IMF Critical of Pemex Business Plan, Production Goals in Mexico Report

The 2019-2023 business plan of Mexican national oil company Petróleos Mexicanos (Pemex) presents an unrealistic picture of production growth and reserves replenishment over the coming years, according to a new report by the International Monetary Fund (IMF).

“Current plans focus on areas where the company has had better success rates in the past,” the IMF said Tuesday in the full report on its 2019 Article IV mission to Mexico.

“This strategy will likely lead to some short-term production gains, but the 60% increase in production by 2024 – to 2.7 million b/d – currently projected by Pemex appears optimistic.”

The IMF had published some of the mission’s preliminary findings in October.

The business plan earmarks nearly all of Pemex’s exploration and production (E&P) capital expenditure (capex) for shallow water and onshore conventional plays, and eschews risk-sharing partnerships with the private sector in favor of oilfield services (OFS) contracts.

Under this model, Pemex OFS providers are paid a per-barrel fee for their efforts at a given E&P area, while Pemex retains full ownership of the asset and the hydrocarbons produced.

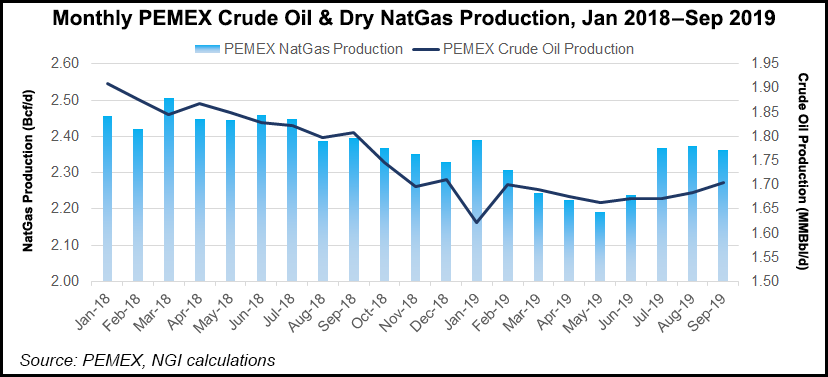

Pemex’s crude oil and natural gas production fell by 6.7% and 3.4% year-over-year, respectively, in the third quarter of 2019 to 1.85 million b/d and 3.81 MMcf/d.

The company reported a $4.6 billion loss for the period.

By focusing its limited resources on increasing production, Pemex also “risks crowding out the rebuilding of reserves,” the IMF said, noting that the business plan assumes Pemex “will be able to add reserves of around 140% of its annual production every year.”

Pemex’s production forecasts also rely heavily on exploration success over the coming years, with commercial discoveries “set to increase from four fields per year in the preceding five years to 34 per year in the next five years.”

“In terms of discoveries, rating agencies are more conservative and assume a 50% replacement rate ratio (RRR), which is in line with the average of the last 15 years,” the IMF said.

The report continued, “In a conservative scenario where production stabilizes at 2019 levels but RRR stays at 50%, reserve life would decline to around five years in 2024, almost half of its 2014 level.”

The Dos Bocas oil refinery, meanwhile, which accounts for about 13% of projected capex from 2019-2023, “will likely crowd out upstream investment even more,” the IMF said.

“Most analysts expect the project to cost around $12-15 billion – compared to the authorities’ $8 billion estimate – and completion to take longer than the current target of mid-2022.”

The agency said that even if Pemex stabilizes production, free cash flow (FCF) “will likely remain negative for the foreseeable future. Additionally, potential difficulties to refinance maturing debt at favorable rates over the medium term could weigh on government finances.”

Pemex’s business plan should be reformulated to include “more cooperation with private firms and a stronger focus on the company’s upstream business,” the IMF said, adding that Pemex “should make progress in selling non-core assets and provide convincing plans to reduce operating costs.”

Although IMF staff made these recommendations to Mexico officials, the multilateral said, “The authorities were confident that Pemex’s business plan would deliver the projected increases in oil production, reserves and refining capacity, and do not see a reason to reconsider it at this stage.”

In a recent paper, Juan Carlos Zepeda, former chairman of upstream regulator Comisión Nacional de Hidrocarburos (CNH), expressed similar concerns to those of the IMF, warning that Pemex’s forecasted capex over the coming years is nowhere near enough to achieve the production goals laid out in the business plan.

Zepeda recommended the creation of a publicly listed E&P subsidiary, modeled after China’s PetroChina Company Limited.

Local think tank Instituto Mexicano para la Competitividad (IMCO) recently recommended cancelling the Dos Bocas refinery altogether, and said Pemex’s business plan “does not truly address” the company’s structural deficiencies.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |