Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Slowdown in 2020 NatGas Production Growth Expected as Appalachian E&Ps Slash Capex

While oversupply continues to pressure the market, signs point to a slowdown in natural gas production growth in 2020 as weak commodity prices take a toll on producers.

U.S. dry gas production is expected to remain strong through the end of 2019, reaching an average 92.1 Bcf/d for the year, a 10% increase from the 2018 average, according to the Energy Information Administration (EIA).

However, production growth has been slowing in the United States and will grow much less in 2020 from the lag between changes in price and changes in future drilling activity, the agency said in its latest Short-Term Energy Outlook (STEO). Domestic production is expected to average 94.9 Bcf/d in 2020.

As the saying goes, the cure for low prices is low prices, and that idiom could prove true once again in 2020 based on the latest guidance from gas-focused exploration and production (E&P) companies in the Appalachian Basin.

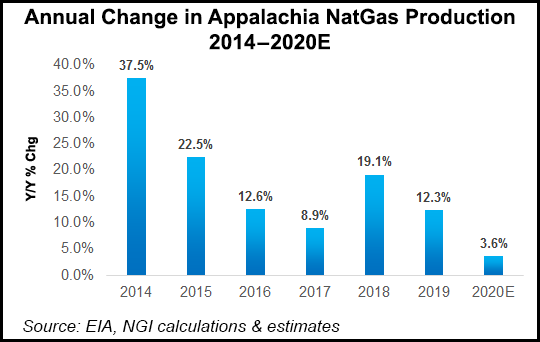

According to data compiled by NGI from the financial results of nine key publicly traded Appalachian E&Ps, the operators on average plan to cut capital expenditures (capex) by 19% year/year in 2020, while they expect to grow production by only 3.6%.

“Publicly traded Appalachian producers are guiding to about a 20% reduction in their aggregate capital spend in 2020, not quite to maintenance capex levels, but pretty close,” said NGI’s Patrick Rau, director of strategy and research. “As such, we estimate their total production growth in Appalachia will be 3-4% in 2020, a far cry from the double digit percentage increases that have become the norm in the area.

“Eventually, those staggering growth rates were going to have to come down anyway, if for no other reason than because of the law of large numbers,” he said. “However, I do think low- to mid-single digit production growth will be the new normal in the area.”

E&Ps are under pressure from investors to generate dividend growth, Rau noted. “In order to do that, they must grow their free cash flow, and since producers are price takers, the only real leverage they have to grow cash flow is via production growth.”

Production growth in 2019 has overshadowed demand; analysts have routinely pointed to loose balances as injections outpaced the five-year average during the refill season, while speculators have loaded up on short exposure in the futures market.

“At the beginning of April, when the injection season started, working inventories were 28% lower than the five-year average for the same period,” EIA said. “By Oct. 31, U.S. total working gas inventories reached 3,762 Bcf, which was 1% higher than the five-year average and 16% higher than a year ago.”

Unusually cold temperatures should push prices higher in the closing weeks of 2019, but demand declines and slowing export growth will have Henry Hub spot prices averaging $2.48/MMBtu in 2020, according to EIA.

The updated 2020 price forecast, issued Wednesday, is down 4 cents from EIA’s previous STEO and would be 13 cents below the 2019 average.

“The Henry Hub natural gas spot price averaged $2.33/MMBtu in October, down 23 cents/MMBtu from September,” EIA said. “The decline largely reflected strong inventory injections. However, forecast cold temperatures across much of the country caused prices to rise in early November, and EIA forecasts Henry Hub prices to average $2.73/MMBtu for the final two months of 2019…

“Lower forecast prices in 2020 reflect a decline in U.S. natural gas demand and slowing U.S. natural gas export growth, allowing inventories to remain higher than the five-year average during the year even as natural gas production growth is forecast to slow.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |