Weather-Driven Rally Stalls as Natural Gas Futures Pull Back

Natural gas futures pulled back a few cents Wednesday as the bullish momentum generated by a recent stretch of strongly colder-trending forecasts showed signs of petering out. The December Nymex contract slid 3.4 cents to settle at $2.828/MMBtu after going as high as $2.891. January settled at $2.907, off 3.3 cents.

In the spot market, with below normal temperatures expected to blanket regions east of the Rockies the next few days, big gains in the Midwest and Northeast helped lift NGI’s Spot Gas National Avg. to $2.675, up 14.5 cents.

Coming off a strong rally in the futures market over the past week and a half or so, there were indications that natural gas had become “a little overbought,” according to Powerhouse commodities broker William Wilson.

“I’d say, overall, we’ve seen a lot of strength” going into Wednesday’s trading, “so it’s not too surprising to see a pullback,” Wilson told NGI.

The front month attempted to continue the move higher but failed to get back to the $2.905 intraday high recorded in Tuesday’s session, he said.

“We did not register a lower low, though, so I do think the bull move could still be intact,” Wilson said. “Can’t deny the last move here has been strong. I wouldn’t say it’s necessarily stalled out completely, but I’d keep an eye on where storage comes in” on Thursday.

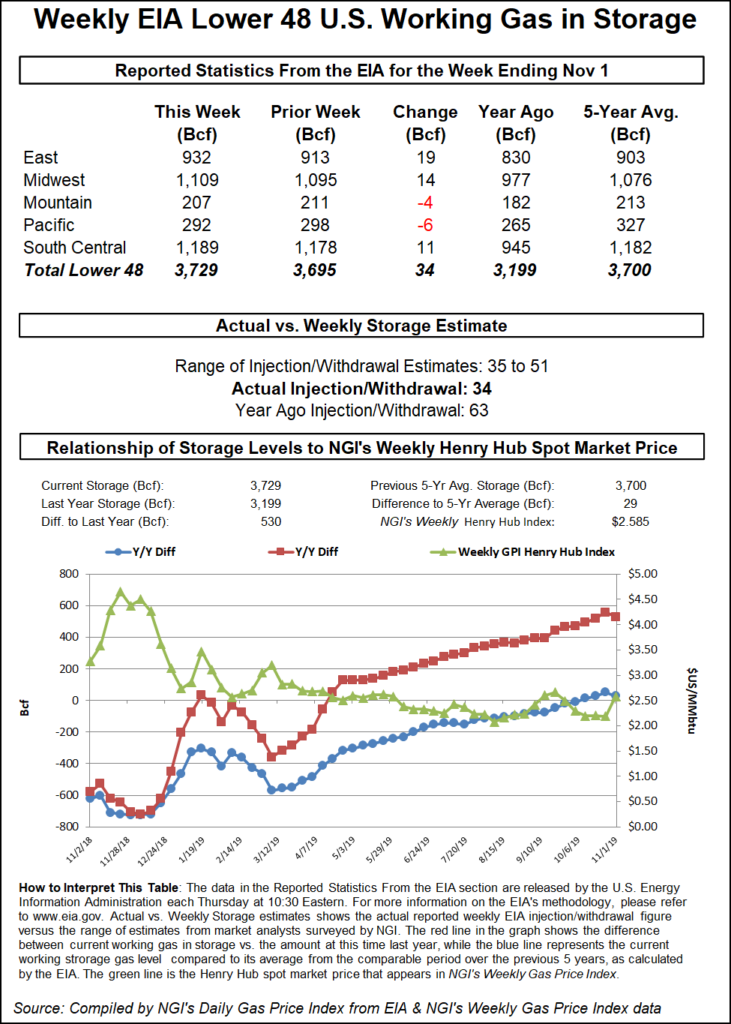

Estimates Wednesday were pointing to a build around 45 Bcf for Thursday’s Energy Information Administration (EIA) storage report, covering the week ended Nov. 1. That would compare with a 63 Bcf injection recorded in the year-ago period and the 57 Bcf five-year average.

A Bloomberg survey showed a median prediction of 45 Bcf, with estimates ranging from 31 Bcf to 51 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 43 Bcf; NGI’s model predicted a build of 44 Bcf.

An injection in line with estimates would come in well below last week’s reported 89 Bcf injection, likely signaling the imminent transition to withdrawal season as temperatures cool.

It will likely require “another sizable jolt to the colder side” or additional tightening in the supply/demand balance to push prices above technical resistance around $2.90, according to Bespoke Weather Services.

Midday data from both the American and European models “suggested that the intensity of cold could be a little less than what’s in the current forecasts,” Bespoke said. The data also advertised changes in the Pacific that would be “necessary to ultimately get us out of the cold pattern.

“We’ve seen models tease this before over the last couple of weeks and then fail, so we are cautious, but we do believe a milder pattern comes. It just may not be until the very end of the month or into December.”

Forecasts showing a wide swath of below-normal temperatures east of the Rockies the rest of the week correlated with gains at most spot price hubs across the eastern two-thirds of the Lower 48 Wednesday, including double-digit increases in the populated Midwest and Northeast regions.

The National Weather Service (NWS) called for “much of the nation” to experience below normal temperatures over the next few days and for snow to fall in the Great Lakes and Northeast.

“The general upper level pattern over the continental U.S. through the end of the week” is expected to feature “an upper level ridge situated over the West Coast and a broad upper level trough east of the Rockies,” the NWS said. “This will support the passage of a strong cold front that will reach the Gulf Coast and East Coast Thursday night, with anomalously cold temperatures for early November behind the front across the Plains and extending to the Northeast states.

“Readings could be 20 to perhaps 30 degrees below normal for some areas, which may be enough to set some record low temperatures.”

Midcontinent hubs recorded some of the largest gains Wednesday. Northern Border Ventura rallied 41.0 cents to $3.185. In the Midwest, Chicago Citygate climbed 19.0 cents to $2.975.

Northeast points also saw strong increases, including at Algonquin Citygate, which picked up 23.5 cents to crest the $3 mark, averaging $3.080 on the day.

The downstream price increases also translated into significant strengthening further upstream. In Appalachia, Dominion South surged 55.0 cents to $2.455.

Spot prices could see further strengthening as forecasts show even more early-season cold in store for next week.

Guidance over the past week has continued to ratchet up heating demand expectations, and Genscape Inc. meteorologists projected that daily heating degree day (HDD) totals could spike to around 215 HDDs next Wednesday. That compares to a climatological average of 117 HDDs for that date, according to the firm.

“In the past two weeks, we have added 87 HDDs alone,” Genscape senior natural gas analyst Rick Margolin said. “…This is historically cold weather for November, with the first five days of the month actualizing 18 degrees colder than normal, and the next two weeks currently forecast to be 74 HDDs colder than normal.”

Meanwhile, on the West Coast, SoCal Citygate shed 91.5 cents to average $3.475, reversing sharp gains recorded earlier this week.

Utility Southern California Gas is expecting demand on its system to ease off over the next few days, dropping to around 2.3 million Dth by Friday, down from more than 2.6 million Dth on Tuesday. Maxar’s Weather Desk was calling for temperatures in Burbank to warm up into the weekend, averaging in the low 70s Friday and Saturday, about 10 degrees above normal.

Price adjustments were mixed in the Rockies Wednesday. Kern River eased 4.0 cents to $2.705, while Cheyenne Hub picked up 13.5 cents to $2.605.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |