Natural Gas Forwards Melt as Polar Blast Moves Out; Long-Term Outlook Bleak

With fingers and toes already starting to thaw from this week’s Arctic blast, and weather models unconvincing of sustained frigid air for the rest of November, natural gas bears regained control of the forwards market this week.

December prices plunged an average 22 cents from Nov. 7-13, January tumbled 23 cents and the balance of winter (December-March) dropped 20 cents, according to NGI’s Forward Look.

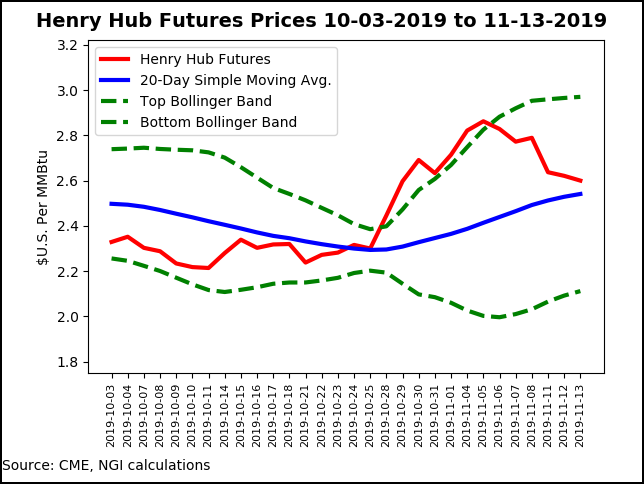

The move lower was to be expected given the sharp rally that had ensued over the previous two weeks, which resulted in the December Nymex futures contract surging more than 40 cents to close in on $2.90. But with moderating medium-term outlooks at the start of the week, the prompt month contract gave back 17 cents between Nov. 8 and 16 to settle at $2.600. January fell to $2.692 and the balance of winter landed at $2.620.

Despite the moderating outlook, models became increasingly at odds in the last couple of runs, with the American model pointing to much stronger demand over the next 15 days and the European model not showing nearly the intensity of cold. This now places the Global Ensemble Forecast System (GEFS) a full 30 gas-weighted degree days colder than the European model, “an astounding difference,” according to Bespoke Weather Services.

The GEFS plays more into the North Atlantic Oscillation blocking signal, keeping the eastern half of the nation colder, while the block is not as strong in the Ensemble Prediction System (EPS), and the firm sees the upper level trough weaker and back toward the middle of the nation. In its midday run, the American model held onto its chilly stance for the Midwest and Northeast during the Nov. 22-28 period, which makes the European model the one to watch.

“Our forecast is nearly unchanged, in between the two, but a slightly lean toward the EPS,” Bespoke chief meteorologist Brian Lovern said. “Most often, when models are this far apart, the answer indeed lies somewhere in the middle.”

While it was clear that bullish optimism had outpaced fundamentals, the speed with which Nymex futures have reversed lower suggests that speculators continue to short natural gas, according to EBW Analytics Group. From Oct. 22 to Nov. 5, cold weather and the associated surge higher in Nymex futures led to short positions created by 111,000 contracts, carrying the rally higher than warranted by fundamentals.

“While the latest data will not be released until Friday, it is highly likely that speculators have smelled weakness and pounced to lead the December contract lower,” EBW said.

Fundamentally, the projected natural gas storage trajectory leads to 1,543 Bcf end-of-March storage, a number that is likely 200 Bcf oversupplied in weather forecaster DTN’s most-likely weather scenario. EBW believes the market will target closer to 1,350-1,400 Bcf in end-of-March storage.

“Although a meager premium may remain warranted this early in the winter, particularly with the potential for a very cold January and February still on the table, absent an extreme cold outcome, prices are likely to remain biased downward,” the firm said.

To be sure, the latest government storage data failed to give market bulls much sway. The U.S. Energy Information Administration (EIA) reported a modest 3 Bcf injection into storage inventories for the week ending Nov. 8.

Some market observers viewed the report as bearish considering the wide range of expectations in which some analysts had called for a withdrawal. Ahead of the EIA report, estimates had clustered around a range between minus 9 Bcf and plus 9 Bcf, with major surveys suggesting stocks might finish near-even week/week. NGI’s model predicted a 4 Bcf injection.

Bespoke said the 3 Bcf build is reflective of “more tightening than we have seen in quite awhile” although the firm ultimately viewed it as “rather neutral overall, as it does show that weather can tighten the market when strongly biased to the cold side…”

Market observers on energy chat platform Enelyst.com wondered if next week’s EIA would be more reflective of the chilly temperatures so far this month, with storage operators likely stocking up last week in preparation for this week’s Arctic blast.

“We are definitely in that camp,” said EBW economist Eli Rubin. If December/January turn out to be mild, the pricing sell-off “could be fierce.”

Broken down by region, the Midwest and Pacific reported slight draws of less than 5 Bcf, as did nonsalt facilities in the South Central, according to EIA. Salts added 10 Bcf into the region’s inventories, while the Mountain and East regions posted saw no change in stock levels week/week.

Total working gas in storage stood at 3,732 Bcf, 491 Bcf higher than last year at this time and 2 Bcf above the five-year average, EIA said.

Even in an extreme cold weather scenario, it appears the market has largely shrugged off the possibility of a storage squeeze this winter. That’s because production continues to sit near highs and is on pace to average 10% higher year/year at 92.1 Bcf/d, according to the EIA’s latest Short-Term Energy Outlook.

Genscape Inc. estimated that production hit a new high of 94.32 Bcf/d on Nov. 9, besting the previous high of 94.11 Bcf/d logged on Nov. 3. By Wednesday, however, about 1.3 Bcf/d of that output had been curtailed by freeze-offs. Since freeze-offs started hitting in late October, there has been a cumulative 7.9 Bcf of production impacted by freeze-offs.

“Due to the early start (the earliest we had previously seen freeze-offs was Nov. 11, 2014) and progressively greater impact freeze-offs have from the growth of liquids-rich plays, this is by far the highest accumulation of production impacted in a winter-to-date,” Genscape senior natural gas analyst Rick Margolin said.

Meanwhile, Lower 48 demand was on the downswing and failed to bring about any new records even on the coldest day of the week. Tuesday’s demand reached 106.9 Bcf/d, which was short of the projected 108 Bcf/d Genscape had forecast and shy of the 107.6 Bcf/d record set on Nov. 27, 2018.

Liquefied natural gas (LNG) exports have also been volatile, with nominations data for Thursday indicating volumes to be just a tick below the 7 Bcf/d mark, about 0.6 Bcf/d off the peak achieved on Nov. 2, according to Genscape.

“While feed gas to Corpus Christi has jumped back up, flows to Freeport have receded,” Margolin said.

On Nov. 6, feed gas volumes to Freeport reached a record 729 MMcf/d, but on Nov. 9 plummeted to 262 MMcf/d and have remained below the 0.3 Bcf/d mark since. “This type of volatility at Freeport has been somewhat common as Train 2 spools up to begin commercial LNG production by end of year,” Margolin said.

As for exports to Mexico, Genscape sees a seasonal decline already starting to take place as flows have come down appreciably from the handful of days in early October when prints were in the 5.8 Bcf/d range. U.S. pipeline exports to Mexico are averaging just shy of 5.27 Bcf/d so far this month to date, which is line with the firm’s forecast of 5.28 Bcf/d.

“Those early October volumes came on the heels of the startup of the new Sur de Texas-Tuxpan pipeline and were very surprising to us, being nearly 0.4 Bcf/d greater than our forecast for October. However, since Oct. 10, flows have been declining steadily. By the time October closed, flows for the month ended up averaging 5.51 Bcf/d, just 63 MMcf/d above our forecast,” Margolin said.

Genscape’s forecast has called for year/year growth in exports to Mexico with new infrastructure enabling displacement of existing Mexican supplies from LNG and production declines, as well as some demand growth. However, the firm has been calling for lower U.S. exports than other estimates based on its belief that Mexican production is/will not decline as rapidly as many think, “nor is there quite as much demand growth as has been seen in recent years,” Margolin said.

This week’s polar blast is already moving out, paving the way for dramatic losses across the high demand region of the Northeast. Although a reinforcing cold shot is expected to race across the northeastern United States beginning Friday and maintain strong demand, the pattern for next week is forecast to bring a return to more seasonal conditions.

After trading well above $6 last week, the December contract at Algonquin Citygate plunged 63 cents between Nov. 8 and 13 to reach $5.283, according to Forward Look. January also lost 63 cents to finish at $7.914, and the balance of winter tumbled 55 cents to $6.403. Summer prices were down just 4 cents to $2.45.

Similarly pronounced declines were seen across New England, where AccuWeather shows temperatures fluctuating in the 40s and 50s for most of the next 10 days.

At Transco Zone 6 non-NY, December dropped 29 cents between Nov. 8 and 13 to reach $3.297, but January slipped just a penny to $5.442 and the balance of winter fell a dime to $4.167, Forward Look data show. The summer was down 5 cents to $2.08.

In Appalachia, Texas Eastern M-3 prices posted hefty losses across the curve as the pipeline released its Winter Storage Withdrawal Plan, which outlines maximum withdrawal limits for specific periods throughout the winter for each of its storage customers.

Texas Eastern M-3 December slid 68 cents to $3.54, January dropped 56 cents to $5.847 and the balance of winter tumbled 41 cents to $4.496, according to Forward Look. Summer shed a nickel to land at $2.05.

Earlier this week, several pipes in the East took precautionary measures in anticipation of the cold spell. Transcontinental Gas Pipe Line (Transco), Tennessee Gas Pipeline and Southern Natural Gas Co. were among the pipelines that declared operational flow orders, with Transco declaring it specifically for Zones 4, 5 and 6.

Both Texas Eastern Transmission and Algonquin Gas Transmission (AGT) suspended no-notice service for gas day Nov. 13, and AGT planned to increase capacity at its Southeast and Cromwell compressors to 1,723 MMcf/d and 1,260 MMcf/d, respectively, by as early as Nov. 12, with plans to increase capacity to 1,824 MMcf/d and 1,296 MMcf/d by Nov. 16.

Dominion had cut all interruptible transportation and other non-firm services within its PL-1 system.

Although stout declines were seen across the United States as rampant production, healthy storage levels and moderating weather outlooks pressured the market, record-low storage inventories in western Canada aided in keeping forward prices in the region relatively supported.

NOVA/AECO C December fell just 5 cents from Nov. 8-13 to reach $1.916, according to Forward Look. January dropped 6 cents to $1.845 and the balance of winter slipped 5 cents to $1.761. Summer also was down just 5 cents to $1.27.

The pared down losses come as demand is averaging its second strongest month-to-date level in the past 12 years, according to Genscape. Furthermore, production is down 0.23 Bcf/d versus the same period last year, which is being almost entirely made up for by a year/year increase of withdraws from already-low storage inventories.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |