Markets | Infrastructure | NGI All News Access

Natural Gas Futures Retreat as EIA Report Misses, Extends Injection Season

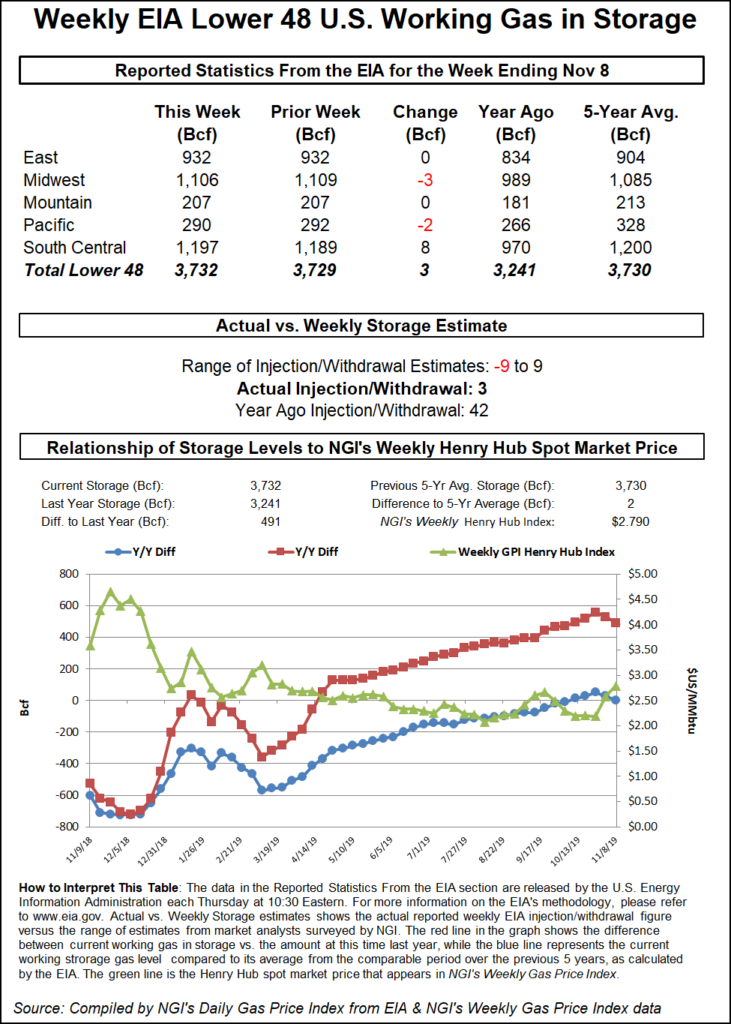

The Energy Information Administration (EIA) reported a net 3 Bcf injection into U.S. natural gas stocks Thursday, extending the refill season another week and sending futures prices lower.

The 3 Bcf build, recorded for the week ended Nov. 8, came in on the higher side of consensus, as expectations had ranged from a single-digit withdrawal to a single-digit injection. However, 3 Bcf is bullish against the historical comparisons, as last year EIA recorded a 42 Bcf injection for the period, and the five-year average is a 30 Bcf build.

In the lead-up to EIA’s report, the December Nymex contract was generally trading in a range around $2.650-2.670. As the report crossed trading screens at 10:30 a.m. ET, the front month quickly sold off several cents, falling to as low as $2.625 over the next 15 minutes. By 11 a.m. ET, December had recovered to around $2.639, up 3.9 cents from Wednesday’s settle but off from the pre-report trade.

Prior to Thursday’s report, estimates had clustered around a range between minus 9 Bcf and plus 9 Bcf, with major surveys suggesting stocks might finish near-even week/week. NGI’s model predicted a 4 Bcf injection.

Bespoke Weather Services said the 3 Bcf injection “is reflective of more tightening than we have seen in quite a while,” even though the number did come in above consensus.

“We still view this as rather neutral overall, as it does show that weather can tighten the market when strongly biased to the cold side,” Bespoke said. “The market likely shows some loosening once the strong cold departs, although that will not be evident for a couple of weeks yet, as next week’s report is expected to be another one reflecting tighter balances due to the current cold.”

Total Lower 48 working gas in underground storage stood at 3,732 Bcf as of Nov. 8, 491 Bcf (15.1%) higher than year-ago levels and nearly flat with the five-year average of 3,730 Bcf.

By region, the Midwest (minus 3 Bcf) and Pacific (minus 2 Bcf) each posted net withdrawals for the week, while there was no net change to stocks in the East and Mountain regions, according to EIA. The South Central posted an 8 Bcf net injection for the week, including a 10 Bcf build for salt stocks, partially offset by a 2 Bcf withdrawal from nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |