HighPoint’s DJ Production Lifts 3Q Output 24% Year/Year

Denver-Julesburg (DJ) Basin pure-play HighPoint Resources Corp. produced 36,946 boed/d in the third quarter, 10% above the midpoint of guidance, management reported along with earnings results Monday.

Third quarter output marked an 18% sequential increase and a 24% increase year/year. The Northeast Wattenberg wells and Hereford field wells each saw sequential increases in production.

Average production sales volumes from the Hereford field totaled 10,101 boe/d, 80% oil, a 41% sequential increase. Six gross wells were spud and 16 gross wells were placed on flowback during the quarter. For the Northeast Wattenberg, average production was 26,845 boe/d in 3Q2019, 58% oil and up by 9% sequentially. Highpoint spud nine gross wells in the Wattenberg and placed nine gross area wells on flowback.

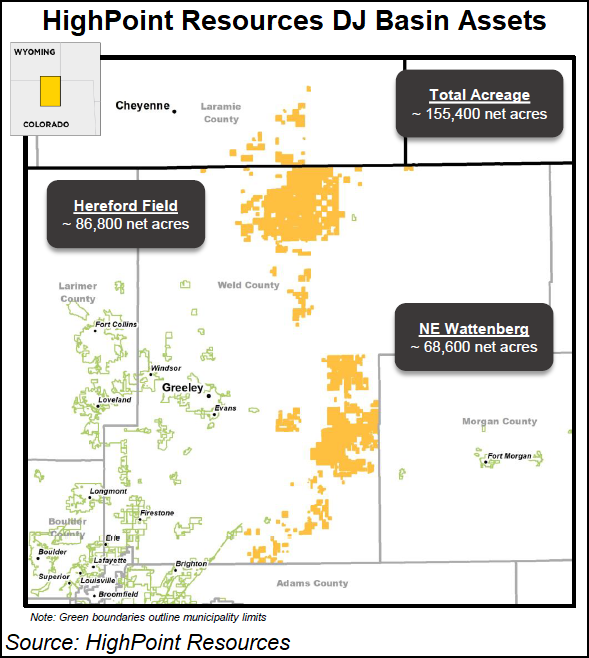

The Denver-based independent has 155,400 net acres primarily in Weld County, CO, and parts of southern Wyoming.

“We continue to assess further performance opportunities of up-spacing and increased completion intensity,” said CEO Scot Woodall on a conference call to discuss earnings Tuesday.

The company has 112 permits, enough to sustain a 1.5 rig program through the end of 2020, mostly in the Hereford field.

“It’s going to be more heavily weighted toward Hereford with the well results that we’re getting out of Hereford,” said CFO Bill Crawford, citing the higher oil cut.

HighPoint expects to produce 3.6-3.7 million boe in total during the fourth quarter under a capital expenditures outlook of $30-40 million.

Net income was $11.1 million (5 cents/share) for 3Q2019, up from a net loss of $29.4 million (minus 14 cents) in 3Q2018.

The glaring weak spot in Highpoint’s earnings was the drop in revenues from natural gas liquid (NGL) sales. Despite a 9% year/year increase in NGL production, the average sales price dropped by 76% to $5.76/bl before hedging. Depressed processing yields related mostly to third-party facilities in the Hereford field, as well as basin-wide ethane rejection, impacted quarterly volumes by an estimated 100,000 boe, said Crawford.

“Ethane prices were weak and transportation and fractionation costs were high from the Rockies,” he said. “We expect NGL infrastructure and yields to improve in the fourth quarter in 2020, but expect NGL prices will remain weaker than historical levels.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |