E&P | NGI All News Access | NGI The Weekly Gas Market Report

Big Seven U.S. Unconventional Plays to Increase Production Less Than 1% in December, Says EIA

Production of both oil and natural gas out of the most prolific U.S. onshore unconventional plays will increase slightly in December compared with this month, continuing a longstanding upward trend, according to the Energy Information Administration (EIA).

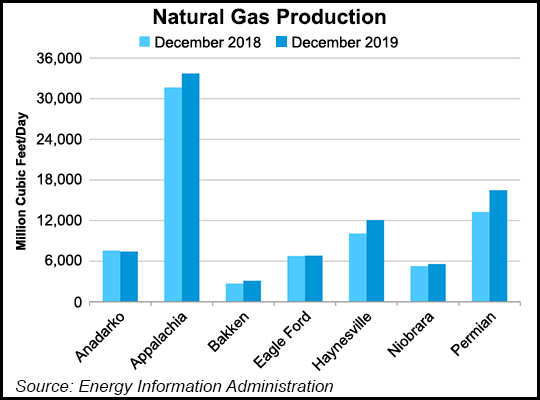

Total natural gas production from the seven plays — the Anadarko, Appalachian and Permian basins, and the Bakken, Eagle Ford, Haynesville and Niobrara formations — is expected to increase by 263 MMcf (0.3%) in December from November, EIA said in its latest Drilling Productivity Report (DPR), which was released Monday.

EIA expects increases in five of the seven plays, including the Appalachian Basin, home to the Marcellus and Utica shales, with a forecasted 33.72 Bcf/d, up from 33.67 Bcf/d in November. EIA also expects increases in the Bakken (3.10 Bcf/d from 3.09 Bcf/d), Haynesville (12.05 Bcf/d from 11.93 Bcf/d), Niobrara (5.58 Bcf/d from 5.56 Bcf/d) and the Permian (16.49 Bcf/d from 15.27 Bcf/d).

The Eagle Ford is expected to produce 6.82 Bcf/d in December, down from 6.88 Bcf/d in November, and the Anadarko is expected to decline to 7.43 Bcf/d from 7.54 Bcf/d.

Total oil production from the plays is expected to increase by about 49,000 b/d (0.5%) from 9.08 million b/d in November. EIA said it expects increases in oil production month/month from Appalachia (170,000 b/d from 167,000 b/d); Bakken (1.51 million b/d from 1.50 million b/d), Niobrara (771,000 b/d from 765,000 b/d), and Permian (4.73 million b/d from 4.67 million b/d). The Eagle Ford is forecast to produce 1.37 million b/d, compared with 1.38 million b/d in November. The Anadarko is expected to produce 551,000 b/d, down from 563,000 b/d, and the Haynesville should be unchanged at 40,000 b/d, according to the DPR.

About 40% (546) of all new wells completed (1,373) in DPR regions in October were in the Permian, as were about 55% of the active drilling rig fleets, according to DPR author Josef Lieskovsky. While there has been a year/year decline in Permian rig count, “the productivity is increasing — new oil and gas pipeline infrastructure is helping,” Lieskovsky said.

EIA has reported consecutive month-to-month increases out of the seven plays since January 2017, when total gas production was about 47.51 Bcf/d, and total oil production was an estimated 4.54 million b/d.

Drilled but uncompleted (DUC) well counts across the Big Seven ended October at 7,642, a decrease of 225 from September, EIA said. DUCs decreased in every play, with the Anadarko down by 72 to 741, Appalachia down by 30 to 492, Bakken down by 20 to 739, and Eagle Ford down by 32 to 1,418. The Haynesville was down by four to 211, the Niobrara down by 22 to 452, and the Permian down by 45 to 3,589.

The productivity of new gas wells in the Big Seven plays is expected to decrease by 100 Mcf/d in December to 4.16 MMcf/d. At the same time, new well oil production per rig is expected to increase marginally during the month to 824 b/d.

EIA compiles the DPR using recent U.S. data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in output from existing wells to provide estimated changes in production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |