Markets | E&P | Infrastructure | NGI All News Access

Signs of Hope for Natural Gas Bulls as Afternoon Weather Data Inspires Late Gains

Natural gas futures eased lower in Wednesday’s trading before a fresh round of colder-trending weather data coincided with a rally after the settle; the December Nymex contract settled at $2.600/MMBtu, down 2.1 cents, but the front month was trading back above $2.670 at around 4 p.m. ET. January settled lower at $2.692 but was trading around $2.755 as of around 4 p.m. ET.

In the spot market, discounts dominated — especially along the East Coast — amid indications that weather-driven demand associated with this week’s cold blast would trend lower by the end of the work week; NGI’s Spot Gas National Avg. fell 46.5 cents to $2.565.

“What had been a rather uneventful session in the natural gas market suddenly got very interesting” Wednesday afternoon, Bespoke Weather Services said. “…We had been mentioning the $2.55-2.60 zone as a target if we keep weather around normal after this week, which we did, but that price zone is a strong level of technical support.”

Once the data from the afternoon European model trended colder, “it appeared to provide the spark needed to send prices much higher” after the December contract settled at $2.600. “Getting a piece of bullish data right at solid support is notable, but this also marked the third day in a row of colder trends, and the market seems to be saying that’s enough to warrant a move back higher.”

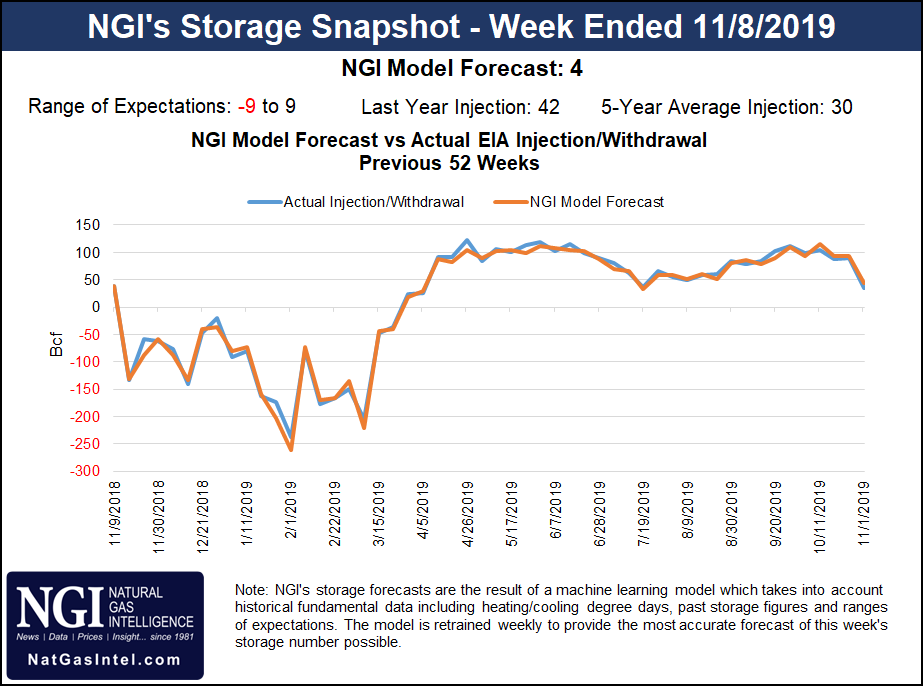

Meanwhile, Thursday’s Energy Information Administration (EIA) storage report, covering the week ended Nov. 8, could show the season’s first withdrawal or an injection in the single digits, according to estimates. Survey responses as of Wednesday showed expectations clustering around a range between minus 9 Bcf and plus 9 Bcf.

A Bloomberg survey showed a median prediction for a 2 Bcf withdrawal, while a Wall Street Journal survey pointed to a 1 Bcf withdrawal. According to a Reuters survey, EIA will report no net change to stocks. NGI’s model predicted a 4 Bcf injection.

Looking at the supply picture, Genscape Inc.’s production estimate Wednesday showed freeze-offs in the Lower 48 taking about 1.3 Bcf/d of output offline.

That’s compared to about 1.7 Bcf/d of impacts in Tuesday’s estimate, “so it appears the worst is over as weather migrates eastward out of producing areas,” Genscape senior natural gas analyst Rick Margolin said. “Since freeze-offs started hitting in late October, there has been a cumulative 7.9 Bcf of production impacted.

“…Due to the early start (the earliest we had previously seen freeze-offs was Nov. 11 in 2014) and the progressively greater impact freeze-offs have from the growth of liquids-rich plays, this is by far the highest accumulation of production impacted” at this point in the season compared to previous winters.

Production estimates have pointed to strong output growth in 2019, with analysts routinely pointing to loose balances as supply has overshadowed demand. However, guidance issued during 3Q2019 earnings results from major Northeast exploration and production (E&P) companies points clearly to a slower growth rate for 2020.

According to data compiled by NGI from the financial results of nine key publicly traded Appalachian E&Ps, the operators on average plan to cut capital expenditures (capex) by 19% in 2020, while they expect to grow production by just 3.6%.

“Publicly traded Appalachia producers are guiding to about a 20% reduction in their aggregate capital spend in 2020, not quite to maintenance capex levels, but pretty close,” said NGI’s Patrick Rau, director of strategy and research. “As such, we estimate their total production growth in Appalachia will be 3-4% in 2020, a far cry from the double digit percentage increases that have become the norm in the area.

“Eventually, those staggering growth rates were going to have to come down anyway, if for no other reason than because of the law of large numbers,” he said. “However, I do think low- to mid-single digit production growth will be the new normal in the area.”

E&Ps are under pressure from investors to generate dividend growth, Rau noted.

“In order to do that, they must grow their free cash flow, and since producers are price takers, the only real leverage they have to grow cash flow is via production growth,” he said.

The slowdown in the Northeast aligns with the broader U.S. production forecast from EIA. As part of its latest Short-Term Energy Outlook, issued Wednesday, EIA said it expects dry natural gas production to remain strong through the end of 2019, reaching an average 92.1 Bcf/d for the year, a 10% increase from the 2018 average. However, production will grow much less in 2020 due to the lag between changes in price and changes in future drilling activity. Domestic production is expected to average 94.9 Bcf/d in 2020.

Spot prices sold off from coast to coast Wednesday amid indications that demand from an ongoing wave of Arctic temperatures had already peaked. Discounts were particularly steep along the East Coast as numerous hubs erased a large chunk of the hefty premiums added earlier in the week.

In the Northeast, Algonquin Citygate fell $2.450 to average $3.925.

The National Weather Service called for this week’s “record-breaking Arctic outbreak” to remain over the East Coast into Wednesday night.

A second cold front was “pressing southward across the Central and Southern Plains” Wednesday and was expected to “shift eastward to the Ohio Valley Thursday” before “weakening through the East Coast by Friday,” the forecaster said. “This will keep temperatures below average for the remainder of the work week. However, the air mass’s origin is from the Pacific, so it’s not as brutally cold as the preceding one.”

Genscape’s estimate for Lower 48 demand Wednesday came in at 101 Bcf/d, with a similar demand total projected for Thursday.

“Weather forecasts have moderated only slightly, but that has generated slightly lower expectations for Friday, now forecast to be 96 Bcf/d,” Genscape’s Margolin said in a note to clients.

After a downward revision, Tuesday’s estimated demand total clocked in at 106.9 Bcf/d, just shy of the November record of 107.6 Bcf/d set on Nov. 27, 2018, according to the firm.

Transco Zone 6 NY tumbled $2.330 to $3.270, while further upstream in Appalachia, Texas Eastern M-3, Delivery dropped $2.280 to $3.070.

Texas Eastern Transmission (aka Tetco) declared a force majeure Wednesday due to an unplanned outage at its compressor station in Entriken, PA, in the M-3 zone.

Genscape analyst Josh Garcia said the event was impacting about 259 MMcf/d of flows day/day, dropping capacity through the station from 2.48 Bcf/d to 2.13 Bcf/d.

Elsewhere in the congested Northeast, a force majeure declared Tuesday due to an unplanned outage on the Iroquois Gas Transmission system was restricting southbound flows through the pipeline’s Dover, NY, compressor station, Garcia said.

“This is an unreported compressor, but a pipe balance north of Dover shows that implied flows spiked by 449 MMcf/d between Monday and Tuesday (Nov. 11 and 12),” Garcia said.

In Tuesday’s trading, Iroquois Zone 1 and Iroquois, Waddington, reflecting transactions farther north on the pipeline, both posted discounts. Conversely, Iroquois Zone 2, reflecting transactions between the Wright Compressor Station in upstate New York and the New York City metro area, saw higher prices Tuesday.

Discounts were also the norm throughout the rest of the Lower 48 Wednesday, paced by a 10.5-cent drop at Henry Hub, which averaged $2.620.

In the Midwest, Joliet shed 16.0 cents to $2.445, while in the Midcontinent, Northern Border Ventura tumbled 16.0 cents to $2.455. Farther west in the Rockies, Cheyenne Hub eased 11.0 cents to $2.070.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |