Natural Gas Futures Finish Higher as Traders Mull Differing Weather Models

As the market digested divergent weather outlooks and a slight bearish miss from the latest government storage data, natural gas futures finished higher on Thursday but gave back some of the gains recorded late in the previous session. The December Nymex contract settled at $2.647/MMBtu, up 4.7 cents day/day but well off the $2.696 intraday high. January settled at $2.719, up 2.7 cents.

In the spot market, easing cold and weaker-than-expected demand prompted a second straight day of steep discounts for East Coast hubs, helping to drop NGI’s Spot Gas National Avg. 6.5 cents to $2.500.

The December contract settled near the 50% retracement level between its Oct. 11 low and last week’s high just above $2.900, noted Powerhouse Vice President David Thompson.

“We didn’t hold the high of the day, and it was sort of a lackluster performance after the inventory number,” he told NGI.

Last week saw the market form an “island top reversal” after prices gapped up before gapping back lower this past weekend. During the move higher, the relative strength index suggested the market had become overbought, increasing the likelihood that prices would form the island top, Thompson said.

“That sort of last gasp higher is one of those classic indications of overexuberance,” he said. “…I’d still probably lean a little bit more to the bearish side, just because we’ve not quite yet reached oversold levels” and the longer-term outlook doesn’t show the kind of “painful purple color” in the forecast maps that the market saw this week.

The major weather models Thursday couldn’t manage to work out their differences on the pattern to close out November, with the Global Forecast System (GFS) taking a much colder view than its European counterpart. The midday GFS run Thursday maintained a “rather chilly stance for the Midwest and Northeast” during the period starting next Friday and continuing through Nov. 28, according to NatGasWeather. Subsequent data from the European model Thursday did move in the cooler direction.

“However, it again wasn’t nearly as cold as the GFS Nov. 22-28,” the forecaster said. “The European model still shows several bouts of cooling into the U.S. next week and through Nov. 28, but they just aren’t very cold and are rather seasonal,” a pattern that would produce near-normal daily national heating degree day totals.

“This is much different than the colder GFS that sees a rather strong push of subfreezing air into the U.S.” and “much greater than normal” heating demand during the same time frame, according to NatGasWeather.

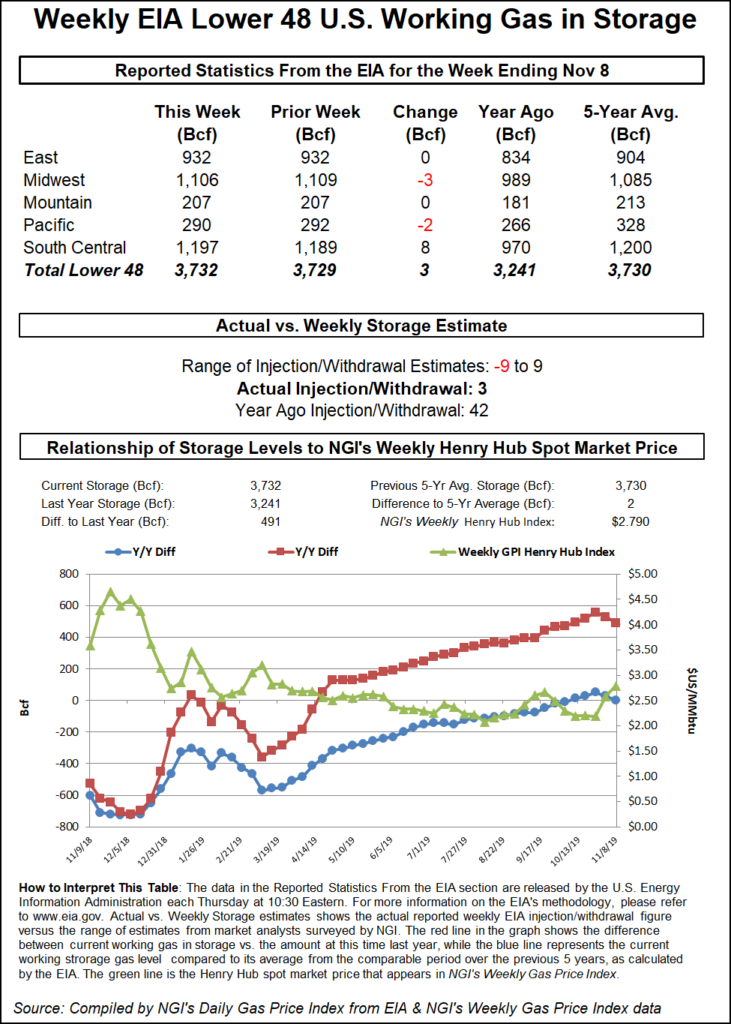

Meanwhile, the Energy Information Administration (EIA) reported a net 3 Bcf injection into U.S. natural gas stocks Thursday, extending the refill season another week.

The 3 Bcf build, recorded for the week ended Nov. 8, came in on the higher side of consensus, as expectations had ranged from a single-digit withdrawal to a single-digit injection. However, 3 Bcf is bullish against the historical comparisons, as last year EIA recorded a 42 Bcf injection for the period, and the five-year average is a 30 Bcf build.

Prior to Thursday’s report, estimates had clustered around a range between minus 9 Bcf and plus 9 Bcf, with major surveys suggesting stocks might finish near-even week/week. NGI’s model predicted a 4 Bcf injection.

Total Lower 48 working gas in underground storage stood at 3,732 Bcf as of Nov. 8, 491 Bcf (15.1%) higher than year-ago levels and nearly flat with the five-year average of 3,730 Bcf.

By region, the Midwest (minus 3 Bcf) and Pacific (minus 2 Bcf) each posted net withdrawals for the week, while there was no net change to stocks in the East and Mountain regions, according to EIA. The South Central posted an 8 Bcf net injection for the week, including a 10 Bcf build for salt stocks, partially offset by a 2 Bcf withdrawal from nonsalt.

Spot prices continued to sell off along the East Coast Thursday as forecasts pointed to a break in this week’s frigid temperatures heading into the weekend. Maxar’s Weather Desk called for lows in Boston and New York City to warm from the mid-20s on Thursday to the mid- to upper-30s for Friday.

Algonquin Citygate dropped $1.005 to $2.920 Thursday, while Transco Zone 6 NY shed 42.5 cents to $2.845. In Appalachia, Texas Eastern M-3, Delivery tumbled 41.0 cents to $2.660.

Demand in the Northeast and New England during this week’s cold blast “underperformed expectations,” helping to mitigate price impacts from pipeline disruptions in the region, including forces majeure on the Texas Eastern Transmission (aka Tetco) and Iroquois Gas Transmission systems, Genscape Inc. analyst Josh Garcia said Thursday.

“New England pipe sample demand reached 3.77 Bcf/d” Wednesday, “and Northeast demand reached 20.19 Bcf/d, far below peak demand for those regions,” Garcia said.

Looking at the broader pattern over the next few days, the National Weather Service (NWS) called for a “weaker, relatively dry cold front” to move out of the Plains and into the Ohio Valley late Thursday and into Friday. The Pacific origins of this system were expected to result in less intense cold compared to earlier in the week but still enough to “keep temperatures below average through Saturday across the eastern half of the United States.”

Also potentially limiting buyer interest, forecasts pointed to milder temperatures to open next week.

“The pattern for early and mid-next week will bring a return to more seasonal conditions as a weather system tracks across the northern U.S. and a second one tracks across the Southeast, just not very cold ones,” NatGasWeather said.

After selling off the past few sessions, Midwest prices saw modest increases Thursday. Michigan Consolidated picked up 7.5 cents to average $2.530. In the Midcontinent, Northern Natural Demarc inched 1.5 cents higher to $2.485.

Down in Texas and on the Gulf Coast, a number of locations picked up around a nickel or more, including benchmark Henry Hub, which added 4.5 cents to $2.665. In East Texas, Houston Ship Channel gained 9.5 cents to $2.605. Over in West Texas, Transwestern eased 2.0 cents to $1.860.

A force majeure event on the Transwestern Pipeline system Wednesday was not impacting flows out of the Permian Basin as of Thursday’s gas day, according to Genscape analyst Matthew McDowell.

Transwestern reduced capacity for westbound volumes on its system by around 100 MMcf/d because of mechanical issues at a compressor station in Corona, NM. The capacity restriction, expected to only last one day, may have impacted Permian volumes on Transwestern’s West Texas and Panhandle laterals, McDowell said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |