E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Diamondback’s 3Q Permian Oil Output Falls on ‘Frack Hits’, Gassier Wells

Permian Basin pure-play Diamondback Energy Inc.’s oil production in West Texas is returning to normal after taking an “unprecedented” hit from neighboring offset well interference during the third quarter.

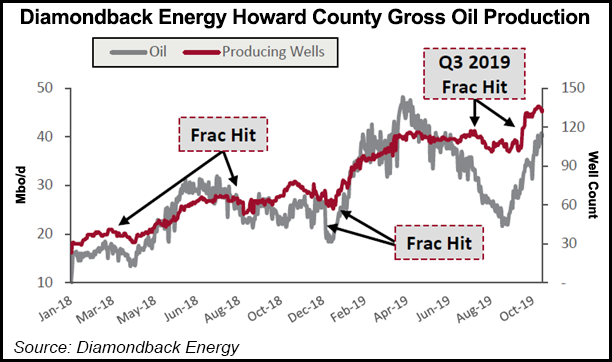

The Midland, TX-based independent estimated it lost about 8,000 b/d net (123,000 b/d gross) in 3Q2019 in part as neighboring exploration and production companies fractured (fracked) and completed “large pads on the western and eastern edges” of its acreage position in Howard County.

The neighboring activity led to “frack hits,” CEO Travis Stice said during the recent third quarter conference call. “Specifically in Howard County, one of its most active and highest oil-cut fields, the combination of frack activity and offset operations to the east and west of Diamondback’s leasehold cut production in half, or over 20,000 gross b/d during portions of the quarter.”

The plan is to model impacts “more conservatively going forward,” but the company still expects frack hits “to continue to be significant, primarily in the Midland…”

Oil production in 4Q2019 is forecast to increase 3% sequentially, but the offset frack impact “is still expected to be large in the fourth quarter, particularly in Howard County, where there’s significant rig and completion activity due to the economics of the area.”

Stice said the Permian oil production miss was “not the start of a continuing trend…When there’s a miss of the magnitude that we just experienced in the third quarter, we have to fundamentally reexamine the assumptions that led to this performance.

“We’ve done this, and as a result, we’ve more conservatively modeled our expectations for the future, particularly external issues that are out of our control, such as offset operator frack hits like those experienced in the third quarter.”

Full-field development by operators in the Midland also has increased the amount of produced water on average this year, “which was not modeled conservatively enough in 2019,” Stice said. “These are operational challenges, not reservoir problems.”

Diamondback has increased the amount of co-development zones across its leasehold, and these are expected to increase in 2020, particularly in the Midland. In some areas, though, the capital allocation “generates lower first-year oil production/developed pad,” Stice noted.

On a percentage basis, Diamondback plans to add “fewer new drill, high-flush volume wells and high oil-cut wells to the 2020 production mix than in previous years, which also lowers the corporate oil mix,” he said.

“When you have a miss of the magnitude that we did in the third quarter, you really have to, like I said…re-examine every single thing we’ve done…And we’ve done that…When you stub your toe like we did in the third quarter, you’ve got to be able to adjust your future forecast to make sure that that you can hit those numbers, and we’ve done so with the assumption we put in place.”

Overall output climbed 2% sequentially and 133% year/year, averaging 287,138 boe/d versus 122,975 boe/d. Part of the gain came from the $9 billion-plus merger last year with Energen Corp. Oil production fell by 5,800 b/d to 17.06 million bbl, while natural gas production soared, climbing to 26,271 MMcf from 7,804 MMcf.

The oil production percentage declined in part from selling Central Basin Platform assets in early July. In addition, quarterly activity was “heavily weighted” toward completing gassier wells, i.e. higher gas-to-oil ratio (GOR) wells, in Glasscock and northern Reeves counties.

High GOR activity, which accounted for 36% of completions in 3Q2019, “is expected to normalize to 15%” in 4Q2019 and in planned 2020 completions, Stice said.

“Our business is complex,” he told analysts. “In this quarter, we had a number of anomalous events that caused several of the metrics we follow and are held accountable for to underperform our expectations. We understand that the market monitors performance on a quarterly basis, which is why we have been as transparent as possible as to the impact of these events and our path forward. But let me be clear, none of this performance requires a course correction or change in strategy at Diamondback.”

KeyBanc Capital Markets analyst Leo Mariani, who covers Diamondback, said frack hits “absolutely” will continue to plague Permian operators.

“You are only going to see more and more wells in this play over time,” Mariani told NGI’s Shale Daily Wednesday. “As it gets more and more crowded, you are going to continue to see neighboring wells have impacts on existing producers and on activity in a lot of cases.”

Solving the issues associated with taking hits from neighboring wells won’t be easy, Mariani said.

“Wider well spacing can help a little bit, but not really,” he said. “The solution is better cooperation among all of the fellow operators around the basin and to really try to work with those guys on their scheduling and coordinate with their own activities to try and minimize any downtime associated with these frack hits.”

Natural gas production is also going to increase in the Permian, Mariani said.

“That’s going to continue to happen in the basin as these shale wells get older and older. The percentage of oil they produce goes down, and the percentage of gas will go up on a relative basis. So, as the basin matures, I would expect the oil-to-gas cut to continue to fall over time.”

Diamondback also “drilled some wells that had a higher percentage of gas during the third quarter, and a lot of them came on at the same time,” Mariani noted.

In addition, many of the frack hits that Diamondback experienced in the quarter were in Howard County, “which is your highest oil percentage county,” he said. “So, you had a couple issues that led to the higher gas percentage production in this quarter.”

Diamondback expects oil production in 2020 to increase by 10-15% from 2019 using average commodity prices of $45/bbl West Texas Intermediate (WTI) oil, $13/bbl natural gas liquids (NGL) and $1.50/Mcf natural gas.

During 3Q32019 the independent fetched on average $51.71/bbl for oil, $11.61/bbl for NGLs and 62 cents/Mcf for natural gas. In 3Q2018, realized oil prices were $55.96/bbl, while NGLs fetched $30.26/bbl and natural gas sold on average $1.86/Mcf.

Realized prices should improve relative to WTI through the rest of the year and into 2020 “as fixed differential contracts roll off and convert” from commitments on the Epic Crude Oil Pipeline and the Gray Oak oil pipeline, both of which are designed to move Permian supply to the Gulf Coast, Stice said.

“Based on current market differentials and estimated in-basin gathering costs, Diamondback expects to realize 95% of WTI for the remainder of 2019 and 100% of WTI in 2020, all including the effect of current basis hedges, firm transportation agreements and in-basin gathering costs,” he said.

If commodity prices were to decline in 2020, “we will be prepared to act responsibly and cut capital spending as we have done multiple times over the past few years.”

Net income climbed to $388 million ($2.27/share) in 3Q2019 from $160 million ($1.59) in 3Q2018. Revenue increased to $975 million from $537 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |