse Vice President David Thompson. The forecast has shifted colder this week but “by no means has it returned to a much colder-than-expected outlook,” leaving the market without a clear signal.

“The fact that the storage number didn’t cause a more sustained reaction than this sort of tells you this is a market that, at the moment, is not ready to make a big move,” Thompson told NGI.

The Energy Information Administration’s (EIA) first reported natural gas storage withdrawal of the season surprised to the high side, but after an initial injection of bullish momentum the futures market ultimately shrugged off the news.

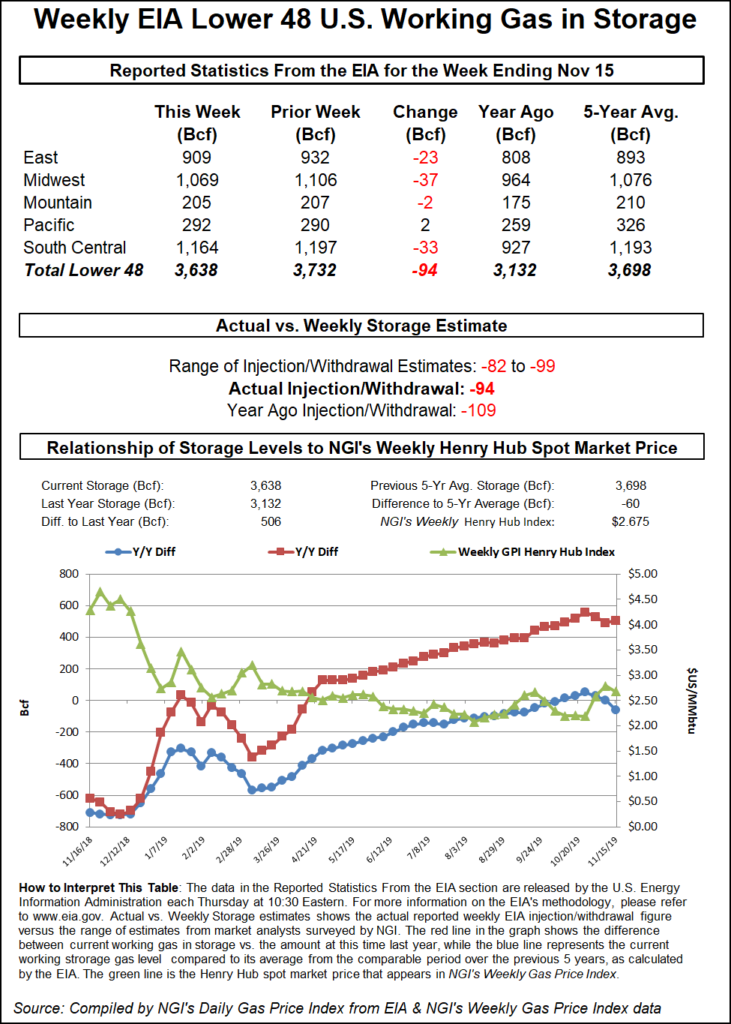

EIA reported a 94 Bcf net withdrawal from U.S. gas stocks during the week ended Nov. 15, higher than consensus, which had landed in the upper 80s Bcf. The 94 Bcf figure comes in well above the five-year average pull of 32 Bcf, but shy of the 109 Bcf withdrawal EIA recorded for the year-ago period.

In the hour leading up to EIA’s report, the December Nymex contract had been trading around $2.550-2.570. As the figure crossed trading screens at 10:30 a.m. ET, the front month briefly rallied to as high as $2.590 before receding back to around pre-report trade levels.

Prior to the report, survey responses had pointed to a build around 88 Bcf, with expectations ranging from 82 Bcf to 99 Bcf. Intercontinental Exchange futures had settled at 87 Bcf, while NGI’s model predicted a 101 Bcf withdrawal.

During a chat on Enelyst, The Desk’s John Sodergreen said responses to his storage survey had pointed to a consensus 88.8 Bcf pull.

“We received a few forecasts late, and it bumped the number over 89 Bcf,” Sodergreen said. “So, at minus 94 Bcf, it’s supportive but not a barnburner.”

Total Lower 48 working gas in underground storage stood at 3,638 Bcf as of Nov. 15, 506 Bcf (16.2%) higher than year-ago levels and 60 Bcf (minus 1.6%) lower than the five-year average, according to EIA.

By region, 37 Bcf was withdrawn from the Midwest during the week, and 23 Bcf was pulled in the East. In the South Central, 20 Bcf was withdrawn from nonsalt, along with 14 Bcf from salt stocks. The Mountain region recorded a 2 Bcf withdrawal, while the Pacific injected 2 Bcf, EIA said.

Looking at the latest weather data Thursday, the midday Global Forecast System (GFS) advertised a colder outlook for early December, according to NatGasWeather.

“The front 10-11 days of the latest GFS weren’t as impressive as needed and lost a little more demand, but the Dec. 1-5 period came to the rescue with very cold air sweeping across the northern United States for strong demand,” NatGasWeather said.

There were, however, “major differences” between the GFS and the European model for the early December time frame. The GFS shows a “hefty amount of frigid air” spreading “aggressively” eastward from the West, the forecaster said.

“The European model also sees a cold shot spreading eastward but is less impressive with the amount of cold and less aggressive in spreading it across the northern United States,” NatGasWeather said.

Following widespread gains in Wednesday’s trading, spot prices continued to ratchet higher in the Rockies, California and Desert Southwest Thursday. Kern River surged 44.5 cents to $3.480, while El Paso S. Mainline/N. Baja jumped $1.075 to $4.130.

A “deep upper-level low over the Great Basin” Thursday was expected to move eastward into the weekend, according to the National Weather Service (NWS). “The system will produce rain and higher elevation snow over parts of the Great Basin, Central/Southern Rockies and Southwest, with the rain ending by Friday morning and the snow by overnight Friday.”

In California, SoCal Border Avg. added 39.5 cents to $3.405, while the supply-constrained SoCal Citygate added another 55.0 cents to reach $6.480, a more than $4 premium to Henry Hub.

Southern California Gas (SoCalGas) posted a series of notices this week announcing the availability of withdrawals from the restricted Aliso Canyon facility because of “Low OFO” (aka operational flow order) conditions on its system.

In the wake of the high-profile 2015 leak at Aliso, withdrawals from the facility have historically correlated with “significantly higher” spot basis at SoCal Citygate, Genscape Inc. analyst Joe Bernardi said. Prior to Monday, “the average effective Citygate basis price on a day with an Aliso Canyon withdrawal in 2019 was $5.99, compared to 71 cents on days without a withdrawal and a $1.34 average overall.”

This week’s gains also come as maintenance has limited withdrawal capacity at non-Aliso storage fields on the SoCalGas system, according to Bernardi.

“Prior to July, the Aliso Canyon withdrawal protocol required voluntary curtailments of electric demand…before withdrawals could be made,” the analyst said. SoCalGas has been operating under a new protocol since July that “does not require that facility to be used as an ”asset of last resort.’ Since that new protocol went into effect and prior to this week, the only day with a posted Aliso withdrawal was Aug. 28.”

SoCal Citygate basis “did creep up slightly” at that time but peaked at $1.38, well below the year-to-date average during Aliso withdrawals, according to Bernardi.

Further upstream in West Texas, prices rallied sharply across the board Thursday. Waha surged 62.5 cents to average $1.565. NGPL Midcontinent saw a similarly large increase, up 72.5 cents to $1.580, suggesting day-ahead prices at Permian Basin and Midcontinent producing hubs got a lift from the conclusion of scheduled maintenance impacting northbound flows on the Natural Gas Pipeline Co. of America (NGPL) system.

NGPL planned to conclude a two-day maintenance event at its Compressor Station 105 in Kansas on Thursday. The maintenance had reduced capacity through the station to 425,000 Dth/d, or no less than 35% of contracted maximum daily quantities, according to NGPL’s schedule.

Elsewhere, prices sagged at a number of Northeast hubs as forecasts showed generally mild temperatures in the region for Friday. Maxar’s Weather Desk called for Boston to see highs in the mid-50s and lows in the mid-30s Friday, with temperatures slightly warmer than normal on average.

Algonquin Citygate plunged 76.0 cents to $2.820, while Tenn Zone 6 200L slid 37.0 cents to $2.845.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |