NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Bleeds Red Amid Bearish Storage Data, Warmer Mid-November Weather

After a solid run that lifted December natural gas prices nearly a quarter over the last three days, a bearish government storage stat and weak cash market stopped the rally dead in its tracks. The December Nymex gas futures contract went on to settle Thursday at $2.633, down 5.8 cents. January fell 4.9 cents to $2.732.

Cash prices softened nearly across the board Thursday even as chilly air lingered after a midweek cold front plunged into the central United States. The exception was in the Northeast, where the blast of cold was set to arrive on Friday. The NGI Spot Gas National Avg. fell 17.5 cents to $2.345.

Thursday’s retreat in futures prices was no surprise given weak cash trading. And while additional colder shifts were seen in overnight weather models, the latest Energy Information Administration (EIA) storage data offered a counter-punch that solidified the downtrend.

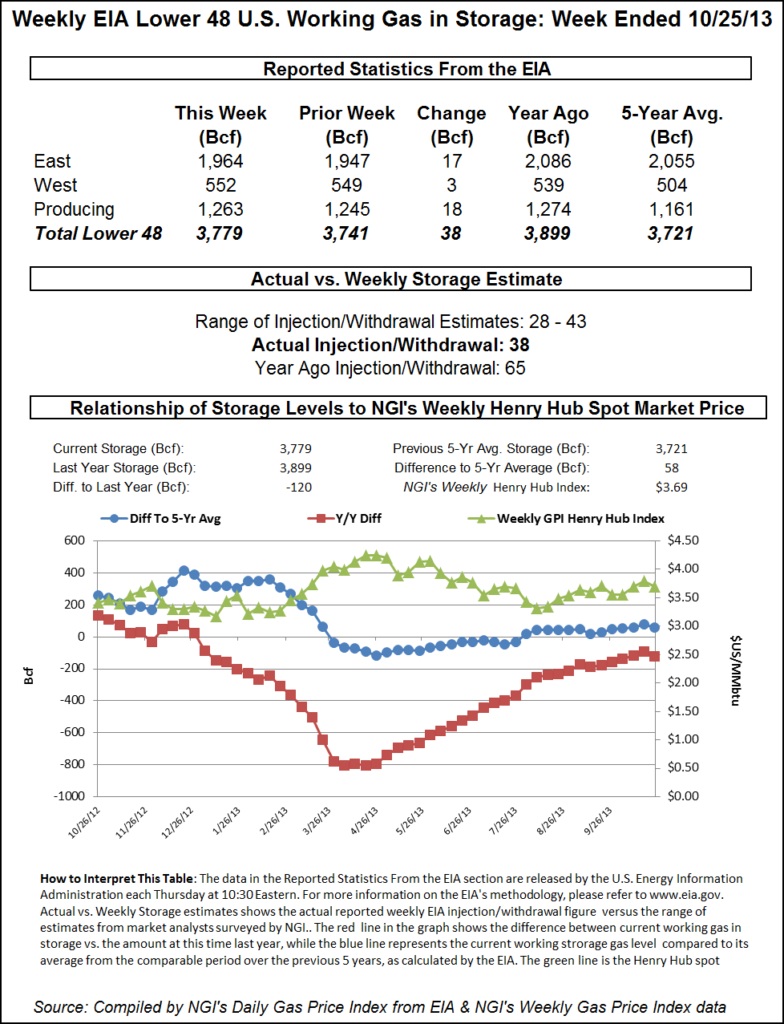

The EIA reported that storage inventories as of Oct. 25 rose by 89 Bcf, easily surpassing last year’s 49 Bcf injection and the 65 Bcf five-year average. The reported build came in on the high side of wide-ranging estimates between 66 Bcf and 94 Bcf, although most projections had clustered around an 85 Bcf injection.

Broken down by region, the South Central added 44 Bcf into storage stocks, including a 25 Bcf build into salt facilities and a 19 Bcf injection into nonsalts, the EIA said. Midwest inventories grew by 26 Bcf, while East stocks rose by 15 Bcf.

Total working gas in storage as of Oct. 25 was 3,695 Bcf, 559 Bcf above last year and 52 Bcf above the five-year average, according to EIA.

Bespoke Weather Services, which had called for a 91 Bcf injection, said the print is still reflective of balances that were loose last week. “The market had sold off ahead of the number due to some weakness in physical markets, and this week’s in-week balances do look improved, but from here, the trade still will remain mostly tied into which direction the weather forecasts trend as we head into this weekend.”

Indeed, weather models continue to advertise frigid conditions for the next couple of weeks, although there remains much uncertainty about whether temperatures begin to moderate after mid-November or remain on the chilly side. The midday Global Forecast System (GFS) may have provided a clearer outlook as the model lost nearly 15 heating degree days, according to NatGasWeather.

“The GFS initially added demand by being faster with a frigid cold shot into the United States next week,” the firm said. “However, the data was also faster exiting it and allowing warming to follow. Overall, a solid cold shot this weekend and again next week, but then with cold retreating to the far northern United States and much more comfortable elsewhere.”

Although NatGasWeather sees ways the frigid air can continue into the northeastern United States, the data so far has been unsupportive. “Natural gas prices have tested $2.71-2.72 several times the past few days and are now back below it, proving this to be too strong of resistance to overcome.”

Nevertheless, “things are starting to get interesting now that winter is here,” according to Het Shah, managing director of industry chat platform Enelyst.com. He noted that pipeline freeze-offs are already occurring as much of the central United States is blanketed by arctic air.

That is “even more important now that we have a ton of wet gas,” Shah said. Residential/commercial demand is also soaring, and liquefied natural gas feed gas deliveries also have continued to come in near record highs.

But with colder temperatures being consistently forecast for the first month of withdrawal season, short speculative interest has dominated the market. The rally over the past three days is best categorized as short covering, with the jury still out on whether late 2019 will see a repeat of the seemingly annual trend of explosive upside overshooting fundamental support, according to Mobius Risk Group.

“This dynamic has been in play since 2016, and it is worth noting that none of these pre-winter rallies were followed by consistently cooler-than-normal temperatures. As such, it is unclear what sustained cold will generate in terms of weekly storage withdrawals under today’s supply and demand dynamics.”

Spot gas markets across the United States sold off Thursday even though chilly air continued to blanket much of the country’s midsection and was forecast to head to the higher demand centers of the East on Friday.

Although persistent warmth has dominated much of eastern United States thus far this fall, a strong storm system will mark the pattern change as it wreaks havoc with damaging winds, severe thunderstorms and heavy rain and snow, according to AccuWeather. In the Northeast, this pattern will feature shots of reinforcing cold, ushered in by a series of storm systems bringing rain and snow and gusty winds. In between these bouts, temperatures will be allowed to rebound some for a day or two.

Multiple widespread freezes were forecast to occur across the Northeast and Mid-Atlantic, according to AccuWeather. After the lake-effect snow machine ramps up across the Great Lakes to start November, many farther south and east of the lakes will also get their first snowflakes of the season by mid-November.

“A couple of disturbances tracking farther south around the end of the first week of November can bring the potential for some snowflakes all the way to the mid-Atlantic coast,” AccuWeather meteorologist Dan Pydynowski said.

The blast of bitter cold has impeccable timing. Winter capacities for both Texas Eastern Transmission (Tetco) and Algonquin Gas Transmission begin on Friday and pose risks to the upside for prices the longer the restrictions last into winter, according to Genscape Inc.

The most impactful of limitations, which are being put in place to revalidate previous tool runs to check for various types of corrosion, are a series of events along the Northern Penn-Jersey Line in Tetco’s M3 zone beginning at the Delmont compressor that will cut up to 770 MMcf/d if these curtailments last until peak flows. According to Genscape’s interpretation of Tetco’s winter maintenance, the firm believes these segments will be returned to service if positive results are found for the new tool runs.

For the events on the Penn-Jersey Line, the last report date is Dec. 8, and there are other segments needing smaller curtailments this winter, such as in M2 and in South Texas.

“There is significant upside risk that curtailments last until 3Q2020 if negative tool run results are found,” Genscape natural gas analyst Josh Garcia said.

Algonquin has similar winter maintenance that is currently active through the 26-inch diameter Main Line from Southeast to Cromwell. Revisions to this event have been more bearish, with the event set to be resolved before Nov. 15 and maintenance capacity being revised up to 901 MMcf/d from 728 MMcf/d originally, according to Genscape.

However, over the last two years, November flows have reached above 900 MMcf/d as early as Nov. 2 and maxed at 1,224 MMcf/d on Nov. 15, 2018, “meaning there is still room for some short-term upside for AGT Citygate prices, especially with temperatures dropping rapidly,” Garcia said.

Indeed, Algonquin Citygate next-day gas climbed 5.5 cents to $1.955. Conversely, Transco Zone 6 NY was up just 2.0 cents to $1.890.

In Appalachia, Texas Eastern M-2, 30 Receipt spot gas slipped about a nickel to $1.740.

Southeast cash markets were down less than 20 cents, and losses in Louisiana were capped at similar levels.

Transcontinental Gas Pipe Line (aka Transco) will perform maintenance that will limit injection and withdrawal capacity at its Washington Storage facility in St. Landry Parish, LA, from Nov. 1-30. Curtailments are not yet final, and Transco will provide further notice if they are indeed required, Genscape said.

Storage levels at Washington can vary wildly, according to the firm. Winter 2013-2014 had a record low ending inventory of 20.5 Bcf, and winter 2018-2019 had a record low starting inventory of 61.8 Bcf/d and appeared to be on pace to beat 2014.

“This year, injections averaged 168 MMcf/d, and inventory reached a healthier level of 66.1 Bcf, 5.2 Bcf higher year/year,” Garcia said. “Washington is now 87.4% full, but it is still below the roughly 69 Bcf mark that seems to have been the target storage level between 2015 and 2017.”

The Midcontinent posted hefty declines across the region, with Southern Star shedding 38.0 cents to average $2.065. Chicago Citygate in the Midwest dropped 11.5 cents to $2.570.

Texas spot gas prices were down anywhere from a nickel to as much as 21.5 cents.

In the Rockies, El Paso San Juan next-day gas plunged 55.5 cents to $1.975.

Malin dropped 45.5 cents to $2.775, similar to other decreases seen across California.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |