Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

First-of-its-Kind U.S. Offshore LNG Export Terminal Delayed

Delfin Midstream has again delayed a final investment decision (FID) on its floating liquefied natural gas (FLNG) export project off the coast of Cameron Parish, LA, as it works to secure offtakers and finalize engineering work.

The company has signed new agreements for front-end design and engineering work with Samsung Heavy Industries (SHI) and Black & Veatch for the first-of-its-kind U.S. offshore LNG export terminal. While preliminary engineering work was completed earlier this year, Delfin has also been working with those companies on an engineering, procurement, construction, installation and commissioning (EPCIC) contract for an FLNG vessel. The company expects to have the engineering work done and the EPCIC contract in place my mid-2020.

COO Wouter Pastoor told NGI that the company will now make an FID on its first FLNG vessel in 2020 rather than this year. First production is expected by 2024, he said.

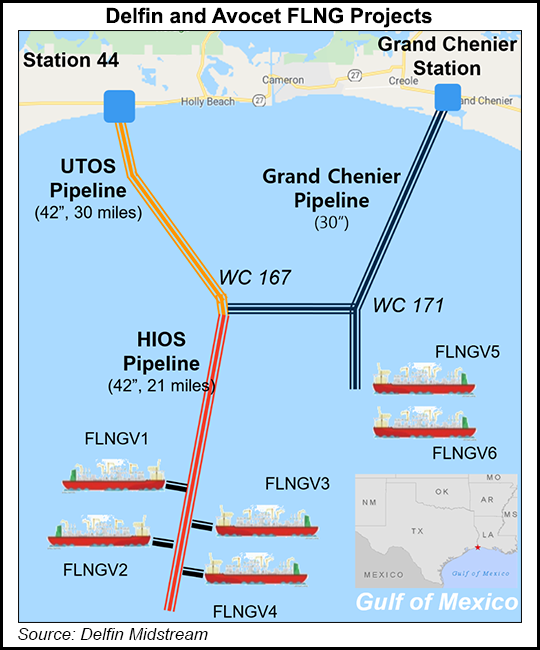

Delfin LNG is currently under development and is a brownfield deepwater port that would support up to four FLNG vessels capable of exporting up to 13 million metric tons/year (mmty). Another project, Avocet LNG, would expand that capacity and include another deepwater port capable of exporting 8 mmty from two vessels.

Over the summer, Golar LNG Ltd., considered an FLNG technology expert, abandoned plans to jointly develop the terminal with Delfin, voicing concerns about offtake agreements and reliable feed gas. Golar entered an agreement with Delfin in 2017. At that time, an FID was expected the following year, with operations anticipated by 2021.

A global LNG glut this year, driven by recent capacity expansions, has put downward pressure on prices, and the trade war between the United States and China has created a barrier for U.S. projects hoping to secure agreements with Chinese offtakers. Prior to the trade spate, Delfin had a preliminary agreement to sell LNG to China Gas Holdings Co. Ltd.

Pastoor said, however, that the company is engaged with more than 20 potential offtakers and is in various stages of work on term sheets with up to 10 of them.

“Most of these are focused on Henry Hub-indexed deals of 10-25 years, but we are also negotiating tolling and integrated opportunities,” he told NGI. “We expect to have one vessel contracted by the time the newbuild engineering work and EPCIC negotiations are finalized in 2020.”

He noted too that since the FLNG vessels can be developed independently with their own commercial and financial structure, FIDs can be made on a vessel-by-vessel basis.

“We can therefore take FID in 2020 with only one, but probably two foundation buyers,” Pastoor added.

The work Delfin is doing with SHI and Black & Veatch also applies to multiple vessels. The company has secured all of its permits for the Delfin LNG project. It still needs to complete permitting work for the Avocet project.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |