E&P | NGI All News Access | NGI The Weekly Gas Market Report

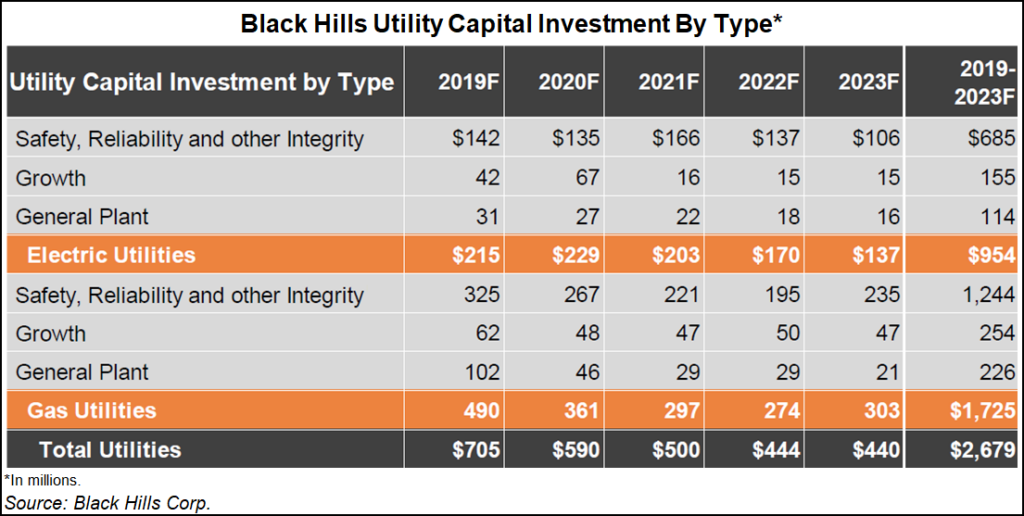

Black Hills Ups Five-Year Capex to $2.9B, with Focus on Natural Gas

Rapid City, SD-based Black Hills Corp. (BH) is cranking up its five-year capital expenditure (capex) plans for 2019-2023 with natural gas utility safety projects at the top of the list, according to CEO Linn Evans, speaking Tuesday on a 3Q2019 earnings conference call.

Black Hills, a utility holding company with gas and electric utilities in eight states, raised forecasted capex from previous projections by $148 million to nearly $3 billion. The company originally projected five-year capex at $2.5 billion when it announced its strategic shift in February.

The company is now more squarely focused on its utility businesses, one of which cleared a regulatory hurdle in the third quarter. In late October, Nebraska Gas received approval from state regulators to consoidate two gas distribution companies, which is expected to take effect in January.

The boost in spending comes on the heels of a noncash, pre-tax $20 million impairment charge related to the company’s now discontinued exploration and production (E&P) businesses.

“The impairment was triggered by a deterioration of earnings performance of the privately held oil and gas company and an adverse change in future natural gas prices,” the company said in a regulatory filing.

Evans highlighted “lots of opportunities” among the gas utilities through various infrastructure replacement projects.

Since completing the acquisition of SourceGas Holding LLC four years ago, and consolidating gas utilities in three states, the company is now in pursuit of pipe and meter work, both new and replacement construction, and potential construction in the renewables area, he said.

One example is the company’s $54 million, 35-mile Natural Bridge Pipeline project, which is expected to go into service by the endo of the year.

Black Hills reported third quarter net income of $11.7 million (19 cents/share), compared with $17.8 million (32 cents) for the same period in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |