E&P | NGI All News Access | Permian Basin

Permian’s Callon Gains Major Shareholder Support to Combine with Carrizo

Permian Basin pure-play Callon Petroleum Co. may have saved its takeover of Texas rival Carrizo Oil & Gas Inc. after reducing the offer of the all-stock deal, as a major shareholder now supports the new terms.

Callon last July agreed to buy Carrizo, a Permian and Eagle Ford Shale operator, in an all-stock deal valued at $3.2 billion. Callon’s stock took a hit, and the merger was facing opposition by major shareholders.

The third largest shareholder, hedge fund Paulson & Co. Inc., which held an estimated 21.6 million shares, or 9.5% of Callon, had argued that the tie-up was not what shareholders wanted. Under pressure as the merger vote neared on Thursday (Nov. 21), Callon and Carrizo last week amended the agreement.

“Since announcing the transaction, we have had extensive and valued dialogue with our shareholders, who have expressed support for the industrial logic and strategic merits of this transaction,” Callon CEO Joe Gatto said. “In recognition of evolving investor expectations for a successful combination in the current environment, we have agreed to revised terms with Carrizo that enable value-creation opportunities for both shareholder bases.”

Under the amended terms, each Carrizo share would be exchanged for 1.75 shares of Callon, giving Callon 58% of the merged company. The original offer would have exchanged 2.05 Callon shares and given Callon 54% control. Callon said the new terms represent a 6.7% premium to the trading price before the merger was disclosed, down from an original 25% premium.The shareholder vote also was rescheduled to Dec. 20.

“We continue to be very excited to join forces with Callon and believe, in light of today’s market environment, the revised terms offer compelling near- and long-term value for Carrizo shareholders,” Carrizo CEO S.P. “Chip” Johnson IV said. “Under the revised terms of the merger, Carrizo shareholders will have meaningful participation in the upside of a strong company that reflects current investor priorities and benefits from the enhanced operational efficiencies needed to be a low-cost producer in today’s dynamic pricing environment.”

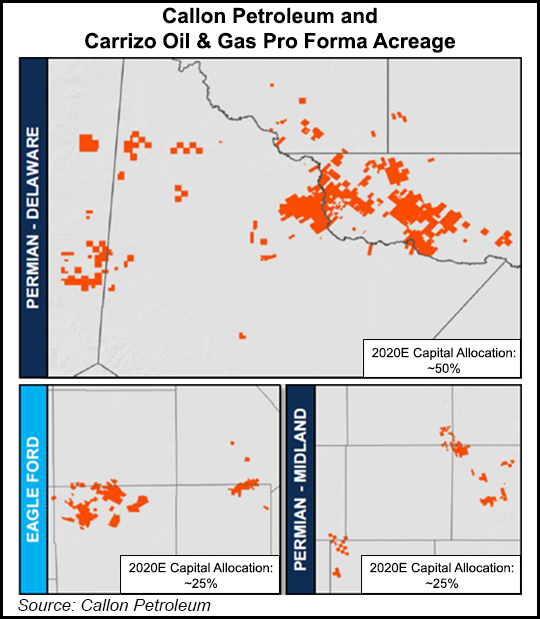

Gatto said Callon’s strategy “remains unaltered,” as the combination would create an independent producer “with a larger cash flow base to employ more efficient scaled development of our pro-forma Permian Basin position of over 100,000 net acres. With increased size and scale driving achievable synergies, the combined company will benefit from a leading cost of supply on an ‘all-in’ corporate basis and be well positioned to deliver durable free cash flow generation through commodity price volatility.”

The merger, Gatto said, would accelerate Callon’s strategy to increase returns, generate free cash flow, reduce leverage and enhance optionality “in the evolving industry landscape.”

New York City-based Paulson said Monday that it would vote its shares in favor of the transaction.

“While Paulson believes that a pure Permian focused producer would be a more attractive alternative, Paulson respects that different shareholders might have different viewpoints on this matter.” Although it no longer opposes the transaction, Paulson said it had reduced its investments in Callon.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |