Markets | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Mexico, LNG Projects Fed by Up to 17 Bcf/d of New U.S. Pipeline Capacity This Year, Says EIA

The United States will add a total of 16-17 Bcf/d of capacity from an estimated 46 new natural gas pipeline projects this year, most built to provide additional takeaway capacity, which will increase deliveries to Mexico or liquefied natural gas (LNG) export facilities in the Gulf Coast region, according to the Energy Information Administration (EIA).

“More than 40% of this new pipeline capacity — 7.2 Bcf/d — delivers natural gas to locations within the South Central region,” EIA said. “Many of these pipeline projects will provide additional takeaway capacity out of the Permian Basin in western Texas or enable additional Permian natural gas production to reach the interstate pipeline system.”

Among those pipelines is Kinder Morgan Inc.’s 2 Bcf/d Gulf Coast Express pipeline, which began providing takeaway capacity from the Waha hub in the Permian Basin Sept. 25, and El Paso Natural Gas Pipeline’s 320 MMcf/d Northern Delaware Basin Expansion Project, which would add capacity to its system in West Texas.

Other pipeline projects due to be completed in the South Central region this year will deliver gas to demand centers, “in particular to LNG export facilities on the Gulf Coast,” EIA said. They include the Cheniere Energy Inc. Midcontinent Supply Header Interstate Pipeline Project, a 1.44 Bcf/d pipeline that would move supply from the prolific Anadarko Basin to the Gulf Coast for potential export.

Texas East Transmission Co. completed expansions to its pipeline infrastructure during the second quarter, including the 400 MMcf/d Stratton Ridge Expansion project, which was designed to provide natural gas to the Freeport LNG Development LP export project on the upper Texas coast. The only South Central pipeline project of 2019 that moves gas out of the region was the 2.6 Bcf/d Valley Crossing Pipeline, which exports to markets in Mexico, EIA said.

There also has been significant pipeline capacity built in the Northeast in 2019, providing additional outlets for natural gas produced in the Appalachian Basin. Most of that new pipeline capacity was the result of projects that were originally slated to enter service in 2018, EIA said.

The largest projects completed in the Northeast so far this year are Millennium Pipeline’s 223 MMcf/d Eastern System Upgrade, which increased deliverability to customers in Pennsylvania and New York, and Transcontinental Gas Pipeline Co.s 190 MMcf/d Riverdale South to Market project, which increased deliverability into the New York City market.

The remainder of the new pipeline capacity in the Northeast connects natural gas supply to the Nexus pipeline in the Midwest or to market hubs within the Northeast, EIA said.

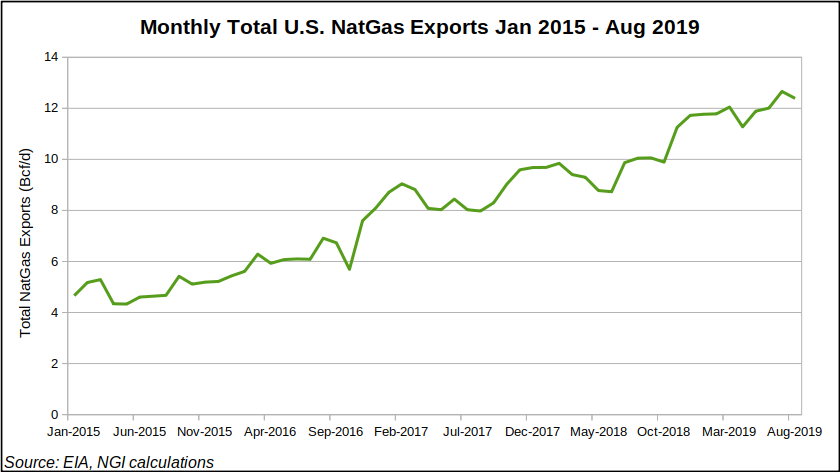

Net U.S. natural gas exports through the first six months of 2019 more than doubled year-ago levels, and EIA expects net U.S. exports to continue to grow, averaging 4.6 Bcf/d in 2019 before rising to 7.2 Bcf/d in 2020. That growth is to be driven by more LNG export capacity and pipeline infrastructure buildout in Mexico, according to projections.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |