E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Potential Federal Drilling Bans ‘Fraught with Serious Economic Ramifications,’ Says Devon CEO

Devon Energy Corp. CEO Dave Hager warned Wednesday that a proposal pushed by some Democratic presidential candidates to ban drilling on federal lands would harm U.S. communities that benefit from oil and gas drilling and impact the broader economy because of “an inevitable spike” in energy costs.

Hager and his management team shared third quarter results during a conference call, highlighting strengthening Lower 48 production in particular from the Permian Basin. However, in addition to showcasing the exploration and production activity, Hager took aim at a call by some Democrats, who are advocating drilling bans on federal land if elected.

Proposals to ban drilling is “campaign rhetoric” that “is fraught with serious economic ramifications,” Hager said. There are likely “substantial obstacles…for such an idea to be enacted into law.”

Around 20% of Devon’s Lower 48 leasehold is on federal land. In the Powder River Basin (PRB), nearly 60% of net operating area is on federal land. In the Permian Delaware sub-basin, roughly half of the acreage is federal, while Eagle Ford Shale assets are “almost entirely on private lands,” he said.

Devon already has done “a lot of background legal work” around such a proposal, which is “really fraught with serious legal ramifications in the ability to enact on a short-term basis. I think even more importantly obviously, we just think it is going to unfairly harm the communities where we work,” Hager said.

The demand for oil and gas is not going to change, ban or no ban, he noted.

“It’s there on a worldwide basis, and all this would do is to shift the production to areas in the world…where there are not as high environmental standards followed. We just think it is obviously going to be impactful, very impactful to the U.S. economy, as well as our national defense…

“We think it’s just obviously a bad idea from a number of fronts, and it’s not good for the U.S., it’s not good for the world…”

There would be a “significant timeframe to do anything from a purely legal standpoint,” and from a regulatory standpoint, things could slow down, Hager said. “But we’ve obviously been thinking through that and we have a deep inventory permit to help mitigate that.”

Regardless of how the politics play out, Devon has been building a “deep inventory of federal drilling permits” across the Delaware and PRB.

“This proposal would unfairly harm the communities that financially benefit from our business activity as well as impact the broader U.S. economy from an inevitable spike in energy cost,” Hager said, and “unnecessarily limit” gross domestic product growth.

Meanwhile, the independent posted solid gains in the onshore during the third quarter, so much so that it has increased its 2019 oil production forecast for the third time this year to 20-21% from 2018.

“Year-to-date, the fully burdened rate of return on our capital program exceeded 25% and a cash return on total capital employed is also strong trending well above 20%,” Hager said. “The attractive returns we have delivered year-to-date are a function of the learnings attained from appraisal work in prior years. By deploying these learnings to our highly focused development program in 2019, we have made substantial improvements in drilling and completion designs, reduce cycle times and increased well productivity through enhanced subsurface target selection.”

The step change in improving execution allowed the company to again raise its oil production outlook while lowering our capital spending guidance.

Devon also has “acted with a sense of urgency to materially improve our cost structure,” he said. “Our multi-year cost savings initiatives are now on pace to achieve more than 80% of our targeted $780 million in annual cost reductions by year-end.”

The spending plan meets “capital allocation priorities” at a breakeven West Texas Intermediate (WTI) oil price of $48/bbl and a Henry Hub gas price average of $2.50/Mcf.

CFO Jeff Ritenour said in general, Devon expects 2020 commodity prices to “look a little bit like this year,” with continued pressure on Waha gas pricing in the Permian Delaware. “But with the hedges that we have in place, as well as some of the takeaway options we have there, we think we’re going to mitigate that to some degree…

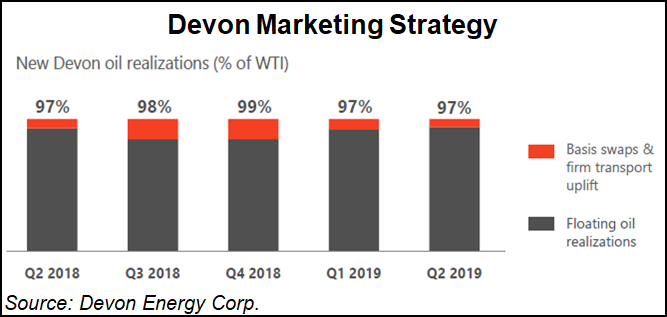

“There’s obviously plenty of pipeline capacity there to move the product, and we generally have a pretty balanced approach,” Ritenour said. Around 50% of Devon’s oil production “is exposed to Gulf Coast pricing, and the remainder would get exposed to that Midland area pricing, which right now looks pretty positive. It’s actually trading at a premium relative to WTI.”

Total net production from Devon’s retained assets averaged 325,000 boe/d in the third quarter, with oil output of 148,000 b/d, a 19% increase year/year. Results exceeded the midpoint guidance by 3% or 4,000 b/d.

Production in the Delaware sub-basin of New Mexico, where wells are being tested in the Leonard Shale, averaged 127,000 boe/d in the quarter, a 59% surge year/year while production costs fell by 12% to $9.06/boe. In the Leonard, 15 wells were brought online with average 30-day rates of 2,200 boe/d, while completed well costs averaged $7.5 million.

In the PRB, quarterly production averaged 25,000 boe/d net, a 33% increase from a year earlier. Growth was driven by 18 new wells targeting the Parkman, Teapot, Turner and Niobrara formations.

A three-well spacing test in the Niobrara averaged 1,300 boe/d per well over 30 days. Devon has, to date, ramped up eight Niobrara appraisal wells across its 200,000 net acre position, and it plans to accelerate activity in 2020.

Net production from the Eagle Ford averaged 45,000 boe/d in the latest quarter, however, because of completion activity timing, no new wells were turned to sales. However, in the final three months, more than 25 wells are scheduled to ramp with production averaging 50,000-55,000 boe/d.

From Oklahoma’s STACK, i.e. the Sooner Trend of the Anadarko Basin mostly in Canadian and Kingfisher counties, production totaled 121,000 boe/d in the quarter, with liquids accounting for 56% of the volume mix. Sixteen operated wells were brought online with 30-day rates averaging 1,600 boe/d.

“Although we are still finalizing the details of our 2020 operating plan. I can tell you we are directionally planning on a capital program in a range of $1.7 billion to $1.9 billion,” Hager said. “This level of activity is expected to generate oil growth of 7-9% compared to 2019 on a retained asset basis.”

Fourth quarter oil production from retained assets is forecasted to average 154,000-160,000 b/d, a 6% sequential improvement at the midpoint. Upstream capital from retained assets for 2019 remains unchanged at $1.83-1.87 billion.

Devon also has formed a midstream partnership in the Permian Delaware with QL Capital Partners LP (QLCP). Devon is contributing gathering system and compression assets in the Cotton Draw area in exchange for $100 million; it would continue to operate the assets. QLCP also committed $40 million of expansion capital to the partnership to fund the build out of the Cotton Draw midstream assets over the next several years.

Meanwhile, other asset sales are progressing, including for the Barnett Shale portfolio in North Texas. A data room was opened in the third quarter and “multiple bids” were received in September. Also ongoing is the sale process for an enhanced oil recovery project in the Rockies.

Net earnings totaled $109 million (27 cents/share) in 3Q2019, versus year-ago profits of $2.54 billion ($5.17). Operating cash flow totaled $597 million from continuing operations, a 22% sequential increase and up from $560 million in 3Q2018. Cash flow funded $541 million of capital spending, resulting in $56 million of free cash flow.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |