Markets | NGI All News Access | NGI The Weekly Gas Market Report

U.S Critical in Mexico Natural Gas Supply/Demand Equation

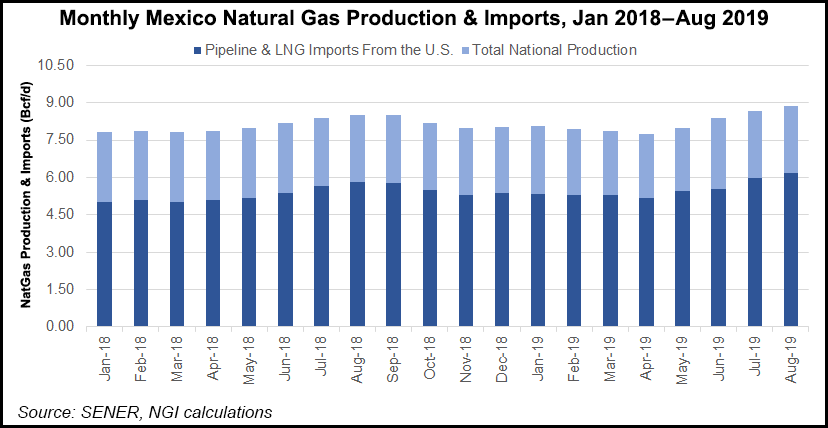

Mexico will be unable to close the gap between natural gas supply and demand within the next five years, meaning that imports of the fuel from the United States will play an increasingly important role, a panel of experts said on Tuesday.

Speaking at the U.S.-Mexico Natural Gas Forum in San Antonio, TX, independent energy analyst Rosanety Barrios said that even if Mexico’s state-owned petroleum company Petroleos Mexicanos (Pemex) hits its production target of 5 Bcf/d by the end of the current government’s administration in 2024, that amount will be far short of what’s necessary.

Wellhead production from Pemex and its partners stood at 3.81 Bcf/d in September 2019, down from 3.88 Bcf/d in the same month a year ago. However, given Pemex’s own gas consumption needs, less than half that amount is injected into the national pipeline system, Barrios said.

Barrios, who helped design Mexico’s market-opening 2013-2014 energy reform during her tenure at energy ministry Sener, highlighted that Mexico’s gas consumption could reach 10-11 Bcf/d by 2024, up from about 8 Bcf/d currently.

Imports supplied 70% of Mexico’s natural gas demand as of August and 91% excluding demand from national oil company Pemex, according to Sener data.

RBN Energy LLC’s Jason Ferguson said his firm expects pipeline exports from the United States to Mexico to reach 8 Bcf/d by 2025, up from around 5 Bcf/d currently.

Panelists agreed that, given Pemex’s lack of focus on gas exploration in its 2019-2023 business plan, and President Andrés Manuel López Obrador’s distrust of private sector participation in the upstream segment, Pemex will be hard-pressed to meet Mexico’s gas supply needs over the coming years.

Natural gas is only mentioned a handful of times in the business plan, said Talanza Energy Consulting’s David Rosales, midstream and downstream partner.

The document is more of “a list of wishes” than an actual business plan, he said.

“The fact is that what we definitely need is private investment, and today that door is totally closed,” said Barrios, referring to Obrador’s cancellation of upstream bid rounds and risk-sharing exploration and production partnerships between Pemex and the private sector.

“For me it’s just a matter of time” before bid rounds resume, Barrios said, citing that Pemex faces a high chance of losing its investment grade credit rating if it can’t turn around its oil and gas production.

The lone bright spot in Pemex’s upstream natural gas plans is the Ixachi onshore field in Veracruz state, said energy consultant Eduardo Prud’homme, who cited that Mexico consumes more natural gas than any country in Latin America, including Brazil.

Pemex aims to produce 600 MMcf/d at Ixachi by 2023.

But given the natural decline of Pemex’s legacy shallow water mega-fields such as Cantarell and Ku-Maloob-Zaap, Ixachi will only help to slow the plunge in Pemex gas production, Prud’homme said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |