NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

Natural Gas Forwards Rally Higher on ‘Ultra-Cold’ Forecasts, but Bears Gaining Momentum

The surge in natural gas forward prices that began last week continued mostly unabated for the Oct. 31-Nov. 6 period as weather models extended cold patterns through the middle of November.

With strong demand projections on tap for at least the next couple of weeks, December forward prices rose an average 17 cents, and the balance of winter (December-March) climbed an average 13 cents, according to NGI’s Forward Look. Smaller increases were seen further out the curve.

The continued momentum in the forwards market mirrored that of the Nymex futures market, where the Henry Hub prompt month notched three straight days of gains before pumping the brakes midweek. The December Nymex futures contract ultimately jumped about 20 cents from Oct. 31-Nov. 6 to $2.828, January shot up roughly 18 cents to $2.907 and the balance of winter climbed around 16 cents to $2.822.

“Another bullish weather forecast shift has added 53 gas-heating degree days (GHDD) to the near-term outlook, bolstering the two-week cumulative increase to 96 GHDDs and 173 Bcf of natural gas demand,” EBW Analytics Group said.

Nevertheless, current gas prices appear unsustainably high in all but the coldest weather scenarios, according to the firm, and the latest weather models are hinting at more seasonable weather beyond the second week of November.

The overnight weather data lost 10 heating degree days (HDD) in both the Global Forecast System (GFS) and European models, backing off just slightly next week’s Arctic blast, according to NatGasWeather. Even more important, however, was the Nov. 18-22 period, where the data favors warmer conditions building over the northern and eastern United States.

If the period after Nov. 18-19 doesn’t trend back chillier soon, “it will take on a bearish lean,” the forecaster said.

While the depiction of a breakdown in the Alaska ridge pattern suggested lower risk for major cold beyond the current 15-day forecast, Bespoke Weather Services also observed some rather notable upper-level changes that have been showing up by Days 4-5 in the modeling. “That is unusual and tells us there is something models are struggling to resolve, meaning that there could be more model volatility to come.

“We do ultimately believe in a milder pattern toward the very end of the month, but could see some back and forth in modeling yet.”

Regardless of the intensity of the coming cold blasts, EBW observed that in contrast to the early cold surge in November 2018 that sent prices to $4.84, the market has absorbed the latest frigid forecast while keeping prices below $3.00, nearly 40% lower. Furthermore, the firm expects that over the next seven to 10 days, the market could consolidate as upward momentum flags and bulls take profits.

“A renewed rally cannot be ruled out, particularly if weather forecasts shift even colder. Strong spot market demand on ultra-cold weather near term may also support prices,” EBW said. “Producer hedging to lock in higher prices may become an increasing headwind.”

Indeed, not even a substantial miss on the latest government storage data was enough to stop the downward trajectory in prices that began with Wednesday’s 3.4-cent decline in the December contract.

The Energy Information Administration (EIA) reported a 34 Bcf injection into storage inventories for the week ending Nov. 1. The reported build came in well below estimates that had clustered around a build roughly 10 Bcf above the actual print. It also fell short of last year’s 63 Bcf injection and the five-year average build of 57 Bcf.

Bespoke said the EIA stat was reflective of much tighter week/week balances. With the firm’s 38 Bcf projection on the low side of market estimates, it was not all that surprised with the actual print.

Prices immediately bounced after the EIA report was released. The prompt month had been trading lower in the lead-up to the report. But when the 34 Bcf print crossed trading screens, the December Nymex contract immediately shot up from around $2.810-2.820 to as high as $2.882.

“Consider that production was decently lower, and we had some stronger burns with new liquefied natural gas highs,” Bespoke chief meteorologist Brian Lovern said. “For these reasons, we still consider it rather neutral, even though, yes, it was bullish to market and has pushed prices higher.”

Market observers on energy industry chat platform Enelyst.com pointed to the South Central region, widely viewed as lacking transparency considering the vast network of intrastate pipelines that traverse the region, for the large discrepancy between storage estimates and the actual 34 Bcf injection.

Only 11 Bcf was added into South Central inventories for the week ending Nov. 1, including a 10 Bcf injection into salt facilities and 1 Bcf into nonsalts, according to EIA. Estimates for the region ahead of the EIA report ranged from the high teens to the mid-20s Bcf.

“Mother Nature is a stern mother,” said Huntsville Utilities’ Donnie Sharp, natural gas coordinator, who “seems to always have a stick in her hand to slap anyone that thinks they know what’s she’s planning. And so the anxiety continues. Weather rules.”

Elsewhere, the East added 19 Bcf into stocks, and the Midwest injected 14 Bcf. The Mountain and Pacific regions both posted small withdrawals of 4 Bcf and 6 Bcf, respectively.

Total working gas in storage was 3,729 Bcf, 530 Bcf higher than last year and 29 Bcf above the five-year average, according to EIA.

Despite the initial surge that followed the government report, Bespoke warned the rally may be sold if weather models do not flip back colder. Indeed, the swing into positive territory was cut short after the midday GFS run trended further milder to lose 6-7 HDDs versus Wednesday night and 16 HDDs versus the previous 24 hours, according to NatGasWeather.

The data was “a touch colder” with the quick cold shot into the Northeast late next week, however, the frigid cold pool is favored to retreat into Canada Nov. 19-22, thereby being too far north to be tapped by U.S. weather systems, which is also what the overnight European model favored, NatGasWeather said. Given the pullback in prices after the latest weather data, “bears appear to be gaining some momentum.”

The December Nymex futures contract ultimately settled Thursday at $2.772, down 5.6 cents day/day. January fell 4.8 cents to $2.859.

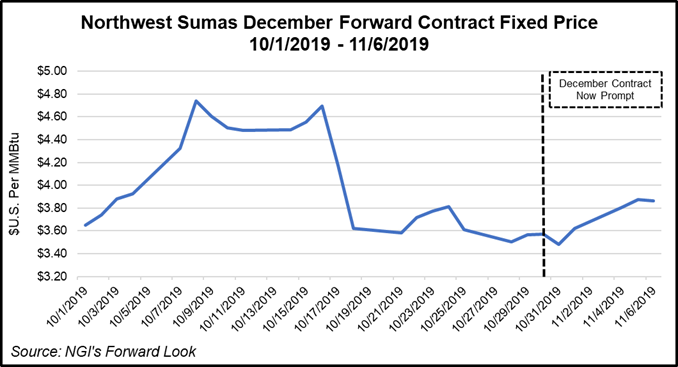

With some of the chilliest weather of the winter season so far seen in the Rockies and ongoing import restrictions, Northwest Sumas has seen its fair share of volatility in recent weeks, and the Oct. 31-Nov. 6 period was no different.

Hot on the heels of last week’s 24-cent decline at the front of the curve, Sumas’ December contract shot up 38 cents to $3.861, according to Forward Look. The dramatic gains extended throughout the winter, with January picking up 26 cents to land at $3.636 and the balance of winter (December-March) climbing 25 cents to $3.339. By comparison, the summer 2020 strip picked up only a few pennies to reach $1.73.

Cold air arrived in the northern Plains on Wednesday as high pressure built into the region behind a large storm system moving into the Northeast, according to AccuWeather. Temperatures dropped into the single digits from Montana to the Dakotas and into northern Iowa through Wednesday night.

“The normal low temperature for this region during the beginning of November is in the middle to upper 20s Fahrenheit,” AccuWeather meteorologist Maura Kelly said.

The bitter conditions on tap for the region come as southbound capacity on Westcoast Transmission remains curtailed following last year’s explosion. Although capacity was expected to ramp up significantly this month, a notice on the pipeline’s electronic bulletin board indicated that a system-wide operational flow order was in place because of the T-South line operating at a reduced level. Furthermore, strong Canadian demand was also keeping gas north of the border for domestic use.

Other markets in the country’s midsection also posted notable gains for the Oct. 31-Nov. 6 period given the frigid forecast. Genscape Inc. projected earlier in the week that Lower 48 population-weighted HDDs would spike to a maximum of 215 HDDs by Nov. 13. This compares to a long-term climatological average of 117 HDDs on the same date.

“This is historically cold weather for November, with the first five days of the month actualizing 18 degrees colder than normal, and the next two weeks currently forecasted to be 74 HDDs colder than normal,” Genscape senior natural gas analyst Rick Margolin said.

The strong demand that has resulted from the chilly air boosted forward prices along the Northern Natural Gas Pipeline, which issued a safe operating limit in several of its market zones this week from the colder-than-normal temperatures.

With customers nominating insufficient supply volumes to cover their anticipated loads and another week or more of Arctic air in the forecast, Northern Natural Ventura December prices jumped 36 cents from Oct. 31-Nov. 6 to reach $3.43, Forward Look data show. January was up 13 cents to $4.061, and the balance of winter was up 18 cents to $3.642. Summer 2020, however, climbed just 3 cents to $2.15.

Interestingly, even as parts of the Northeast were expected to wake up to the first coating of snow of the season on Friday, prices in the region posted only modest gains across the front of the curve and even some declines further out the strip.

At Algonquin Citygate, December tacked on 2 cents from Oct. 31-Nov. 6 to reach $6.269, but December moved up a more pronounced 9 cents to hit $8.713. The balance of winter climbed 2 cents to $7.178, and next summer rose 4 cents to $2.49.

Transco Zone 6 NY December prices were up 7 cents to $4.817, while January tumbled 11 cents to $8.611. The balance of winter fell 4 cents to $6.348, but next summer picked up 4 cents to reach $2.13.

The erratic swings in the Northeast forward markets fail to accurately reflect the significant blast of wintry air set to hit the region ahead of the weekend. The system was forecast to produce windy conditions throughout the Northeast, as well as some lake-effect snow in parts of northwestern Pennsylvania and New York state.

Snow amounts were generally expected to range from one to three inches, with a few locations getting up to six inches, according to AccuWeather. Parts of northern Maine into New Brunswick will bear the brunt of this storm, with snowfall totals of six inches to a foot likely.

“This does not look to be the last of the cold and wintry weather for the Northeast. Another round of December-like cold is likely next week, along with the potential for more snow,” AccuWeather meteorologist Jake Sojda said.

Even with some of the coldest air of the season on tap for the next week or so, several pipelines are in the middle of planned maintenance, restricting flows at a time of strong demand.

Columbia Gulf on Thursday began maintenance at the Stanton Compressor Station (StanSeg) in Powell County, KY. This event was expected to conclude on Nov. 14 but restrict operational capacity through the station to anywhere from 1.31-1.46 Bcf/d.

Flows through the station have averaged 2.10 Bcf/d over the past 30 days, meaning that anywhere from 0.64-0.79 Bcf/d could be cut, according to Genscape.

“This will have a significant effect on gas flows on the system as substantial cold sweeps across the Midwest and Northeast,” Genscape analyst Dominic Eggerman said.

Meanwhile, the Southeast Supply Header remained under a force majeure from a mechanical failure on its Delhi, LA, compressor station, which necessitated the removal of one compressor unit. As a result, capacity through the Delhi, Gwinville and Lucedale compressors was reduced, and flows had fallen by as much as 171 MMcf/d compared to the 30-day average and 243 MMcf/d compared to the 30-day max, according to Genscape. The outage was expected to last two weeks.

Nexus Gas Transmission is nearing the end of its planned line replacement, which essentially shut down all flow on the pipeline and restricted up to 1.2 Bcf/d of northbound gas. In addition to the line replacement, operators also simultaneously conducted detailed investigations on the entire pipeline, which reduced the capacity through Wadsworth Station to zero from Nov. 5-Nov. 11.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |